Dress Allowance – New Rates | Get the Latest Rates

The 7th Central Pay Commission introduced various allowances for Defence personnel, including Junior Commissioned Officers and Other Ranks. Among these allowances, Dress Allowance is an essential component that has been revised to provide new rates for JCOs/OR. This allowance covers the expenses related to the maintenance and purchase of uniforms for these personnel. The new rates are expected to provide better compensation and support to JCOs/OR for their clothing needs, ensuring that they are equipped with the necessary attire for their duties.

The Dress Allowance is a new initiative that has replaced several other allowances, including Kit Maint Allowances, Clothing Allowance, Initial Equipment Allowance, Outfit Allowance, Uniform Allowance, and Washing Allowances. This new allowance is designed to provide financial support to employees for the purchase and maintenance of their work attire. The Dress Allowance recognizes the importance of professional appearance in the workplace and aims to help employees maintain a polished and put-together look. Additionally, it streamlines the previous allowance system, making it more efficient and easier to manage for both employers and employees.

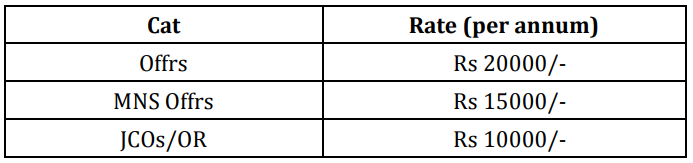

| Cat | Rate |

| Officers | Rs. 20000 |

| MNS Offices | Rs. 15000 |

| JOCs and OR | Rs. 10000 |

What is the dress allowance?

The dress allowance is an allowance given to individuals to purchase and maintain their work-related clothing.

What are the new dress allowance rates?

The new dress allowance rates are as follows:

- Officers: Rs. 20000

- MNS Officers: Rs. 15000

- JOCs and OR: Rs. 10000

Who are considered Officers?

Officers include individuals holding officer positions in their respective fields.

Who are MNS Officers?

MNS Officers refer to individuals employed in the Military Nursing Service.

Who are JOCs and OR?

JOCs and OR refer to Junior Commissioned Officers and Other Ranks, respectively.

Will the dress allowance rates change for other categories not mentioned?

The dress allowance rates mentioned above pertain only to the mentioned categories. Rates for other categories may vary and should be checked with the respective authorities.

How often will the dress allowance rates be reviewed?

The dress allowance rates are subject to periodic review and may be adjusted in the future based on factors determined by the relevant authorities.

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months