7th CPC arrears paid as bonds – Totally wrong and unwanted – Karnataka COC

7th CPC Pay Statement

Comrades,

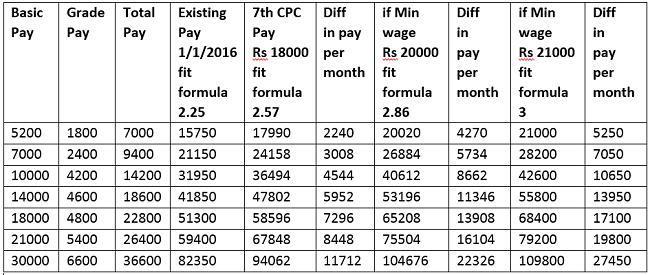

There are various reports on 7th Central Pay commission on the media on fitment formula, arrears being paid as bonds , these reports are totally wrong and unwanted , these confuse the Central Government Employees, if you read the below table it is quite clear that a Group “C” employee shall get.

The true picture, as per the 7th CPC recommendations has provided only at 14% wage hike at Group “C” level it is only ranging from Rs 2240 to Rs 3500/ increase per month, and at Group “B” level ranging from Rs 4000 to Rs 6500/ increase per month.

The Empowered Committee is likely to rectify and change the fitment formula in that case.

As per media reports the committee may recommend a minimum wage of Rs 20000/- or Rs 21000/- against the demand of Rs 26,000/ of the staff side , the Central Government Employees (Group “B” & Group “C” ) and shall get a salary increase of just Rs 4000/ to Rs 16000/- only , that is also too meager considering the aspect of price rise and modern day expenditures.

Secondly arrears of six months if the 7th CPC is implemented shall be only Rs 8000/- per month on average per employee per month , for six months it will just at Rs 50000/- per employee only , this amount will not affect the Central Government finances,So don’t believe any news paper reports.

Secondly there is no change in allowances expect HRA, that too its rates are reduced by the 7th CPC and also many allowances have been withdrawn. This is saving for the Government.

Hence we should not bother too much on these reports, instead we should educate the members and prepare for struggle, so that we get at least get a minimum wage of Rs 24,000/- ( 50 % wage hike without allowances) , as allowances are not taken into pension benefit.

Comradely yours

(P.S.Prasad)

General Secretary

Source: www.karnatakacoc.blogspot.in

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months

Pay Fixation in the New Pay Structure:

The fitment of each employee in the new pay matrix is proposed to be done by multiplying his/her basic pay on the date of implementation by a factor of 2.57. The figure so arrived at is to be located in the new pay matrix, in the level that corresponds to the employee’s grade pay on the date of implementation, except in cases where the Commission has recommended a change in the existing grade pay. If the identical figure is

not available in the given level, the next higher figure closest to it would be the new pay of the concerned employee. A couple of examples are detailed below to make the process amply clear.

Why Lower fixation for higher GP in many cases.

Example: Fixation of same figure i.e. Payband+GradePay*2.57, suppose 30950*2.57=79542 in the fitment table, for GP 5400 PB2 is 80200 and for GP 5400 PB3 it is 8000.

Is there any remedy for these type of cases.