NDA for Ordnance Employees Fixed at Rs.12380

The Ministry of Defence has recently revised the rates for the Night Duty Allowance (NDA) payable to its eligible civilian employees working in various establishments. This payment is made to compensate employees for working during the night shift, which can be physically and mentally strenuous. The revised rates are applicable to all eligible employees, and the ministry has ensured that they are in line with prevailing market rates and take into account the cost of living. The payment of this allowance is a critical aspect of ensuring that the ministry’s workforce is motivated and productive, and it reflects the government’s commitment to the welfare of its employees.

Office of the Principal controller of Accounts (FYs)

10-A, S.K.Bose Road, Kolkata – 700 000

Pay/Tech-II/1206/2015/13

Dated: 09.09.2015

To,

All Cs F A (Fys)

Subject: Payment of Night Duty Allowance (NDA) at revised rates to the eligible civilian employees working in the Establishments under the Ministry of Defence.

Kindly refer to this office earlier circular No.Pay/Tech-II/1206/07 dated 28/05/2015 and No.Pay/Tech-II/1206/2015/08 dated 29/05/2015 under which the orders for payment of NDA at revised rate have been issued. In this regard it is to mention that the ceiling of pay for entitlement of NDA was Rs. 2200/- pm’ vide DOPT order dated 04/10/1989. Keeping in view of pay structure under 6th CPC it has been decided that the ceiling limit for entitlement of NDA may be fixed at Rs.12380/-. While making payment of NDA, an employee’s pay in the pay band will be compared with that figure and if pay in the Pay Band is less than above limit then he will be eligible for NDA at current rates otherwise he is not.

If any of the employees have been paid NDA already in terms of this office earlier circulars dated 28/05/2015 and 29/05/2015 whose pay in the pay band is beyond this ceiling limit, recovery action may please be initiated.

The same may please be communicated to all the Br. AOs under your jurisdiction, for necessary action at their end.

This issues with the approval of Competent Authority.

sd/-

Joint controller of Accounts (Fys)

Source: www.pcafys.nic.in

Latest orders and news about 7th Pay Night Duty Allowance (NDA)

- 7th Pay Commission Night Shift Allowance DoPT Order Dated 13.7.2020

- Payment of Night Duty Allowance (NDA) and Arrears for Civilian Employees working in Ordnance Factories

- No ceiling for entitlement of Night Duty Allowance – MoD

- Free Night calling facility to BSNL Employees – SNEA

- Central Government permits Rs. 500 and Rs. 1000 currency notes on highway toll plazas till midnight of 11.11.2016

- 500 and 1000 rupee notes will no longer be legal tender from midnight tonight

- Eligibility of Night Duty Allowance for Ordnance Employees fixed at 12380(Band Pay) – PCAFYS Orders on 9.9.2015

- Method of Night Duty Allowance and Night Shift Bonus Calculation for Industrial Employees

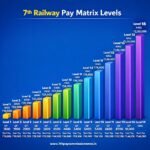

- Rates of Night Duty Allowance w.e.f. 1.1.2015 for Railway Industrial Employees and Staff

- Night Duty Allowance (NDA) for Ordnance Employees – MoD Orders on 8.5.2015

- Grant of Night Duty Allowance on the basis of Actual Salary – Implementation of Courts Judgements – BPMS

- Grant of Night Duty Allowance on the basis of actual salary of 6th CPC

Any civilian employee working in the Establishments under the Ministry of Defence is eligible for Night Duty Allowance.

The Night Duty Allowance is fixed at Rs.12380 (Band Pay).

The employee must submit a written application to their respective administrative officer. The application should include details of night duties performed and the amount of payment claimed.

Yes, Night Duty Allowance must be claimed each time it is earned.

Yes, Night Duty Allowance is taxable as per applicable tax laws.

Leave a Reply