Child Education Allowance Scheme: Hostel Subsidy

The CEA (Children Education Allowance) Scheme is a program that provides financial assistance to employees who have school-going children. This scheme includes a hostel subsidy and educational concession. The hostel subsidy covers expenses related to accommodation, food, and other amenities for children who reside in hostels. The educational concession provides financial assistance for tuition fees, books, uniforms, and other educational expenses. This scheme aims to reduce the burden of education expenses on parents and encourage them to invest in their children’s education.

Under the 7th Central Pay Commission, there are various defence allowances available for JCOs/OR (Junior Commissioned Officer/ Other Rank), designed to provide financial support for educational and hostel-related expenses. The Children Education Allowance (CEA) Scheme offers assistance for children’s education, while the Hostel Subsidy allowance provides support for children’s hostel accommodation. In addition, there is also an Educational Concession allowance that helps to cover the cost of tuition fees for eligible JCOs/OR. These allowances are aimed at easing the financial burden for military personnel and their families, ensuring they have access to quality education and accommodation.

CEA Scheme

The CEA Scheme, which stands for Children Education Allowance Scheme, is a benefit offered to eligible employees by their employers. This scheme has two components: the CEA and Hostel Subsidy. It’s important to note that both components cannot be claimed concurrently. The CEA component of the scheme helps to cover the expenses of a child’s education, including tuition fees, books, uniforms, and other related costs. On the other hand, the Hostel Subsidy component helps to cover the expenses of a child’s stay in a hostel or boarding school. Eligibility for this scheme varies from employer to employer, so it’s important to check with your HR department to see if you qualify.

The Children Education Allowance (CEA) is a government scheme that provides financial assistance to employees for the education of their children. The current rate of CEA is Rs 2250/- per month per child for two children only. This allowance is admissible from Nursery to 12th classes, ensuring that children receive quality education irrespective of their parents’ financial ability. It is a much-needed support system for working parents who want to provide the best education for their children.

It is recommended that reimbursement of expenses should be done just once a year. This should take place after the completion of the financial year, which for most schools coincides with the academic year. By doing so, it helps to streamline the reimbursement process and ensures that all expenses are accounted for accurately. It also reduces the administrative burden of processing multiple reimbursement requests throughout the year and allows for a more efficient use of resources.

Certificate from the head of institution where the ward of government employee studies should be sufficient for this purpose. The certificate should confirm that the child studied in the school during the previous academic year.

CEA Hostel Subsidy

For parents whose children are studying in a boarding school away from their place of work, the Hostel Subsidy program provides financial aid of Rs 6750/- per month per child, applicable for up to two children. This program assists in covering the expenses of boarding and lodging for the children, so that they can focus on their education without worrying about the financial burden placed on their families.

Certificate from the head of institution should suffice, with the additional requirement that the certificate should mention the amount of expenditure incurred by the government servant towards lodging and boarding in the residential complex.

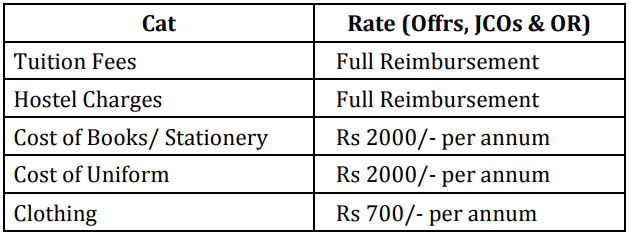

In accordance with the policy for Educational Concession to Children of Personnel Missing/Disabled/Killed in Action, the employee will receive the lower amount of the two specified expenditures. This provision ensures that the children of the personnel who have been affected by military service can avail educational benefits as per their eligibility. It is a small gesture of gratitude towards the sacrifices made by the brave personnel for the country.

It is important to note that the total sum of both Tuition Fees and Hostel Charges must not surpass the limit of Rs 10,000/- per month. This policy has been put in place to ensure that students are not burdened with exorbitant fees and can receive quality education without financial strain. Any amount exceeding the limit will not be covered and will be the responsibility of the student or their guardian.

Auth : GoI, MoD letter No 6(1)/2009/Edu. Concession/ D (Res-II) dated 13 Sep 2017.

What is the Child Education Allowance Scheme Hostel Subsidy?

The Child Education Allowance Scheme Hostel Subsidy is a financial assistance programme designed to help families with children with tuition fees for their stay in hostels.

Who can apply for the Child Education Allowance Scheme Hostel Subsidy?

The Child Education Allowance Scheme Hostel Subsidy is open to families with children aged between 6 and 18 years old who are currently enrolled in a recognised school.

How much subsidy can I get?

The amount of subsidy available depends on the family’s income and the number of children enrolled in the hostel.

What documents do I need to submit for the application?

You will need to submit your income documents such as payslips, bank statements, or tax returns. You will also need to submit the school’s documents, such as admission forms, school fees and hostel expenses.

How long does the application process take?

The application process typically takes 6-8 weeks.

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months