Where is the OROP heading

It is with considerable interest that I read the musings/op ed of Brig V Mahalingam (retd), a noted TV debater/expert and of Col Rajvardhan Singh Rathore (retd), MP and now Hon’ble MoS respectively on the OROP. I do not wish to comment nor am I qualified or knowledgeable enough to do so.

But their learned comments sparked off some questions.

1. What happens in the OROP of the pre-AVSC Majors and Lt Cols with 26 years of service? Would they want the pension of Lt Cols and Cols?

Would they be satisfied if a Major (with 26 years service) was given OROP based on an extended table i.e. 13 years table of a Lt Col with an average of Grade Pay of Major and Lt Col (i.e Rs 8000-6600= 1400 divided by 2 = Rs 700) extended to 26 years of service as on 1.4.2014?

Similarly, would the Lt Col with 26 years service be satisfied with an OROP based on an extended table i.e. 20 years of Col with an average of Grade Pay of Lt Col and Col (i.e. Rs 8700-8000= Rs 700 divided by 2 = Rs 350 extended to 26 years of service as on 1.4.2014?

2. Has the equalisation of 3% been misunderstood to mean increment of 3% annually? Suppose two Lt Cols A born on 01 Jul and the second B on 02 Jul. A would retire on 30 Jun and B on 31 Jul. A would not get the increment that B gets. Now what happens if both had the same number of years of service on retirement? Shouldn’t their pensions be equalised? Wouldn’t it be acceptable as the financial effect may be 1 to 2 % of the total?

3. How would the financial outgo be impacted if Army which has a larger number of Y Group puts in a case for X Group pension for all? Will there be lesser effect in the Navy and Air Force, which has a larger number in X Group?

4. If service in the rank is to be the criteria for OROP, then wouldn’t we need different tables for each Service, each Arm/Service/Branch/Trade? As service records are destroyed after a certain number of years, who and how would this data be provided? Because not every one is provided with or keeps copies of Casualty Reports (and equivalents in the Navy and Air Force)! And how will the clerk in the Banks calculate pension at every subsequent change for at the moment he has tables (in Circular 500 and 501) and where the X axis (rank) intersects with the Y axis (years of service) is where he/she obtains the pension due amount!!!

5. A figure of Rs 14000 crores would probably arise if CGDA (or PCDA (P)) decided that maximum years of service in the X axis and Rank in Y axis in Circulars 500 and 501 multiplied by the number of Lt Cols Rs 26265), Cols (Rs 27795) and Havildars (Rs 9145) and equivalents (the largest strength)with 28years of service or more. Wouldn’t it be prudent to take some real data say over the past 3-5 years to determine the actual years of service, which would definitely be less than the highest amount taken for calculations.

6. There are an increasing number of cases where Brigs, Cols, even some Lt Cols & equivalents, drawing Pay in the pay band + Grade Pay + MSP higher than Vice Chiefs and Army Cdrs and equivalents. Is there a case of OROP for the Maj Gens, Lt Gens and Apex scale?

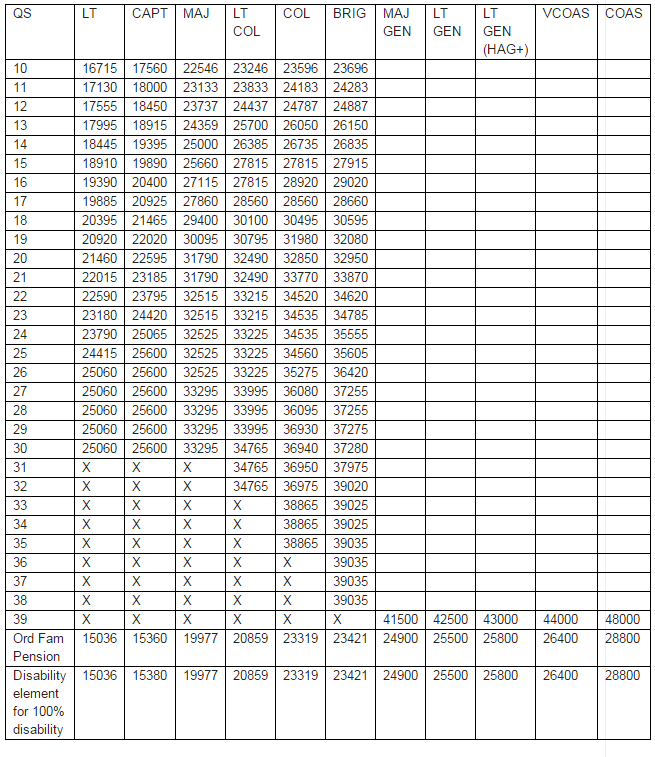

7. Do the following tables (in circulation elsewhere) meet the points above?Note:

1. Table has been made using real date available and best across three Services.

2. For Majors, pension has been fixed based on the pension of higher rank

3. For Lts and Capts, pension is based on VI CPC pay fixation.

4. MSP has been granted notionally to Major Generals and above to grant higher pension vis-à-vis Brigadiers.

5. The Enhanced Ordinary Family Pension will be equivalent of the re-fixed retiring pension, Special Family Pension will be 120% of the re-fixed retiring pension and Liberalised Family Pension will be 200% of re-fixed retiring pension.

6. For lower disability (less than 100%) the above figures will be reduced as applicable.

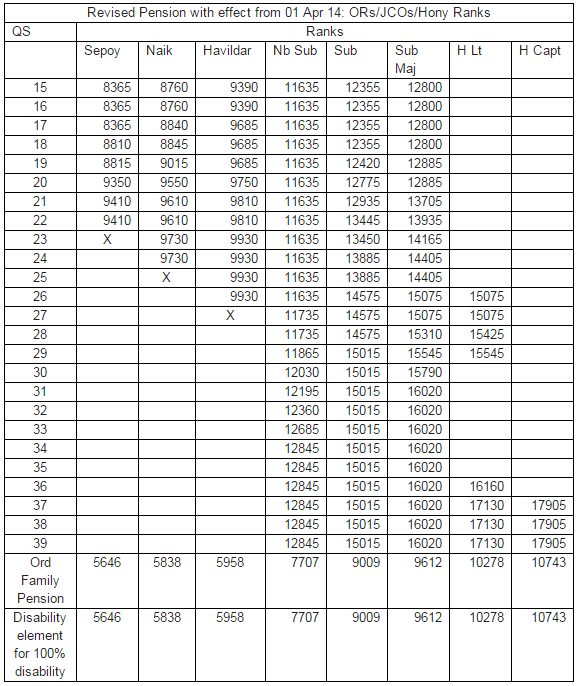

Note: –

1. Table has been made using real data available and best across three Services.

2. Stepping up has been done in cases where the pension for greater length of service in a rank is lower than the lesser length of service in the same rank.

3. Stepping up has also been done in cases where the pension in senior rank is lower than a junior rank for the same length of service.

4. In cases where real data is not available, the data of next rank for same length of service has been used reducing the pension by half the difference in grade pays.

5. The Enhanced Ordinary Family Pension will be equivalent of the re-fixed retiring pension, Special Family Pension will be 120% of the re-fixed retiring pension and Liberalised Family Pension will be 200% of re-fixed retiring pension.

6. For lower disability (less than 100%) the above figures will be reduced as applicable.

Source : Aerial View

Click the below link for more news about OROP…

ONE RANK ONE PENSION – UPDATED NEWS

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months

I’m ashok chachar retire 30/09/2000 from navy as leding rank after 15 years 24 days,my besic pension is 4762 what would be pension basic in orop

OROP is a long pending demand of Ex servicemen , implementation of which should be fast tracked as the men in uniform even after retirement have again been subjected to other hardships ie fasting in rain and hot weather for their legitimate demands. Every successive govt has back stabbed the men who made supreme sacrifices for securing the independence of India . When it comes to pay them their legitimate dues Bureaucrats (in pay commissions) are used to counter their demands. These Bureaucrats are also responsible for change in post independence heirarchy delibrations and grant of lower pay scales to armed forces

ome soon

orop

why are you not issued one rank one pension.daily new dailoge published.

why not impemented one rank.one.pension.

Orop is only required by Pbor only.Officets in Defence services had enjoyed a lot.there argument is totally baseless.Who will drew the attendance on this to the PM.pl God sake do not creat any more confusion in this OROP.

where OROP is heading? It is totally wrong please. There must always between technical and non technical groups. If you make a common OROP table which is meaningless and making engineers fools. If you are ministerial staff can you make as you feel? release group x and y separate table.