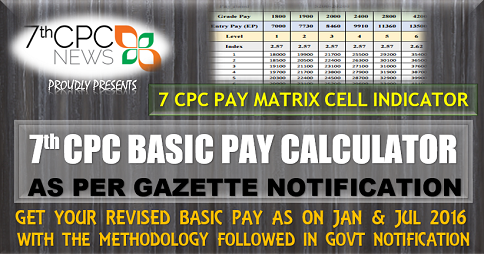

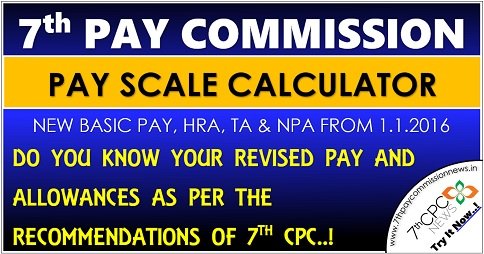

New Salary Calculator as per 7th CPC Gazette Notification for Central Govt Employees

Introducing the New Salary Calculator in compliance with the 7th Central Pay Commission Gazette Notification for Central Government Employees. With this user-friendly tool, you can effortlessly determine your revised pay, including arrears, from January 1, 2016, to July 1, 2017, utilizing our comprehensive Pay Matrix Table. Our meticulous step-by-step process guarantees precise calculation of your updated pay.

[Note: All the figures are indicative]

To begin, simply input your basic salary as of December 31, 2015, in the initial step. In the subsequent step, carefully select your appropriate pay band and grade pay. Furthermore, designate the relevant House Rent Allowance (HRA), Transport Allowance, and Non-Practicing Allowance (NPA). Upon completion, click the Calculate button to promptly obtain detailed information regarding your revised salary.

Our revised pay structure strictly adheres to the Revised Pay Rules of 2016. Our advanced tool incorporates the most recent bunching updates and enables you to conveniently download an image of your revised pay summary for future reference. Stay well-informed regarding the latest pay regulations with our New Salary Calculator aligned with the 7th Central Pay Commission Gazette Notification for Central Government Employees.

| Title of Calculator | Revised Pay Calculator |

| Beneficiaries | Central Government Employees |

| Features | Revised Pay with Arrears |

| Published on | 1.7.2016 |

| Updated on | 12.12.2017 |

| Inputs | 6th CPC Basic Pay, GP, HRA, TA & NPA |

| Outputs | 7th CPC Basic Salary, Pay Level and Arrears from Jan 2916 to Jul 2017 |

| Special Feature | Revised Basic Salary with Pay Matrix Table |

| Developed by | TEUT Digital Concepts |

How to Calculate Your Pay as per 7th CPC Pay Commission?

Discover how to accurately calculate your pay based on the 7th CPC Pay Commission guidelines. Our convenient four-step process allows you to effortlessly determine your 7th CPC pay. Additionally, we have included a helpful illustration that elucidates the calculation method in accordance with the 7th CPC. It is important to note that the influence of the 7th CPC extends beyond Central Government employees and pensioners, as numerous State Governments have also implemented these recommendations for their respective employees and pensioners. Do not delay any further in comprehending the impact of the 7th CPC Pay Commission on your pay. Utilize our state-of-the-art salary calculator, designed in accordance with the 7th CPC Gazette Notification for Central Government Employees, and gain clarity today.

| Existing Pay Band | PB-1 |

| Existing Grade Pay | 2400 |

| Existing Band Pay | 10160 |

| Existing Basic Pay | 12560 |

| Step 1 | Basic Pay x 2.57 |

| 12560 x 2.57 = 32279.20 | |

| Step 2 | Rounded off to the next rupee |

| 32279 | |

| Step 3 | Select Level |

| Level 4 | |

| Step 4 | Select Equal or Higher Value in Your Pay Level Hierarchy |

| 32300 | |

| Revised Basic Pay as per 7th CPC w.e.f. 1.1.2016 is 32300 | |

Retired on 31/5/2002 from SC Railway in scale 6500-200-10500 with basic pay of Rs.7900/- as CTI. Pension fixed Rs3980/- with effect 1/1/2006 pension revised as 8905/- in grade pay 4200 which was subsequently changed as grade pay 4600 by Rly. Board. While Implementation of 7th CPC pay was fixed as 50500/2 based on basic pay at the time of retirement 7900/- and not as per revised pension as on 1/1/2006 i.e., 8905/- What should be the pension to be fixed in 7th CPC?

As your basic pay of 7900 at the retirement month revised table 24 you’re pension of 25250/- from 1-1-2016 is correct. You can contact your Pay Controlling Officer for arrears from 1-1-2006.

RETIRED ON JULY 2015 RS 19070/- PENSION FIXED 7TH PAY COMMISSION ARREARS PAID BY BANK RS 37250/- ONLY 7TH PAY PENSION FIXED 25250/-ARREARS AMOUNT IS RIGHT OR WRONG

Up to which mont the arrears amount received? Confirm your last basic pay Rs.38140/-?

What is the in-hand salary for PGT TEACHER in Jawahar navodaya vidyalaya ?

Sir main up aided junior high school me clerk hu 6th pay me 1.12.2015 Ko GP 1900 BP 7360 basic pay 9260 rha. 9260 me 2.57 guna kernel pr 23798.2 aa rha hai jo najdiki talika me 23800 ke pas hai .kintu aap ke anusar 24500. Ho rha hai please baaye ye kaise ho raha hai.

It is not MACP UPGRADED only pay fixation from 1/1/2016, after increment on 1/7/16 your pay is ₹ 24500/-.

What the 1st pay of Doctors in central Gov.

there is a clause for employes getting NPA on 31/12/2015 that their NPA + 125% DA on NPA would be added to calculate new basic pay

,doesn’t this clause create a discrepancy of pay of doctors getting in service after 1 Jan 2016.

Please explain

Answer to UTKARSH : From the 7th CPC NPA for Doctors as 20% of their revised basic pay.

NPA from 1/7/2016.

psu absorbe in 1984 from central electricity authority to then ntpc

my 10 months average pay in 3cpc in the pay band of 65–1200 is rs 880

(7 increments)

what is the coresponding basic pay in 5cpc, 6 cpc, and 7 cpc

also commuted full pensition in 1984 so what is my present pension in 6th and 7th cpc

I ALREADYREPRESENTED MY CASE BUT NO REPLY BY MAIL OR BY PHONE +917702203231

ANSWER TO V.JAGANNATHA REDDY ; As per your pay scales of 3rd CPC at basic pay of 880 with 7 increments it was in 4th CPC as pay scale 2000-60-2300-75-3200 (S-13), in 5th CPC 6500-10500 (PB2), in 6th CPC 9300-34800 with GP 4200 and in th 7th CPC as notional basic pay of Rs.42,300/- as per 7th CPC matrix level 6, 50% of basic pay as revised pension as Rs.21,150/- w.e.f. 1/1/2016 plus applicable dearness relief at the rate of 2% from 7/16, 3% from 1/17, 5% from 7/17. 7% from 1/18 & 9% from 7/18. Also you are eligible 20% of addition pension with D.R. at the age if attained 80, if it is 85 age at it may be 30%, if 90 age 40%. So far it was not revised contact your ex-employer/PAO/Bank because 90% of pensioners were got revised and got the arrears.

CAN ANY ONE GIVE THE PAY OF ACCOUNTS ASSISTANT WHO WORK UNDER SEMI GOVT/GOVT. SECTOR UNDER CPC VII

Answer to REEJU : LEVEL 6, BASIC PAY OF RS.35,400/-starting.

Dear Sir, I am very much happy to learn this Richest information you have placed here.Thanks. I have Retired as Lower Division clerk from MSEB / MSEDCL Kolhapur. My court mattter about GRANT OF HIGHER PAY SCALE will be over soon. I am in need of the following charts / Calculation to claim my arrrears with effect from April 1997 To July 2010

pay scale 1375 – 45 – 1600 – April 1997

Pay of promotion / Higher grade starts Rs 1375 w e from April 1997

I am going to calculate further with effect of D.A. given time to time. I am going to calculate HRA and C.P.F. till June 2010

please specifically suggest me specific reckoner / Books etc. I am waiting for your HELP. Thanking you

Sir not entitlement 7cpc I am retired, 30 nov2016

My salary is 38302 basic pay is 12660 ( 5200-20200) gd pay is 2800 how much my salary increase in seven pay Bhopal mp

As per concordance table what will be .y pension as py 7th CPC please let us know.

refixation of pay to level 13 of 7th cpc.

“Dear

My basic pay + gd pay as on 01.01.2016 was Rs 55080/=(.pay scale 37400 – 67000 gd pay 8700 )

As per min of fin Gaz notification dtd 25.07.2016 on 7th cpc level 13 ,my pay was fixed as (pay × factor 2.57) ( 55080 × 2.57 ) = 14155 = to pay 141600 as per level 13 & index 7.

Now as per revised 7th cpc report and min of fin Gaz notification dtd 16.05.2017, IOR of level 13 enhanced from 2.57 to 2.67.Accordingly my pay shall has to be revised.

Kindly clarify that wether my pay as on 01.01.2016 which was Rs 55080 shall be multiply by 2.57 or by 2.67.

(1) if multiply by 2.57 then new pay comes as 55080 ×2.57 = 141 555 and to that neares figure is 142700 as per new revised matrix but

(2) if multiply by 2.67 then new pay comes as 55080 ×2.67 = 147063 and the nearest figure is 151400/=.

Kindly advise

INJUSTICE IS ALWAYS DONE TO THE PBORS OF SERVICES.

1. IT WAS WHEN OROP WAS IMPLEMENTED WEF 01-07-2014. THE BASIC PENSION OF JCOs OF X GRP. WAS NOT APPLIED PROPERLY AS THERE IS ALWAYS DIFFERENCE IN THE X & Y GRP.

2.IN THE ORDER BASIC PENSION OF SUBEDAR/WO/MCPO II WAS SAME FOR X & Y GRPs FOR SERVICE LENGTH UP TO 17 YEARS. THERE IS DIFFERENCE IN ALL OTHER RANKS.

IT IS HIGHLY REQUESTED THAT THIS MAY BE CORRECTED AS PER RULES.

a goverment servant in the month of july 2017 my basic pay was 53600 rs which i was taking by 3rd financial.upgradation in the scale of 9300-34800 i have complrted 30 years of service now in the month of august 2017 i have been promoted to the post of accountant in the payscale of rs 9300-34800 in the grade pay of rs 4200.by virtue of promotion to a promotional post and keeping in view my 30 years og service what should be my basic pay in the month of august 2017

See results in English

जुलाई 2017 के महीने में एक सरकार सेवक मेरी बुनियादी वेतन 53,600 रु जो मैं 9,300-34,800 के पैमाने मैं अब अगस्त 2017 के महीने में सेवा के 30 साल complrted है में 3 वित्तीय उन्नयन द्वारा ले रहा था मैं करने के लिए प्रोत्साहित किया गया है था payscale में अकाउंटेंट के पद

The 7th CPC for retired Defence (Army) persons is not satisfactory. It is should re-look and revised up to the standard of modernity

all central govt employs are not satisfied because of not increase the basic,hra and also ariers of allowences.

I ret on28 feb2003 at basic Rs 11300 having BPension Rs 5650 in scale 8000-275-13500(Group A).As per 6cpc pension fixed Rs 12769 without any grade pay.New corresponding scale is 15600-39100.As per 7 cpc my level in matrix is 10and index shown vertical as 13 since earned 12 increaments in ret scale.As per formula no 2 my pensreceiving Rsion evaluated as Rs 34500(mf-2.57).As per formula no 1 on increament basis it comes Rs Rs 40000..Presently receiving Rs 32817 (12769×2.57).pl issue orders for paying me pension as Rs 40000 as per formula no 1.Thanks & regards for implimentation & reply favourable reply as per Govt orders.

I was transferred and posted AT INDORE GPO IN SEPT.2016.MY BASIC PAY IN AUGUST 2016 WAS RS.58600/_AM I INTITLE TO TAKE BASIC PAY OF LAST MONTH AUGUST 2016 ?

I re-employed in same dept with basic Rs33120(4600+28520)in PB-2 w.e.f.01-8-2015 for two years with all allowances.Due to 7th CPC,what will be my pay w.e.f.01-01-2016.

1. I am retirement on 31 Mar 2016. 2. I already recd some or auth (as per 6th pay com mission) ollowing benifitsg :-

A. Graguaty

B. 50% computation of pdnsion

C. Leave encasgment

D. Life insurance

E. CR bal

F. Pension

2. How many arrier or banefits as per 7th pay commission of coloum 1a to 1f.

3. 01 jan 2016 bp gp x pay ms pay -18260÷4600÷!400*2000 @ 26 jan 2016 bp gp ms – 1899(0+5400+6000 & pension on as hony lt basic 15465

4. aarrier as per 7th pay commissin – kab tak

4 thanking you

what will be the advisability pension for a LTCol (s) admissible as per the 7th pay commission

Revised pay wef 01 Jan 2016 to re-employed persons has been fixed and revised pay for the month of Aug 2016 paid on 31 Aug 2016 as per 7th CPC.

The arrears of pay wef 01 Jan to 31 Jul 2016 for re-employed disallowed by payment authority without any Govt orders for the same. What is happening with re-employed persons, God knows when they will get arrears of salary for the month of Jan to Jul 2016

My basic pay as on 1-12-2015 was Rs 45890.00 DA 54609 TWO Addlinc 1800 HRA 4589 DAON addl incr 2142 and HRA ON Addition incr 180 totalling to 109210 in the grade of Sci/Engr SE in pay band 3 with scale of pay 15600-39100 with GP 7600. I was promoted on 01 -01 2016 from Sci/Engr SE to SF. I retired as Sci/engr SF as on 31-05-16 from ISRO .My date of birth is 08-05-56.. fro iwas promoted on 01 -01 2016m Sci/Engr SE to SF.My basic pay as on 1-12-2016 is Rs 48370DA57560 TWO ADDING 2770 HRA 4837 DAON addl incr 3296 and HRA ON Addition incr 277 totalling to 117110.What wii be the pay to be fixed as per & th pay commission recommendations to ISRO employees.Kindly inform

RETIRED AS A OFFICE SUPERNTENDENT IN THE SOUTHERN RAILWAY IN THE YEAR 31-10-1994, my date of birth is 16-10-1936, MY DATE OF APPIONMENT

S 25=11-1958 SCLAE 2000-60-2-3200, NOW ACCORDING TO 7TH PAY COMMISSION HOW MUCH I WILL GET PENSION OPTION 1 & 2 REPLY MAY BE

FORWARDED TO MY E.MAIL ADDRESS.

Sir, I am a Postal Asstt in Deptt Of Post. My basic was Rs. 11510/- with GP- 2400/- as on 01.01.2016 and I had been fixes at Rs. 29600/- on that date. After implementation of Bunching Benefit My basic will be Rs. 30500/- on that date. But my designation is a divisional/unit cadre and there is no such employee of basic 11170/- as on 01.01.2016 in my division. My question is will I get the benefit in this case as there is non availability of such junior employee whose basic bunched with me? Please clarify me.

respected rail minister,

I mr. Sanjay kumar joined in indian railway employee as a commercial apprentice from 1.11.2015.But my stifed is not being given according to 7tj pay commission . why?

awaited to autonomous body working under various Ministry

I am a LDC on dated 2011. .My Grade-pay is Rs.2400/-. After I got macp on 10/06/2011. my grade-pay is fixed to 2800/-. After that I got promotion on 1/1/12. How will my salary be calculated after 7th pay-commission.

I took VRS on 31st July 2016 what will be my pention? According to 6th CPC I am getting 25,600 according to 7th CPC I am getting 22,500? How will my pension be calculated

There are lot of anomalies in 7th cpc. In this system consideration of grade pay not exist. In many cases it is seen that salary of a Gr.B Officer in JS grade becomes lower than his under staff i.e in inspector rank. How it can be possible? In many cases the salary of a senior staff becomes lower than a staff who is junior to him by 02 or 3 years. 7th cpc is not only full of ambiguity but also baseless which have no realistic justification. If the salary of senior staff becomes lower than a junior or if the salary of a AEN (Astt. Engg.) be lower than his under staff then why those junior or under staff will obey his senior or his Officer? An adverse working environment will create as a result of it. The scope of promotion of Gr. B Officer is very less in every central govt. organisation where they have to bear lot of responsibility. Then where the reality of 7th cpc? Banenewala bhi keya oisa navish tha?

pay commission has recommended a fitment factor of 2.72 from level 14-16.as per this the old basic for level 14 is 53000 and new basic is worked out as 144200. the pension for this level as per court order( min 50% of basic works out to be 72100 ) the next level s-29 scale which was given a basic of 54700 by the court is given a pension of 27350×2.57 =70490 which is even less than the 50% of the basic of 53000.( new basic 144200 ). while calculting the new basic for level 14 the fitment factor is taken as 2.72 why this fitment factor is not considered for pension calculation. in such a situation the pension for levels 14-18 will never be 50% of basic which will be contrary to court order

What about the Pension calculation of Doctors who are entitled to Non Practicing Allowance ?

Sir,

1. My Pay in the Pay band on 01.01.2016 Rs. 11630.00 + Grade Pay 2800

2. I have been promoted on regular basis in the revised pay structure, PB-2 (`9300.00 – `34800.00) + Grade Pay of ` 4600.00 with effect from 23.06.2016 (Forenoon). I have get to deffer option for fixation from the date of my increment.

3. On promotion date (i.e. 23.06.2016) he will draw 11630.00+ Grade Pay 4600.00

4. Pay fixed on 01.07.2016,

Rs. 440.00 (Annual Increment) + Rs. 450.00 (Promotional Increment)

= 850/-

5. Pay on re-fixation from 01.07.2016 (12520.00 + 4600.00) = ` 17120.00

6. In 7th CPC, I fill up my option from 1 st January 2016

Sir,

You are kindly requested to provide me the fixation basic as well as my in tabular form.

PLS. RESOLVE MY PROBLEM

IF AN EMPLOYEE WITH BASIC PAY AS ON 01.01.2016 GETS RS. 10,300/- AND ANOTHER JUNIOR EMPLOYEE WITH BASIC PAY AS ON 01.01.2016 GETS RS. 12,430/- IN SAME GRADE PAY OF RS. 4600/- WILL GET THE SAME BASIC AS PER 7TH CPC OF RS. 44,900/-

My date of appointment is march 2015, and my basic pay is Rs 15,600 + 5,400 (GP). I didn’t receive any increment on 1st July 2015. According to 7th CPC, i can opt for my first increment on 1st Jan 2016. So i wanted to know whether the increment will be applied on the previous pay and then pay would be fixed OR first the pay would be fixed and then increment would be applied on this fixed pay ?

Sir,

My basic pay as on 01/01/2016 is Rs. 22590.00+ 5400.00. (PB-3)

I was promoted to next higher grade w.e.f: 01/07/2016 to GP 6600.00 (PB-3)

I was retired on 31/07/2016 with PB-3-BP-6600.00

Which option is beneficial for me as on 01/07/2016

How much is my new pension w.e.f from 01/08/2016

I just appointed as a office assistant with fixed pay of Rs. 12,000/- in central government department. Will I get any benefit of seventh pay commission ?

I recently joined in central government department as an office assistant with fixed pay of Rs. 12000/- in monthly in July 2016. will I get any benefit of seventh pay commission ?

Sir, I was granted MACP on 15/03/2009 in pay band of 9300-34800 in grade pay of Rs. 4600/-. As per above my actual increment due in March every year. As per 7th CPC notification, increment granting on 1 jan and 1 july every year i.e whose increment due between 2nd jan to 1 july entitle increment on 1 Jan and whose increment due between 2nd july to 1 jan entitle increment on 1 july. SO my increment date falling between 2nd Jan to 1 July. Request clarify whether I am entitled to grant increment on 1st Jan 2016 and fix the revised pay after granting annual increment on 1 jan 2016 or otherwise, so that I can submit Option for pay fixation.

My basic pay including go is 9260 and my one year Jr batch those basic is 8990 is also came same basic in 7 th cpc how it is possible. 9260 basic is entitled for bunching benefits OR not?

I repeatedly asking any of the veterans, who can give a solution to my query.

My grade pay in CBI is Rs.4600/- that has been upgraded to Rs.4800/-, whereas, I am drawing the grade pay or Rs.4800/- w.e.f. 14-11-2009 as per MACP.

How may to be fixed under the upgradation ?

Am I eligible to be fixed in the next grade pay of Rs.5400/- and in the Level 9 of the matrix, as I am already drawing the upgraded grade pay since Nov.2009 ?

This is the first time the pay commission has not decided HRA and TA before declaring the pay commission. So something is going on wrong. They are acting as a Gujarat Model. Gijarat govt employees are still not getting so many benefits after implementation of 6th pay.

I am in 5200-20200 (2400 Grade pay). My current basic is 11510 (including GP). IT seems due to the new pay matrix our next batch(joined 1 year later) is also going to get same salary with more arrears. Is it really possible?

If anyone joins at GP 5400 and basic is 21000/-(15600-39100) then he will get at July 2016 Rs. 56100/- basic as per matrix.

And if any one got one increment (3%) then basic pay will be 21630/-

again if I calculate as per matrix basic will be 56100/-

Is it correct?

Both are getting same even after one increment.

What about bunching effect which was mentioned in 7th CPC report.

As per OROP My basic pay is RS 7170.after 7th cpc what is my basic wt pct DA .pl teply.

sir,

what about gratuvity limit

बहुत अच्छा है

I have given a promotion to post of supervisor with grade pay Rs. 4800/- on 1-2-2016 but my pay fixed at the stage of Rs.17380/- plus GP.4600/- due to MACP on 1.4.2014. what would be my fitment in pay matrix on 01.02.2016 and 01.07.16.please advise.

VERY GOOD

If I opt to avail increment on 01-01-2016 itself, will I get one more level up on 01-01-2016

no officer is going to pay fixation at 145800 in pay band 37400-67000 GP8700 on 1/1/2016 a big error in notification kindly correct it

An accurate calculations.

BP+GP=27010

PB-2 (9300 – 34800)

GP=4800

= Enter your basic correctly

?

Thank you Stivan. Calculator rectified

Absolutely very accurate calculator ever seen. Thanks for the same.