Children Education Allowance – Rates, Reimbursement and Forms

Children Education Allowance for Central Government Employees – Rates, Reimbursement and Forms

Most of the young educated people in India seek a Central Government job because of permanent (up to 60 years) income and various benefits. Particularly, various types of leave, free medical including dependents, Air Travel LTC and Children Education allowance.

Check also: Children Education Allowance Reimbursement Form Download

How to get Rs. 54,000 per year?

Central Government accepted the recommendation of 7th pay Commission on Children Education Allowance without any change. A Central Government employee can claim the school fee and other expenses for two children.

Every academic year a Central Government employee could claim Rs. 54,000 for two children.

Consolidated instructions issued by DoPT – Complete details of reimbursement of CEA [Click to read more…]

How many children eligible for CEA & HS?

Eligibility of age of children and what about third child? – Click the below image [Click to read more…]

What is maximum reimbursement amount of CEA and HS?

Maximum amount of CEA and HS – Click the below image [Click to read more…]

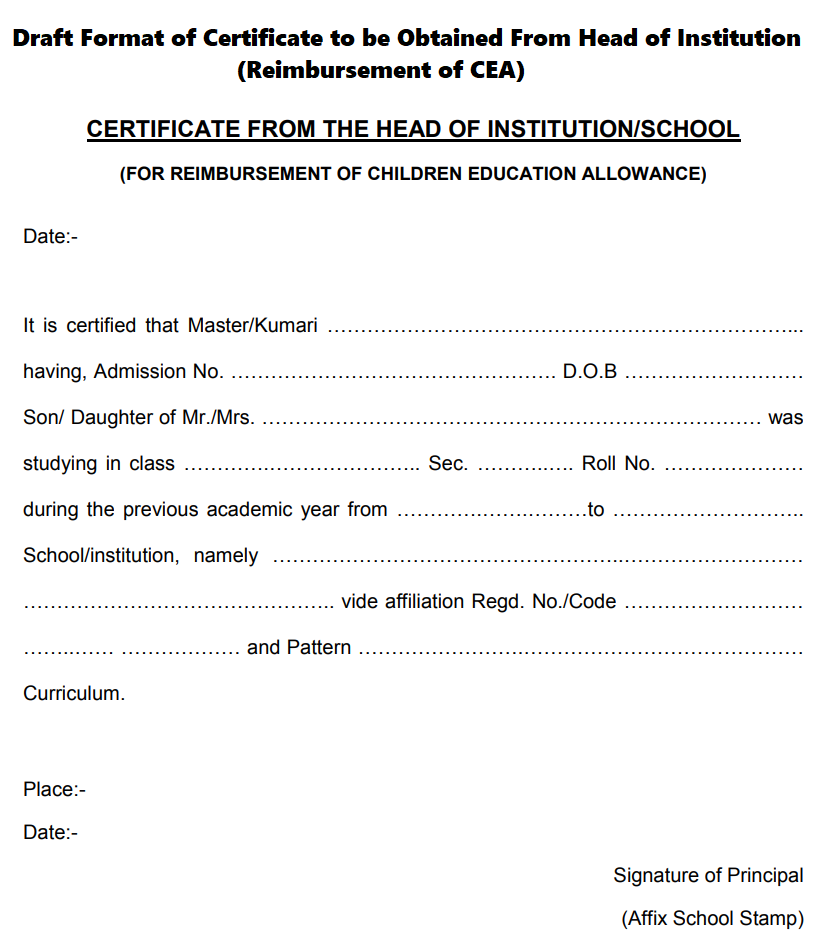

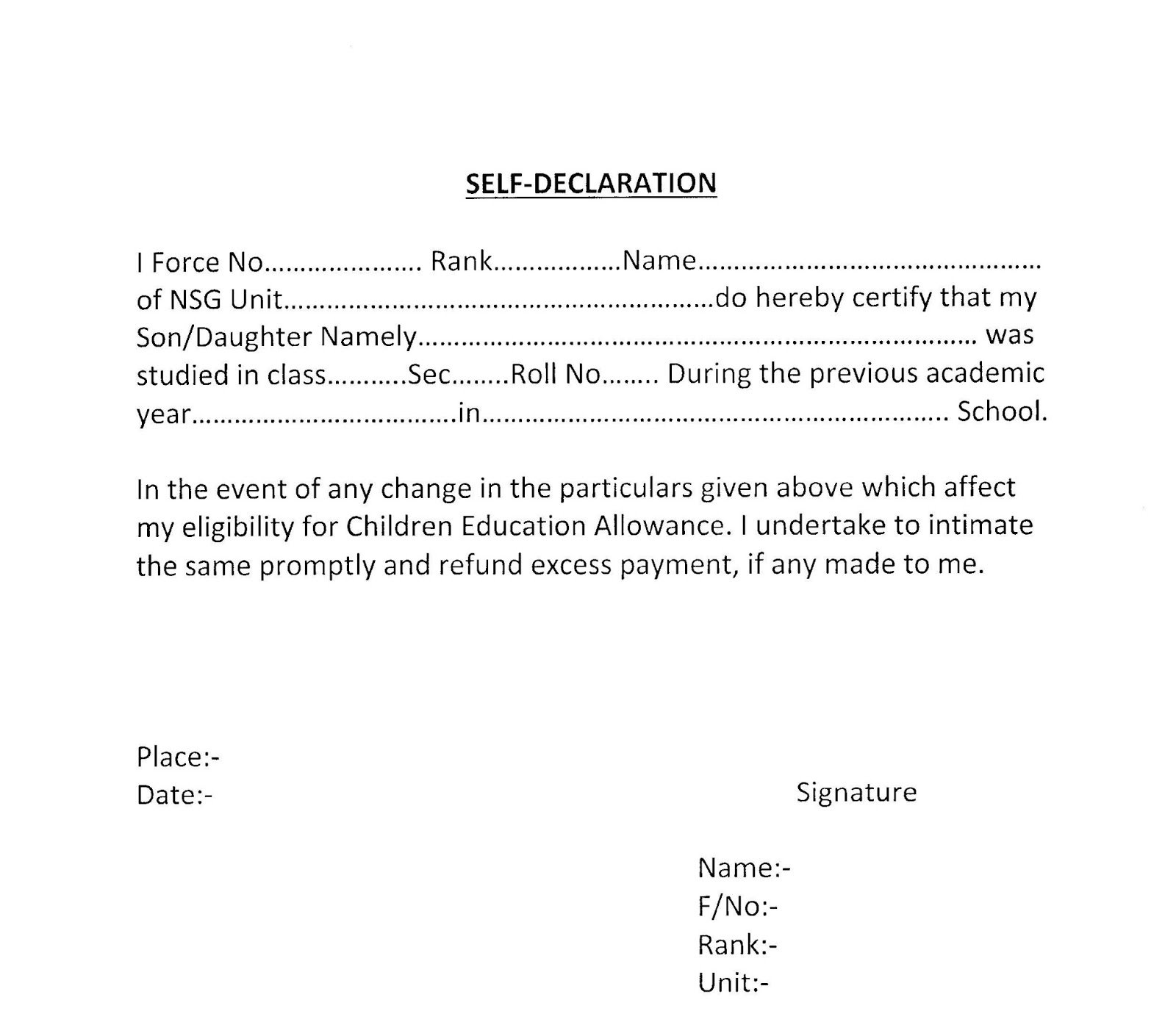

What type of Certificate or Self- Attestation to Produce for Claiming CEA?

Bonafide certificate or self attestation details – Click the below image [Click to read more…]

Check also: 7th CPC CEA Questions and Answers

What is the Ceiling of CEA for Divyaang children?

Physically Handicapped children eligibility amount – [Click to read more…]

Leave a Reply