केंद्र सरकार के कर्मचारियों के लिए संशोधित वेतन मैट्रिक्स तालिका पीडीएफ 2026

Simplified Pay Matrix Table of the 7th Pay Commission: Click or press any level from 1 to 18 to view your basic salary hierarchy by clicking the ‘+’ or ‘-‘ buttons!

7th CPC Pay Matrix Table for Central Government Employees: The pay matrix table introduced by the 7th Pay Commission is designed specifically for the civilian employees of the Central Government. This table has been created to keep up with the new pay matrix and the increasing opportunities that have become available outside of the government sector. It is intended to attract and retain top talent within government services amidst greater competition for human resources. The 7th pay matrix table consists of 760 cells and is a single fitment table for over 30 lakh central government employees. It displays 19 columns and 40 rows, with the horizontal field featuring numbers 1 to 18 indicating functional roles within the hierarchy, and the vertical range representing pay progression within each level.

An annual financial progression of 3.00% per level is demonstrated with a vertical line. The table follows the Aykroyd formula, with the beginning point representing the lowest pay as per the 15th ILC norms. With the subsumed pay and explained levels, employees can now easily understand their current status and potential growth within their careers by consulting this chart. Additionally, this table can also aid in the calculation of pensions.

7th Pay Commission Pay Matrix Table Overview

| Table Name | 7th Pay Matrix Civilian Table |

| Type of Table | Basic Salary Table |

| Introduced By | 7th Central Pay Commission |

| 7th CPC Report | Click to Download PDF |

| Implemented from | 1st January 2016 |

| Updated on | 01.01.2026 |

| Beneficiaries | Central Govt Employees |

| Index of Table | Number of Stages |

| Level of Table | Current Status of Post |

| Total Level | 19 |

| Total Cell | 540 Valued Cell (760) |

| Minimum Value of Table | 18,000 |

| Maximum Value of Table | 2,50,000 |

| 7th Pay Matrix Table | Download PDF |

| 7th Pay Matrix Hindi Table | Download PDF |

7th Pay Matrix Table Full Image

Advantages of 7th Pay Matrix Central Government

The Central Government’s 7th Pay Matrix has numerous benefits. It unifies grade pay and pay bands, simplifying the process. By incorporating PB-3 and PB-4, many problems were resolved. The pay matrix level also decreases the differences between pay bands, which makes it easier to comprehend. Moreover, the pay matrix level facilitates the fixation of modified pay, minus the need for additional calculations. Differential entry pay has also been addressed. The Pay matrix effectively streamlines the administration process and helps with financial management reforms, getting rid of issues in annual progression, frequent promotions, and length of service with effortless visibility and transparency. Overall, this system offers a structured, accurate, and comprehensive view of the payment system, helping with error-free results.

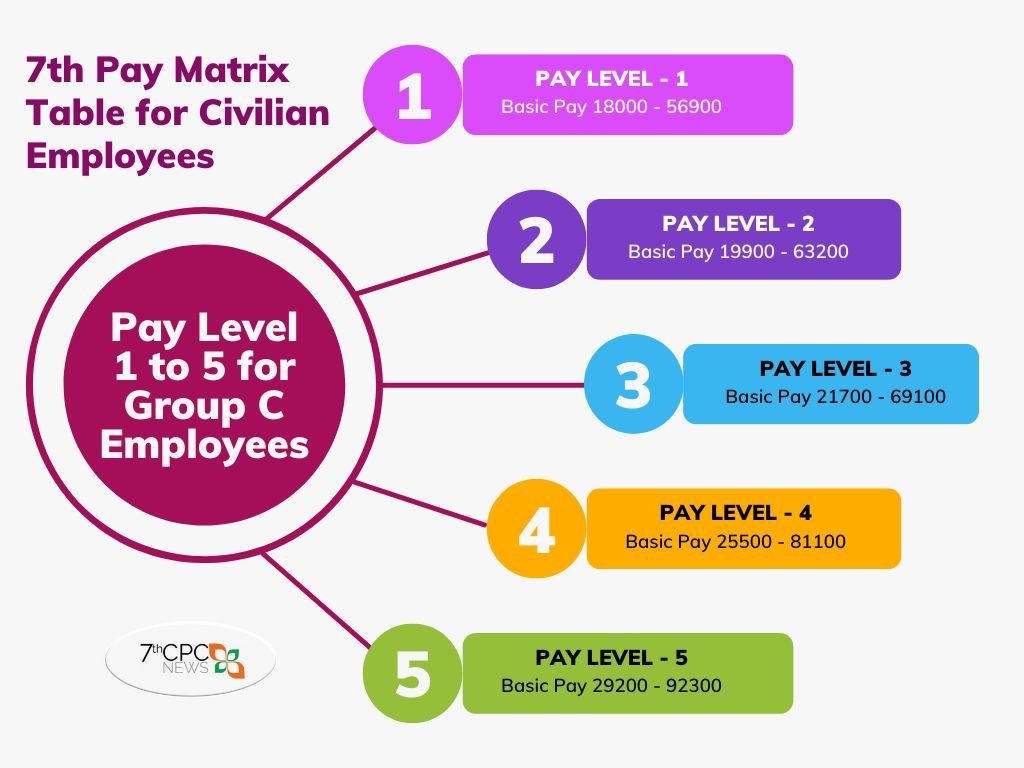

7th Pay Matrix Table for Group C Employees

Based on the categorization of job positions in the Central Government, the number of individuals employed in Group C positions is 29,29,143. This segment constitutes a significant portion of the total Central Government workforce, which amounts to 33,01,536 employees across all groups. More than 88% of the workforce falls under the C Group category. Provided below is the 7th pay matrix table about Group C personnel.

Group B Staff 7th Pay Matrix Table

The 7th Central Pay Commission report states that there are 2,80,892 Central Government employees working in Group B positions. This group plays a vital role in providing valuable services to the Central Government, serving as a bridge between lower-ranked Group C employees and higher-ranked Group A officers. Please refer to the pay matrix table below for more information.

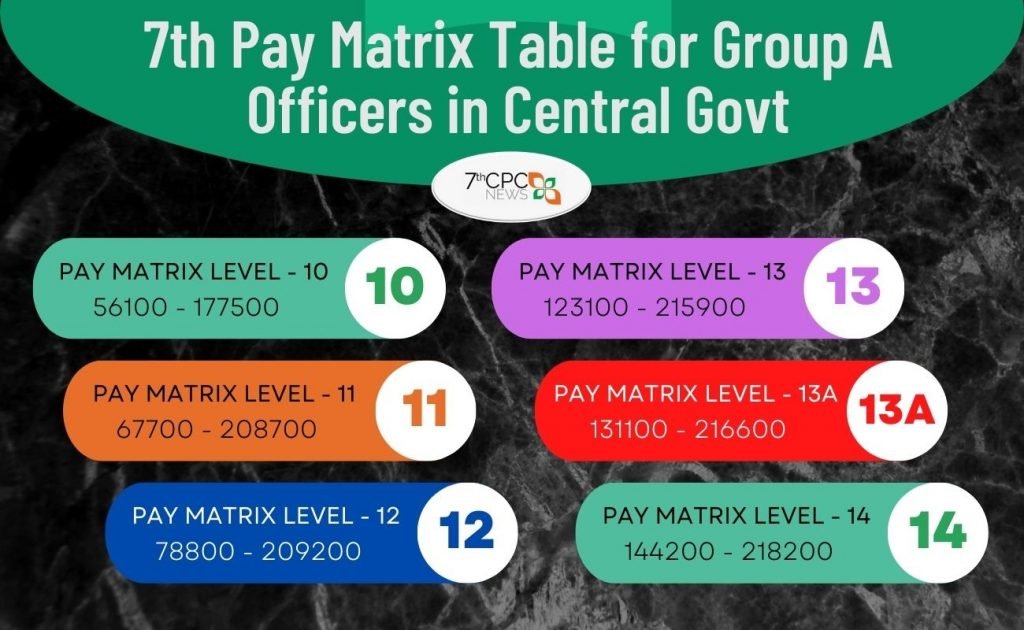

A Group Officers 7th Pay Matrix Table

The table denoting the pay matrix for Group A officers displays the categorization of posts following the 7th pay commission. The levels ranging from 10 to 14 are included in this category, along with the associated old grade pay values of 5400, 6600, and 7600, as well as 8700, 8900, and 10000.

HAG Group A Officers 7th Pay Matrix Table

The HAG Pay Matrix Table is intended for Group A Officers. It represents the highest salary scale available to central government employees, specifically Higher Administrative Grade (HAG) officers and those in higher grades of the Indian Administrative Service (IAS). These officers can expect a salary range of Rs. 182,000 to Rs. 250,000 based on the 7th Pay Matrix Levels 15 to 18.

7th CPC Pay Matrix Level-Wise Chart

The pay matrix chart for the 7th pay system consists of 19 different salary levels ranging from level 1 to 18, including an additional level 13A. You may click on the links below to access specific salary levels for each pay table.

5 Segments Levels in 7th Pay Matrix Table

The standard pay scales in the 6th pay commission were classified into five segments: Pay Band-1, Pay Band-2, Pay Band-3, Pay Band-4, and HAG Scales. However, with the introduction of the 7th pay commission, the pay bands and grade pay structure were transformed into a pay level system. The infographic below depicts the five divisions of the 6th CPC pay bands and the corresponding pay level consisting of minimum and maximum basic salary.

7th CPC Pay Band wise Matrix Table

| 7th Pay Scale Chart Pay Level 1 to 5 | Click to Show |

| 7th Pay Scale Chart Pay Level 6 to 9 | Click to Show |

| 7th Pay Scale Chart Pay Level 10 to 12 | Click to Show |

| 7th Pay Scale Chart Pay Level 13 to 14 | Click to Show |

| 7th Pay Scale Chart Pay Level 15 to 18 | Click to Show |

- 7th Pay Matrix Table Issued on 25.7.2016

- Revised 7th Pay Matrix Table Issued on 16.5.2017

- Defence Rank Wise Pay Matrix Table

- MNS Basic Salary as per 7th Pay Commission

- UGC Pay Scale as per 7th Pay Commission

This table is not a basic chart of numbers, as it outlines the foundational salary of a Central Government employee. The pay matrix comprises 19 columns and 40 rows, which establish a structured pay hierarchy for over 33 lakh Central Government employees.

This table offers various advantages such as the elimination of pay fixation calculations for promotions or MACP and simplification of annual increment calculations.

The pay rates for level 1 range from INR 18,000 to INR 56,900, while the compensation structure for level 2 starts at INR 19,900 and finishes at INR 63,200. Finally, the salary range for level 3 begins at INR 21,700 and concludes at INR 69,100.

The customary compensation scheme for newly-hired workers can be determined by various aspects, which may consist of the availability of an open and fair payment structure, the rationalization of the present grade payment system, and the enhancement of the frequency of the Modified Assured Career Progression.

On January 1st, 2016, the government implemented the pay matrix chart as recommended by the 7th Pay Commission.

I want to book railway holiday home in colva but no body is picking up my call kindly guide me

I am working as Research Officer (Medical) in MoA. My promotion is due in July 2021. (my current basic pay is 112400 with GP 7600. I will get GP of 8700 on my promotion.

please let me inform regarding the pay fixation calculation method or my basic salary after fixation in GP 8700 (level 13) with NPA

Give January increment and if you are not got third pay fixation in service you will get January, 2022 as 115800 in Matrix Level 12 & DNI from 1.-1-2023 in Matrix Level 13 onwards as per the CCS rule 10.

My basic 44100(g.p 2800). I get macp from 27th dec 2021 and promotion in sr.tech (g.p 4200) effected from 26th April 2022. Pl tell me what will basic from macp date and from 1st july 2022. My increment date is 1st july.

Give JULY increment option so normal increment and promotional increment on 1-7-22 as 46800 in MATRIX LEVEL 5 & DNI on 1-7-23as 47600 in MATRIX LEVEL 6 onwards.

You are right Sunil!

In case of an employee is under punishment, his promotion may be denied beyond the 10th stage! But, why was the commission extended the pay matrix table up to 40?

It’s one employee joins service at the age 18 years if he/she getting average or below bench marks in full service without any stagnation of basic pay and gets increments with retired (without any promotion/MACP) get 50% last basic pay of Pension in life time and welfare in family pension of spouse.

What is the purpose of the 40th state in the pay matrix table?

We want to know, the new GP after 2019 of 8700

GP 8700 to 8900, Matrix Level 13 to 13A from 2016.

Corona Virus:

Does the government have enough jobs and money to pay workers?

Hope you have the jobs and the government doesn’t stop pay checks and go back to 2nd pay commission. CPC should be stopped unnecessary pays to people who don’t work hard. I wish government gives money to the needy people.

Sir, I have taken voluntary retirement from defence (DRDO), in December 2019. I want to know tht how much time it will take to get my pension and all benefits , I have completed my 27 yrs of job in defence.

Maximum of 6 months. However, you contact your bank (regional) branch frequently.

Dear sir, Can be confirmed the above revised pension is applicable for me also? As I was retired from CRPF from the rank of Head constable on 01/11/2003 during 5 th cpc

Sir, I had been appointed in the rank of Constable in CISF on 1.11.1993. subsequently, I had promoted to the rank of Head Constable in Gr. Pay 2400 on dated May 2000. Thereafter under the MACP scheme my financial benefits updated to the Gr pay 2800 in the year 2010. Now I would like to know whether I am eligible for the next MACP in the year 2020 after completion of 10 years from previous MACP Or compilation of 30 years of service in 2023. Please

Your 2nd MACP was not in 2010 it was your promotion so on completion of 30 years on date of joined service on the month in 2023.

I think it will be in 2020 on completion of 10 years in one rank

Not in rank. It is from the service joined duty. His appointment date 1-11-1993, so 30.years completion as 11/ 2023.

What is my pay factor 2.57 or 2.67 clarification required .my grade pay 7600. At present I got 2.57 factor.

It is first entry pay calculated, after for all employees 2.57 multiple formula.

Mere father civil defence employees hai 22 Saal nokri Kar li hai ab self pention Jana cahte hai . Kya rules honge or Kitna payment mil Sakta hai.

From 1/1/2016 minimum pension is Rs.9,000/- and it depends upon is last basic pay of 50% plus applicable D.R., (now from 1/1/2019 – 12%.)

मेरा ग्रेड पे 5700 है. मैट्रिक्स पे मे वह नही है.

You are in 10A . You can check from another pay matrix table.

My MACP was due on 22nd May 2018. My basic pay is 60000 with 4600 Grade Pay. I have promoted as PS on 21 November 2018. Kindly help me to fix my pay. Still not received benefit of MACP and Promotion.

You might have got any upgradrations on the basis of joining each every 10 years of complesion in service. November promotion will not get monitory benefits only designation changes higher as per the 7th CPC, since there’s no pay scales separately allotted for promotional posts. If it is PB changes it will eligible.

If is important to notice that while you needs to have a superb basic approach, you

will have times when you have to change up your playing fashion.

सूचना का अधिकार (Act 2005)

मैं वर्तमान में Tech II Grade Pay 2400 / Level 4 में कार्यरत हूँ ।मैं अपना पारस्परिक स्थानांतरण वर्तमान में Tech I Grade Pay 2800/ Level 5 में कार्यरत कर्मचारी से करवा रहा हूँ ।हम दोनों रेलवे बोर्ड नई दिल्ली के पत्र स.E(NG)I -2018/TR/8 दिनांक 26.10.2018 के अन्तर्गत दिये गये निर्देशानुसार करवा रहे है।हम दोनों पदावनति Tech III grade Pay 1900 /Level 2 पर करवा रहे है। दोनों जोनल की तरफ से NOC जारी हो गई है। मैं 05/06/2013 को RRC से Grade Pay 1800 में भर्ती हुआ।मेरा 01सितम्बर 2016 में Tech III Grade Pay 1900 में पदोन्नति हुई । मेरी बेसिक 20500 थी। 01 जुलाई 2017 को मेरी बेसिक 21100 हुई । 01जुलाई 2018 को मेरी बेसिक 21700 हुई । 2 सितम्बर 2018 को मेरी पदोन्नति Tech II Grade Pay 2400/ LEVEL 4 में हुई ।मेरी बेसिक 25500 हुई । अब मैं आपसी पारस्परिक स्थानांतरण पर Tech III Grade Pay 1900/ Level 2 में करवा रहा हूँ । मेरी को रेलवे बोर्ड नई दिल्ली के नियमों के तहत निम्न जानकारी दी जाये ।

1. मेरे को यहाँ से किस बेसिक पर छोड़ा जायेगा । (यदि मैं फरवरी 2019 में यहाँ से रिलीव होता हूँ ।)

2.क्या मेरी बेसिक कम होगी या यही रहेगी।

3.भविष्य में जुलाई 2019 में इंक्रीमेंट के समय मेरी बेसिक क्या होगी।

4.भविष्य में मेरी पदोन्नति के समय मेरे को इंक्रीमेंट मिलेगा या नहीं ।

Sir I joined in 6/8/2005 and my pay on 1/1/2016 by 6th pay was (11210+2800) . 10 years completed on 7/8/2015 so how to calculate macp pay .

I received 4200 as grade pay from 7/8/2017 after competing 12 years.

Check up you joined in which GP it may be GP 2400, then you got 1st MACP on 7/8/15 & one promotion 7/8/17. Since ACP of 12 years it was upto 31/7/2008 after that from 1/9.2008 MACP Scheme started, you may eligible of 30 years completed on 7/8/2025 as Matrix Level 6 (GP 4600). You have to give option for lower promotion 0n 7/8/2017. Mention your latest basic pay & Matrix level as on 1/7/2018.

What will be the Net salary for Level 22 (56100-177500) ?

Sir i am 1.7.1979 retiree with basic pension RS 129.50paise after 15 yrs 5 days service in corps of signal as an wireless operatorgroup ‘c’ on30 the Jun 1979. On 7 cpc my basic pension RS 17130 which is less than 18000/-sin CE 1.1.2016 ho w and why would you kindly explain me the anomoly.

Or whom should I approach that case advise me

As per the 7th CPC from 1/1/2016 basic pay of 50% i.e. Rs. 18000/2 = Rs.9000/- is only minimum pension (not basic pay), your pension is more than that. Those who are in service their minimum basic pay should Rs.18,000/-.

I retired as PRT from KVS on 31.01.1996. My last pay drawn was 7950 in the scale 5500-175-9000. My basic pension was initially fixed at 6424 effective 1.1.2006 ( as I had only 29 years 4 months of qualifying service), Subsequently this was raised to 6750 – again effective from 1,1.2006 following delinking of mandatory 33 years of service for full pension, Following my representation this figure was again revised to 7215 effective 1.1.2006 acknowledging the fact that I retired with last pay drawn of 7950 in the scale 5500-175-9000. Based on the OM dated 28.01.2013 my basic pension was revised to 8251. However no further revision of this figure has taken place taking into account that the base figure from which 8251 was arrived at viz 6424 was enhanced to 6750 and later to 7215 , both effective 1.1.2006. Additionally while implementing 7 CPC decisions the figure used for the multiplication factor of 2.57 was 8251, Am I not entitled for this figure to be revised effective 24.09.2012 so that I get the. benefit of the revision of the original base figure of 6424 to 6750 and lastly to 7215 all with effect from 1.1.2006. I am unable to understand how the figure of 8251 was arrived at from the base figure of 6424.

Check up the figures from 1/4/2004 to 31/12/2005, 50% of Dearness Pay/Pension was merged on 1/1/2006, moreover the pension previous rules were changed from the 6th CPC from 1/1/2006, as 50% of last basic pay as notional pension. From the 7th CPC from 1/1/2016 as per your last basic pay of Rs.7,950 in 5th CPC scale of 5000-175-9000 it will be your pension as per the concordance table No.22 is Rs.24,500/- P.M. plus applicable D.R. as applicable from time to time. From attaining age of 80 also you will get 20% as additional pension with D.R.

Sir I am Retired assistant Divisional fire officer in defence fire service my grade pay 4200 pay band 9300 – 34500 sir please tell me about entry pay i my eligibles for arrears according to new DOPT order 28 sep 2018 for entry pay or not eligible for arrears and tell me about correct grade pay of assistant Divisional fire officer I am retired in 31 July 2013

1998 per basic 2550 da +basic to day how 7th pay basic+ da ?

Answer to MOHAN K CHAUDHARI : If basic pay was in 1998 of Rs.2550/-, in 6th CPC Rs.4,750 + GP 1300 = 6060, in 7th CPC from 1/1/2016 MATRIX LEVEL I as Rs.18,000/- plus applicable D.A., from the 1st increment 7/16 of Rs.18.500/- + D.A., from on the 2nd increment 7/17 of Rs.19,000/- + 7% D.A.of Rs.1,330 upto 6/2018 & from 1/7/18 19,500/- + 9% D.A. as Rs.1,710/-. Now total Rs.21,210/- plus applicable allowances of living city rates.(HRA).

With my calculations add 1998 to 2018 19 or 20 incremens as stage of ₹ 30,600/- or 31,500/- plus 9% D.A from 1/7/2018. Between these periods of promoted add from that amount also. Inform basic pay inclding grade pay as on 31/12/2015 then it will calculate appropriately.

Retired on 30.6.2017 as group’B’ gazettes officer with GP 4600/- from CSD under min of Defence. After completing one year of retirement can I accept commercial employment and also representat CSD on behalf of the firm and what is CCS rule

Please indicate the Aykroyd formula for calculation of 7th Pay Matrix citing example. It is confusing in determining the pay matrix since sometimes Current Entry Pay is taken as basic pay [pay in pay band plus grade pay as on 01/01/2006] or the stage shown in the Fitment Table of 6th Pay Commission in respect of each grade / level as on 01/01/2006 is taken for computing the Rationalized Entry Pay on 01/01/2016 resulting in the difference of entry pay matrix in some of pay level in the pay matrix. Kindly clarify.

I 693343B JWo SS Rathore rtd on 13 dec 2006 My counter part are getting in hand pension of app 24000 and me as 21400 approached Air force record office these stup are not able to respond nor has forwared my new ppo. Bank OBC Sojat Road mean to say not yet recived new ppo

Pl update my pension

forward new ppo

Make PDA for my pension as OBC Sojat Road Pali Rajasthan

B.S.Rao, RPF,ASI,E.Co.R,WAR.

Sir, I was RPF training school joined on 01.08.1986 at S.E.R,KGP after 9 months declared Date of appointment 04.04.1987 , but after 2years your training period including service increment geven , Now i was completed 30 service on 01.08.2016 but still date not implement my 3rd MACP this problem enter E.Co.Rly, near about 150 members. Please send reply immediately.

Dear Sir/Madam,

My father is ex service man. After his death my mother is getting widow pension from March 2007.

Please let me know how to calculate the pension amount.

Minimum Pension/family pension from 1/1/2016 is ₹ 9,000/- it depends upon his last pay & of his pay scales.

Till 11.07.2018,I am not getting any pension as per 7CPC martix table level 7,My grade pay is 4600.I retired from Ordnance Factory Kanpur as on 31 07 2008, that time my basic was 8700. No new PPO is received till today.Please arrange the same. Thanks

You may contact your ex-employer/PAO, they only issue revised PPO to your Pension paying bank.

Mei R.B.S. Degree College mei Library Clerk ki post se 26 june ko retire ho raha hoo. Kya mujhe massant ka labh milna chahiye. Yadi iska koi GO ho to uska number batyei.

Nice

My higher scale date is 16/04/2016. My basic on date 01/01/2016 is 18890 plus grade pay 4600. My increment date is 01/01/2016 and my retirement date is 30/09/2019. Please advise how I can get maximum financial support for long time i.e. in pension also. When will I take 7th pay commission and higher scale. Whether accept higher scale 6th pay commission or 7 th pay commission. I am ready to arrares if can got more pension throughout my life.

No moderation

Sir I invalidated out on 22/09/2011 FM itbpolice ministry of home at that time my basic was 9490 and grade pay was 2800 total 12290 I am getting disability pension (service element 50% and disability element 30% of last emoluments) before 7th cpc 9832=00 basic pension after 7th cpc 2.57=25269 presently received what will my basic disability pension after revision by 7th cpc notional pay fixation my disability percentage is 80% can I get constant attendant allowance

Thanks

Following representation be perused at DoPT level as there are so many sufferers :

Mob : 9775501077 Shri SK Patra, AE (NQA)

Email: soumenk.patra@gov.in CQAE (EFS)

NH – 16, Marripalem PO

Visakhapatnam – 530018

The Addl DGQA

Dte of Quality Assurance (Naval)

West Block 5 – RK Puram Sector 1

New Delhi – 110066

THROUGH PROPER CHANNEL

REQUEST TO REVIEW OF CTG POLICY (7th CPC)

UNDER EXTRA-ORDINARY CIRCUMSTANCES

1. I have the honour to submit the following with reference to DQA(N), New Delhi RTS-17 order no 2542/RTS-17/DQA(N)-Pers dated 26 May 17 and the subject matter, which are enumerated in the succeeding paragraphs.

2. I was transferred from QAE(N) Kolkata to CQAE(EFS) Visakhapatnam vide sl. no. 24 of DQA(N) letter ibid with relieving date on or before 30 Jun 17. Since my effecting transfer date was 23 Jun 17, I was eligible to get CTG as per older rates since it was considered as an allowance and brought into vogue with effect from 01 July 17. However, vide same RTS-17 order issued by DQA(N), majority of those who were granted extension or who availed joining time prior reporting to the new unit, i.e. they moved from old duty station after 01 Jul 17 even though their initial date of transfer was before 01 Jul 17 were eligible to get CTG as per new rate. The advance of CTG was availed from previous unit and the final claim was submitted to concerned payment office in respect of present unit. My transfer claim was severely affected by sudden and belated revised CTG policy with following magnitude:

Name & Designation From To W.E.F. 6thCPC BP+GP 7thCPC BP Gain / Loss amount

Shri SK Patra

AE(NQA) QAE(N), Kolkata CQAE(EFS), Vizag 23

Jun

17 23990 62200 38210 Loss (80% = 25770)

3. Since the allowances were made effective from 01 Jul 17, I have been granted CTG as per old rates only. It is submitted and opined that CTG should not be considered as an allowance and made allowable to employees who have been transferred after 01 Jul 17 only. Further, the office memorandum on the subject has been issued on 18 Aug 17. Hence, at the time of movement there was complete lack of clarity w.r.t. CTG. Therefore, implementation of the same with retrospective date of 01 Jul 17 would cause a financial disadvantage to a Govt servant who promptly complies with the Govt orders, i.e. had the affected employee been in the knowledge of this issue, he / she would have got his date of actual movement for transfer also deferred / extended accordingly to take financial advantage of CTG as per new rates.

4. The CTG is a grant paid to meet expenses arising due to disturbance caused in one’s day to day living resultant to the physical movement of self, family and paraphernalia on the occasion of transfer which is one month BASIC PAY. However, the same has been considered under allowances category in GoI gazette notification on 13 Jul 17 and rate has been revised to 80% instead place of 100% of basic pay with retrospective effect from 01 Jul 17 only. Further, vide Fin Min OM no 19030/1/2017-E.IV dated 18 Aug 17, the revised CTG policy has been clarified. It is opined that since CTG is based on the basic pay, which had already been revised earlier with effect from 01 Jan 16, it should have been given as per the new basic pay only and should not have been linked to the allowances. If CTG is to be paid as per 6th CPC then it comprises of basic and grade pay. Now basic pay has been revised in the month of Aug 2016 with multiplication factor of 2.57 based on which arrear has been paid. Hence, 7th CPC basic pay was already in vogue as on 30 Jun 17 and the same should have been taken into consideration along with the grade pay.

5. It is also opined that the CTG should not be compared with other running allowances like TA, HRA etc. The transfer process of an employee is not complete on his reporting to the new unit after availing joining time on being SoS from the previous unit. The permanent transfer process involves reporting of the employee alone first, his returning to previous unit station after finalising accommodation at the new station, packing up of paraphernalia, obtaining Transfer Certificate from school for children, ceasing of utility services, transportation of paraphernalia, family shifting, re-admission of children to school, settling at new accommodation/place, restoring utility services and repair / replacement of damaged items, if any etc which needs minimum few months of time. During this entire disturbance period the employee incurs huge unforeseen expenses. Therefore in my opinion considering the CTG as an allowance and making it effective from 01 July 17 is misplaced. The date of CTG implementation should not be linked to that of allowances, if done, it will be violation of basic spirit behind it and introductory GoI notifications related to CTG as well. It is further opined that the employees who have dutifully proceeded on transfer as per due date prior to 01 July 2017 and complied with the transfer orders have been at a financial disadvantage by not being eligible to draw the CTG as per new rates and subjected to undue financial hardships.

6. Further, disallowing an employee CTG as per new rates would seem to be logical if the entire process of transfer, i.e. his first move from old duty station to new duty station and return to old duty station to take his family and paraphernalia back to his new duty station is completed prior to 01 Jul 17. In case his return to new duty station with his family has concluded after 01 July 17, in my opinion disallowing him CTG as per new rates would be incorrect. According to the rule position for availing joining time, employees are entitled to avail the same either immediately or within six months. In normal practice immediate availing is hardly helpful/possible and is generally availed during shifting of family. Ironically, the employees who have been awarded deferment are entitled for enjoying the new CTG benefit but others are not. It is pertinent to mention here that the employees who have obeyed the transfer order keeping in mind station seniority new cut-off date (01 Jul in place of earlier 01 Jan of every year) and without any negotiation by not seeking any extension have been at a financial disadvantage. On the basis of early comers reporting, their relievers have been granted small extensions (few weeks to a month) on mutual consent. Hence, they are the only beneficiaries of this dispute / anomaly. Such situations are against employees’ welfare which leads to morale down and mental agony.

7. In view of the above, it is requested that the matter be taken up with DoPT for review and kind consideration as one time measure under extra-ordinary circumstances and CTG as per new rates granted to those employees also who have moved before 01 Jul 17 so that they are not strained financially.

8. Regards,

Dated: Feb 18

Visakhapatnam Soumen Kumar Patra

Asst. Er. (Naval QA)

Kunal Saini – 14/3

Get the arrears details from Pension paying bank.

I’ve retired from railway on 31St July 2013. My health unit (BR SIngh hospital ) is 14 km away from my residence. I am getting any medical allowance. I have to spent a huge amount for private practitioner & for medicine. My wife is bed-ridden patient. I applied for medical allowance on 22nd December 2017 & all the documents submitted to the CPO/KKK/FP Office KOLKATA. I also surrendered my BR Singh hospital registration card. I’ll be highly obliged if u look into the matter so that I can get the medical aid at the earliest. Thanks

My father is a retired navy officer.

He has received arrear in 2017.

He want to file return for assessment year 2017-2018.

But he can’t file bcoz he has no detail of year wise arrear .

Plz tell me how can we find this year wise arrear detail

Basudeo prasad my 7cpc Basic 01-07-2017 Rs 66000 sir my junior staff macp dated 06-03 -2016 GP Rs.5400 same work same pay as MY MACP date 26.-06 -2010 Gp insted RS 4600 grade pay Rs.5400 anomalay adjuestment

I Basudeo prasad as department joining date 15 july 1991 my salary disputed 5 pay commission my fast basic Rs. 1400.-2300 anomaly setalment as DOPT rule govt. of india 7th pay commisson thank you sir plase. Gp Rs 4600

as par rule 7cpc dopt govt. of india basudeo prasad sr. teck doordarshan kendra kalahandi bhawanipatna odisha pin code 766001

Sir I am bsf department person .Sir I am getting 38100in level 5 from July 17 .but now salary of serving personnel being increased with multiple factor 3.00 instead of 2.57.please tell me how much increased my salary per month

Dear sir,

I am a retired pensioner.

My pension is received after deducting the tax but not mentioned in form 26s

Form 16a given by bank not showing any tax deduction.

I need form 16 from cpc to fill Itr.

I have Superannuated on 28-02-2006 after completion of 34 years of service as central Govt health service doctor with a basic pay of Rs19400/-revised after 6th pay commission..Presently I am drawing Rs93004/-as basic pension with DA on that.Is it o.k. Ok or I will get any thing more

मुझे 1900 ग्रेडपे के अंतर्गत 27600 बेसिक मिल रही है। ए. सी. पी. के द्वारा 2400 ग्रेड पे के अंतर्गत बेसिक किया होगी

I am retired on 22.8.2003 at scale Rs 7450-11500. Got stag. inc and basic stands at Rs 11750. Before getting 2nd stagnent allowance I have taken vol.-retirement and before getting stagnent increment.on 22.08.2003. My pension fixed at Rs 5863. Qualifying for pension 39years 3months. I am not aware anything about PAY BAND and GRADE PAY. My pension fixed at Rs 34058. Is it OK or any wrong. Should I not benefitted for stagnent for the long period. At what scale it will be fixed after revised 7th CPC.

pl advice when DOPT is taking all decisions in service matters in consultations with JCM then why are Office Memos are issued by Deptt of Expenditure and if Deptt of Expenditure misinterpret such OM on decisions taken by DOPT, is it not duty of DOPT to correct Deptt of Expenditure. RTI of DOPT in this regard has any value to morons in DoExpenditure!!!!!!!!!!!!! my experience says all on free will going on, no one bothers to correct incorrect, DOPT appears to be a subordinate deptt of DoE, MHA these days, if PM is dominated by jaitely, rajnath

There is a conspiracy to betray the incumbents who are in the pay of level 2, 6 and 7. Their upgradation in accrual of MACP will be enhanced by a increment only. On closure scrutiny one can easily verify that the cells of level 3, 7,& 8 are copied from their previous level.. Because on accrual of increment in these levels it fits exactly over one of the cells in the next level.. But, in other levels same instance will never happen..

My Dad Retired in 1988 from Southern Rlwys as Off Supdt.

His last drawn basic pension as on 31/12/2015 is INR 9,636.

Would like to know what would be the arrears due to CPC 2017.

What is the link from which we can get to know the exact arrears. He is currently aged 86.

Also pls advise if application is needed from the pensioner to get the arrears and if so pls advise the format in which the appln is required to be submitted and where it is to be submitted.

Pls advise – Thanks.

My Dad Retired in 1988 from Southern Rlwys as Off Supdt.

His last drawn basic pension as on 31/12/2015 is INR 9,636.

Would like to know what would be the arrears due to CPC 2017.

What is the link from which we can get to know the exact arrears. He is currently aged 86.

Pls advise – Thanks.

Good news for central government employees

My Basic Pay was Rs 37,630 in the pay scale 15600-39100 on retirement on 31.07.2009 and Pension 01.01.2016 before revision was 18.815 and Family Pension was 11,289. (Less Pension Commuted Rs. 7526/-)

Grateful for the Revised Basic Pension as on 1/07/2017.

Thanks/Regards.

What is the meaning of SG1 .?

My last pay in 6th cpc 1/1/2016 was Rs. 17940/- ( 13740 +4200) i got adoc MACP in DEC 2016 in 4600/ Grade pay.what wuld be the my basic pay today @ Aug 2016

My last pay in 5 th pay commission dec 2005 was 7700/- i got advoc promotion in aug 2004 in 4600/- grade pay and it clears on aug 2009.i got 1 st macp/acp 4800/- on 1.8.2009 and second macp/acp 5400/- 8 dec 2016 . what would be the my basic pay today.

I m working as a trimmer grade 3 Moc & I from 9 years. I get a departmental promotion of assistant Exuctive on march 2016 . so before promotion my pay band 8900 and GP 1900, then after promotion as per 7 cpc can my basic fix ……………..?

I HAVE BEEN PROMOTED AS UDC IN JAUNARY 31, 2017 AND MACP OF 10 YEARS COMPLETED IN APRIL 2016 AND ANNUAL INCREMENT IN JULY.. WILL I GET 2 OR THREE INCREMENTS.

BP AS ON 01..01.01.16 8540 GP 1900

I have a question about pay fixation . I am working in C.M.P.F, IN CADRE restructuring in cmpf INTIAL GRADE IS 2400 AS SSA, AFTER 4 YEARS THEY UPGRADED IN GRAD 2800, THEN 60. % OF SSA+ SR. SSA will be placed in grad 4200, my question is that whether increment will be granted both the time or not

I m working as a trimmer grade 3 in certral railway from 8 years I get a departmental promotion of assistant loco pilot on 1.1.2017 so before promotion my basic fix by 2.57 then after promotion as per 7 cpc can my basic fix by 2.954 ?

What is the benefits of pensioners for 7th PC allowance now.

DOB 15-.7-.1944 date of retirement 31-7-2004 in the scale 8000-275-13500. pay on retirement Rs. 10475 what will be my pension as on 1-1-2016 as per matrix fixation

An error noticed in arriving pay matrix in pay calculator . A single index of 2.57 is seen taken into account for pre -2016 pensioners. In Table-5 :Pay Matrix various index for various Pay Bands has been fixed .2.57,2.62,2.67,2.72&2.81. The error may be rectified and revised calculator could be published to help the pensioners..

Retired on31011995 in the gr.3000-100-3500-125-4500 at bp4500.what will be my pension on 01012016 as per 7th pc

The AIS pensioners would be at ease if the concerned Accountant-Generals are to deal with the matter of final fixation of pension in their offices directly.

I (Shiv Prakash Gupta, LDC) belonging to the Department of Geological Survey of India(GSI), Western Region(WR), Jaipur. The department has 9 Regions all over India. The Head Quarter is in Kolkata. The seniority for LDC is maintained Region wise for promotion. The Central Head Quarter(CHQ), Kolkata is maintaining separate seniority list for promotion and Western Region (WR), Jaipur is also maintaining separate seniority list.

Sir, I was drawing more pay than other LDC (Sh. Rabi Nayak, Kolkata) on 31.12.2015 posted at CHQ, Kolkata and after 7th CPC fixation I was fixed in lower pay than the pay fixed in respect of Sh Rabi. The details are as below: –

Sh. Shiv Prakash Gupta, LDC, GSI, Western Region, Jaipur (Applicant) Sh. Rabi Nayak, LDC, GSI, CHQ, Kolkata

Basic Pay as 31.12.2015 13870/- 13850/-

In the Grade Pay 2800/- 2400/-

B.P. X 2.57 35646/- 35595/-

Pay fixed as on 01.01.2016 in implementation of 7th CPC 35900/-

in Level-5 36400/-

in Level-4

Sir, my grievances to be redressed are as below:

1. Whether, I compare my pay to the other Regions employee.

2. Whether, a Government Servant drawing more pay in the 6th CPC on 31.12.2015 can draw less pay after pay fixation of 7th CPC.

3. Can stepping up be applicable after comparing to the other person who is belonging to other Region for whom separate seniority list is maintained.

4. Is benefit of bunching applicable in this case?

Sir, this letter is hereby written for seeking clarification whether I can draw Rs 37,000/- (w.e.f. 01.01.2016) in Pay level 5 by stepping up and how ?

Waiting for your kind co-operation and valuable suggestions.

I retired on 29/2/2008 in the scale of Rs. 8000- 13500 (class-I) scale. My pension was fixed as Rs.8599/- on the basis of average pay of Rs.17198 drawn in last year. I have earned 13 increments in this scale. My pay in revised pay scale (6th pay commission) was fixed as Rs.27,500/- in the scale of Rs.15600-39000 with grade pay of Rs.5400 and revised pension was fixed as 13,750/-

Now pension on the basis of seventh pay commission has been fixed as Rs. 35338 after giving the benefit of 2.57 method.

In view of the above, my pension should be fixed on the basis of second method as approved by Cabinet as I have drawn 13 increments. My pension should be calculated after giving benefit of 2.68 as per pay Matrix table and revised pension would be Rs.36850 instead of RS.35338 earlier fixed. It is requested to look the matter and send your views in the matter

Regards.

Till the Govt not yet decided the rivew of pay increase and pension to Central govt employees. But Govt considered one Rank one pension to difence personals where the commission also recommend to increase pension for all central govt employees like as defience staff. It is a fault of Recognised trades in our country they are not nogisiate problem with Govt. At very begging the union was done great mistake such as they postponed the indifinate strike otherwise the Govt automatically considers our demand. You see all political leaders like MLA MLC, MP (Lol Sakha, M. P. (RajsabhSabha) is not paying a singe. Pause of the income tax and all getting more and more benefits than regular employees.

I drew 6 increments in my previous grade. My Pay Fixation , based on 6 increments drawn, as per matrix should be : 1,41,600.

1/12/1996 15,500 The error may please be corrected under an

1/12/1997 15,900 intimation to me at my E-mail address.:

1/12/1998 16,300 skmitra_dr@rediffmail.com

1/12/1999 16,700

1/12/2000 17,100

1/12/2001 17,500

THE EMPLOYEES WHO COMPLETED 24 YEARS OF SERVICE INBETWEEN 1.1.2006 AND 31.8.2006 ARE TO BE GIVEN GRADE PAY OF RS.6600/- WHAT ABOUT THOSE WHO HAD COPLETED 24 YEARS BEFORE 1.1.2006.ALL JUNIORS WILL BE ON THIER HEAD.SHOUDNT THIER PAY BE PRTECTED.I SUPPOSE IT WILL TENTAMOUNT TO BIG ANOMALY OTHERWISE.Isnnt it?GHULAM HASAN GHAMGEEN,RTD.PUBLIC BROADCASTER,SRINAGAR KASHMIR.

i am pension out from army on 01 Aug 2016 as Subedar and getting pension @ 11970/- as old rate and now i want what is my new pension. and also know what about my new service gratuity and commputation money . my new corrigendum PPO. please let me know what the time taking.

My grade pay increased after 10 yrs service 4800 (pb2) to 5400 (pb 3) on 13-4-2016.. in 6th CPC my benefit was 600×2.25=1350.but in 7th CPC my benefit is 63100-62200=900 .what a rubbish anomaly.

Pension fixation of pre-2016 pensioners, those who retired before 1-1-2006 as per pay matrix table.I am retired college lecturer from commerce college, taken VR S on 14-6-2000..

M.M.Acharya asked on 11January

2017

Sir I wish to know about implementation of 7th CPC for pre-2016 pensioners of Gujarat university affiliated colleges Teachers those who retired before 1-1-2006.

sir i need 7th pay commision implementation for central govrenment school teachers pay matrix

hello sir/madam

dont u think that there is lose to those promoted between 2 jan.2016 to 30.june 2016. because those who promoted in this 6 months does not complete 180 days or 6 months on 1st july 2016 for their regular or annual increament. And because of non-cmpletion of 6 months or 180 days admintration is not giving them anuual increament, only promotional increament is given to them, and their annual increament is shifted to w.e.f 1.1.2017, which is loss of 6 (six ) months .

please clarify the same. with the below illustration:

basic as on 01.01.2016 – 5630+1800

promoted as jr. clerk as on 10.06.2016 (in 1900/-GP)

plz tell me the my new pay as per 7th cpc as on 01.07.2016

and wen will be my next increament and pay

LDC & UDC pay not upgraded even in the 7th CPC.

Request look into this matter

Heavy load on LDC/UDCs, please expedite.

why lDC & UDC pay not upgraded even in the 7 th CPC ,its sad !!!!!!!!

Whether ceiling of gratuity enhancement had been circulated through going gazette notification.

As fr the first option the department in which the pensioner served will be able to identify the scale of pay and pay at which he retired from service with the permanant records such Pay Bill Register/Accountant General or Comprtroller and Auditor General communication at the time retirement for authoridsation for drawl of pension by the pensioner. very much Scope is there for this.

V.VENKATESWARLU,

01/ .09 /2016

My pension was fixed at 7950, my pay scale was 7450-225-1150 at 6 th. cpc my pension was fixed at 11978/-I gathered taht during this cpc. weightage would be given, kindly let me know how my pension be fixed, and to whom I give the option for fixation. presently I am drawing pension from Bank of India, Kukatpally branch, Hyderabaad.

Sir, i was discharge from DSC due to disability 100pc after 10yr servs dt on30-06-2009.netow i have receivd 100 pc disability pen afterOROP Since march 2016 includeing 125 pc DA total pen Rs 16633.after 7th CPC my above pen will enhencing or not if yes wt will imay begetting pl let us know thanking u sir.

As fr the first option the department in which the pensioner served will be able to identify the scale of pay and pay at which he retired from service with the permanant records such Pay Bill Register/Accountant General or Comprtroller and Auditor General communication at the time retirement for authoridsation for drawl of pension by the pensioner. very much Scope is there for this.

Similar to Civilians Pension Matrix shall be suggested so the bank/pensioni payment officers will disburse pension accordingly. This may be for pre-2006 and pre-2016

The index for present CG employees is 2.67 as per Pay Matrix Table. for Level 10,11 and 12. But while computing Pension it is mentioned that the existing pension is to be multiplied by 2..57 to arrive at the pension by one method and another method is by adding no. of increments . Please see to this.

Sir, I am working as UDC and completing 30 years of service by 11/2017 and eligible for III MACP w.e.f., 1.11.2017. Is there any benefit if i opt for option 2 in the for of option. please comment

a simple and sure shot pocket app. very helpful to each and every govt. employee.

I have retired on 30.11.2003 from Andaman and Nicolae Administration Directorate of Education. NOW Basic Pension IA Rs.10935. Kindly let me know what will be my new pension.

In Neyveli lignite corporation – What about the workers basic+DA calculated when he is under 5 year wage revision ie 2007-2012 & now among workers project notification selected as Jr. Eng in the year 6/4/2015. How he enjoy the WR benefits after 2012 till dt of joining 6/04/15 and after that he goes to 7th pay commission which is a 10 year plan from 01/01/2007 up to 31/12/2016. The basic and DA calculated at the time of joining and continue to draw after that in 7th pay commission

What do govt give and thinks for CG who are sick and put under low medical category while serving for the nation. Is there any facilities for their future and family from the govt side after giving their valuable life for the nation. Please the high thinking politicians and high authority need to think positively so that no citizens in this democratic country is neglect.

Hon bl e sir,

After about 18 years of service I have not been given any promotion without fault .My appointment date is 14.12.1998 as LDC through staff selection commission against DR quota.However 1st MACP has been granted to me and my grade pay has been changed from Rs. 1900/- to Rs. 2000/-.Is there any other relief for such case?

Hon.ble Sir ! Perhaps you may not be satisfied with my comments then so nice of you for seeking solid .field.. I have experience of 43 yrs private &govt. service. My comments are totally experience & alert.eyed base . Again with regards . Anila

Anila TrivediAn employee is more hpnest & aware about receiving emoluments rather than self duty & its cpmpliances .This is bared.truth which may be burried by mass scale & their self. invited ambitions .Which can be paid that is sufficient more than. I.m absolutely satisfied .

What about the similarity of paramedical staff like O.T. Assistant ,Lab assistant, X Ray,Dialysis assistant,etc in pay anomaly in seventh pay commission.

It is not at all clear for we as a pensioner of 1987. after 6th pay commision i received basic pension Rs 4450 + DA and + Medical allounce total 11500 approx.(current) At the time of retirement by basic pay was Rs 1440.00. I was taken VRS after 22 years of service as a Droughtsman Gd-III From CQA(SA) Ichapur.

Please confirm

It is not clear if the OROP principle will be applied to the Central Civil employees also, as in the case of Defence Peresonnel.

Will be obliged for a clarification on this point.

This 7th CPC will be effected the forth coming election in

2017.

Good pay hike but it would be better if fit ment formula would be 2.86

Govt. should consider to increase the fitment formula from 2. 57, which is meagre..

Good pay.. The impact will be more after the DA announcement in coming years

Good pay for employees infact hike in pc salary results hike in facilities

If 2.9 is sanctioned, it would be somewhat better for the employees under this dearness age and will give some relief. Rest part of the VII pay commission is considerable.

why the multiple factor is being taken 2.57 in every case where as multiple factor is recommended different for different levels for example multiple factor for level 13A is 2.67. The change in multiple factor make lot of different in pay. Please look into and make necessary correction in calculation of pay/ pension.

good pryment for modi ji gorment

goood pay

We expect quick promotions for person with differently abled…..

1.SPL Allowances .

2.SPL Leaves.

3.Promotions same as SC & ST people

This (7) cpc has no scientific economical social explanation for pay fixation formula just it appears as if at the last moment some young cleark working on contract basis has filled up the table

Mera head comml. Clerk se medical decategorise huaa thaa Ab meri post clerk kr di gyi hai type test liya ja RHA hai jbki post os honi chahiye appointment 1997 ka v gp 4200 hai please solve my matter

Sir, pls calculate my 7th p. C arrears &pension.

Sir, I retired as a Sr Sec Engr (Tele com) 31. 01. 2014 from SERLY KHARAGPUR. Ishall be oblized what will be my modified pension from july 2016, I’m a graduate engr. My dt of appointment inRly 03. 03. 1980.

Sir meri basic pay 9800 aur grade pay 2400 total pay kitna hogi 7th pay comission mai

Sir my basic 7850 grade pay 2400

Sir Total pay kitni ho jayegi

I am a pensioner, associate professor. In IIT, with gp of 9000. It falls into level 13B. I could not find the initial for this level. Can any one clarify my doubt? Thank you

Sir may payment basic 9070 grade pay 2800 hai and 7th pay comition me meri total salary kya hongi

Sir meri basic pay 10880 +2100.GP hai and 7th pay. Commission main meri total pay kya hogi.

Mera new 7 th p c me on hand kitna aayega mera BP 22810 hai

ldc ke liye pay commission me kuchh nahin hai, mera pay garde pay 1900 sahit 9990 hai 7th pay commission mein basic kitna hoga and grass amount kitna hoga civil mein

I am retirrf in 31stmay 2000. My pension as per 6th pc is 12521. My grade pay is 15600-39100. Pb. and grade pay is 5400. and my pay was 11300 in the scale8000-13500. What would be my pension now. Cvn

Pay commission wrong hai isko 1800 GP ka kuchh bhi nhi diya hai ek ko itna diya dal atta sabji ke rate to ek hote hai fir pay commission me antr kyon eh sab kya Congreshi member the jo har frk dalte aye hai aur dal rahe hai puna smikshya kiya jaye

I am servicing as a doctor in govt.department.I would like to ask about Non private practicing allowance in 7th CPC.

Sir my basic family pension 3500 pl my new grade pension conformation

Chandra Bhan Singh of AMC retired on 31 May 2011 in26 yr as Hav.sir tell me after ONE RANK ONE PENSION.what will be my new pansion…..

Chandra Bhan Singh of AMC retired on 31 May 2011 in26 yr as Hav

I retired in 2003 from army now my basic pension is 5670 after orop it would be 7170 rs.Sir tell me after 7th pc recommend how will be my basic pension.

Dr. Ramesh Chandra mahapatro retd reader in chemistry(Retd) on 1st july 2009 with basic pay of 57260 and gr pay of 9000 and getting pension of 57260 . what will be my pension in 7th pay comission

Dear Sir,

First 5 scales get merged with minimum of Rs.18000/- . In 5200-20200 scale there are 5 grade pays viz.1800,1900,2000,2400 & 2800. Employees with 5200+1800 grade pay=7000 get his pay fixed at Rs.18000/- and employee drawing pay 5200+2800=8000 gets his pay fixed at 29200/- as per the pay matrix. Just because he draws GP Rs.2800/- he gets Rs.11200/- more . Do not you thing it unscientific or illogical. Will you please explain how the pay commission has arrived at entry pay with method applied.

Sir,

The pay fixation given by the 7 th CPC looks illogical. One example is the official in level 10 after 34 years service ( not accepting any promotion) is going to fixed at basic pay 1,48,600 as per the mattrix table. The same officer reaching to level 13 by getting three promotions during his 34 years is going to fixed at 1,41,600 , that is by getting 3 promotions he is going to loose 7 thousands in basic pay. Please inform us whether it is anomaly or not.

USN.Reddy

Fitment. Index is 2.57. Why at some places different index is shown?

Sir I have came to know through AIRMEN/SNCO,,S website that when ever SNCO Air Force, Petty officer Indian Navy & Havildar of Army SNCO Army hospital lised in empenalled Hospital. They are provided treatment in the General wards. Where as A fourth class pensioner getting treatment in semi private or even private wards. This because of higher pension amount. I think during SNCO r Back Bone of defence. After discharge. They are below an peon. Henceforth I request the defence Authority, echs Dirctrctor to maintain the Status of the the SNCO, s.otherwise they themselves Wii be dergràd when you men will be forced not joining defence.

What does mean s1 to S6

The fitment factor is as said 2.57 uniformaly but why it is showing 2.57, 2.62, 2.67 etc for different levels what is its meaning?

As observed in above matrix of revised pay for CG employees, the different multiplication factor for different scales/grade pays are not justifiable when properly analysed and apparently based on general assumptions. Particularly, The jump in the factor from 2.57 to 2.67 between Columns 13 and 13A in the pay scale 37400-67000, that is difference between GP of 8700 & 8900 is the largest in the Pay matrix proposed. This difference owing to work/responsibilities associated with the cadres seems to have arisen suddenly in this pay commission. I hope the authorities will trim the higher or raise the lower to make it appropriate and reasonable

There is Avery Serious Anamoly in the pay matrix recommended, retirement without increments leads to lesser pension than that before promotion. Needs to looked into in detail and redressed.

The committee appointed for formulation of pension rules is requested to consider reckoning of increment which has been earned on the last day of month but could not be drawn on Ist of month due to retirement for the purpose of fixation of pension.This will help the pensioner to receive higher commutation amount higher leave salary amount and higher gratuity

.

Pay fixation when pay band change like 2800 to 4200 under MACP or Promotion

The fitment factor is as said 2.57 uniformly, but why it is showing 2.57, 2.62, 2.67 etc for different levels. Whta is its meaning?

The fitment factor is as said 2.57 uniformly, but why it is showing 2.57, 2.62, 2.67 etc for different levels. Whta is its meaning?

I am 24 years service in def and retd date of my service is on 30 Apr 2018 present time grade pay 2800/- and that time grade pay will be 4200/- in this time my bp is 11430/- how many benefit of the pension in that time

Retired from RLY service on 31.12.2004 in the retiring grade Rs.6500/= to 10,500/= on a Basic pay of Rs.8300/= + Rs. 4150/= as D.P. Basic pension=Rs.6225/= commuted Rs.2490/= Revised pension after 6th.CPC = Rs.9379/= I earned 9 increments (Rs.1800/=) in my Retiring grade. What options of opt. 1 & opt.2 of 7cpc will be benificial to me. Higher amount of Pension may kindly be calculated.

No used next ten years raised hike of things rupees value the pay commission is not satisfied

I am working as a Jr.Technician in the pay band of Rs.. 5200-20200+4200 APCII ( riginal Pay bound 5200-20200 +2400). I completed 28 years govt.service in Goa Medical College , Bambolim and superannuation in the year2018,31/07/2018. My present B,P. Rs.17300 +4200 in the month July 16. What was the benefit for me .?

I have been working as Chief Office Supdt since 2005 and my present Band pay and Grade pay is Rs.19360 & 4600, respectively. I shall retire on superannuation w.e.from 01.02.2016 (Last day of my service is 31/01/2016) Will you please let me know the quantum of my Pension, Leave salary, Commutation value 40% and DCRG after implementation of 7th CPC.

Thanks.

It has been seen that grade pay of certain cases of pre-2006 Retired pensioners (held ‘Gazetted ‘B’ Post) Was fixed at Rs.4600 Istead of 4800/5400, As per O.R.O.P for central civil govt employees under 7th C.P.C, the grade pay is the determining factor for fixation of pension inaccrdance with the post held bythe pensioners under the pay matrics, is required to be corrected before acceptance &fixation of their pensions othewise they will be compelled to knock the door of the court for litigation for their right fixation of pensions.

It pay scale will raise a deep difference between lower grade and higher grade

Sir mein army PBOR rank 11 year service hua hain . basic 9500 aur gp 2400 . kia bata sakta hain mera total pay kitna hoga

If we look at Table 5 pay matrix of civilian employees the highest figure at Index 40 of Level 1 is 56900/- . it means a pensioner/employee retiring in Level 9 with 2 increments is drawing less Pension compare to Level one or equal to pensioners of Level 10 with 1 increment. This is absolutely a gross injustice to the pensioners of all Level 2 – 9.

I joined as LDC in Pondicherry Govt on 8/4/1968 and retired as Superintendent on 30/9/2006.Thus i have put in 38 yrs and 5 months service..My basic pension is Rs 9365 in the GP of 4600 in 6 cpc.. As per 7 pc my pension will be Rs24067 after multiplying my present pension by 2.57 or Rs 25250 i.e 50%of 50500 since i earned 4 increments in the retiring cadre. If I had continued as LDC and retired in that post as per pay matrix my basic pay will be Rs 65100 in G.P 2000 and my pension will be Rs 37600 at present and there is a huge difference of Rs 11350 . T.his will be more useful in my old age….Hence the 7 pay commission may clarify whether i can opt to retiire in my entry post of LDC. My promotion in my service fetched loss only.