केंद्र सरकार के कर्मचारियों के लिए हाउस रेंट अलाउंस (HRA) की संशोधित दरें (2026 में अपडेट की गईं)

7th Pay Commission House Rent Allowance to Central Government Employees

7th CPC HRA 2026: For Central Government civilian employees the HRA payable (as per implementation of the 7th Central Pay Commission) is expressed as a percentage of basic pay and depends on the city classification (X / Y / Z). The basic (current) rates notified in July 2017 are 24% (X), 16% (Y), 8% (Z) of basic pay. These rates are subject to upward revision tied to the Dearness Allowance (DA) level: the OM provides for revision to 27% / 18% / 9% when DA crosses 25% and further to 30% / 20% / 10% when DA crosses 50%.

How to Classify a City for HRA?

City classification — criteria & practical points

Criterion used: population / urban agglomeration as per the latest Census (the DoE/CGDA documents state the classification is population-based: X = 50 lakh & above; Y = 5 lakh to 50 lakh; Z = below 5 lakh).

8-km rule: staff working in Central Government establishments within 8 km from the periphery of the municipal limits of a qualified city may be allowed HRA at that city’s rate if a certificate in prescribed format is obtained and referred for sanction (usually for 3 years).

Local changes: the classification can be updated by DoE / Department of Expenditure on re-classification of UAs and on state notifications; the official annexure to the DoE OM lists the cities classified as X and Y — remaining towns are Z by default. Always check the latest DoE/DoPT OM for the authoritative list.

HRA Revised Rates Table 2026

| City Class | Standard HRA rate (per cent of Basic Pay) | On DA > 25% (revised) | On DA > 50% (further revised) |

|---|---|---|---|

| X | 24% | 27% | 30% |

| Y | 16% | 18% | 20% |

| Z | 8% | 9% | 10% |

Minimum floor amounts (as per earlier OM) continue to be observed in special cases where the cash minimums are prescribed. See the DoE OM/annexure for details.

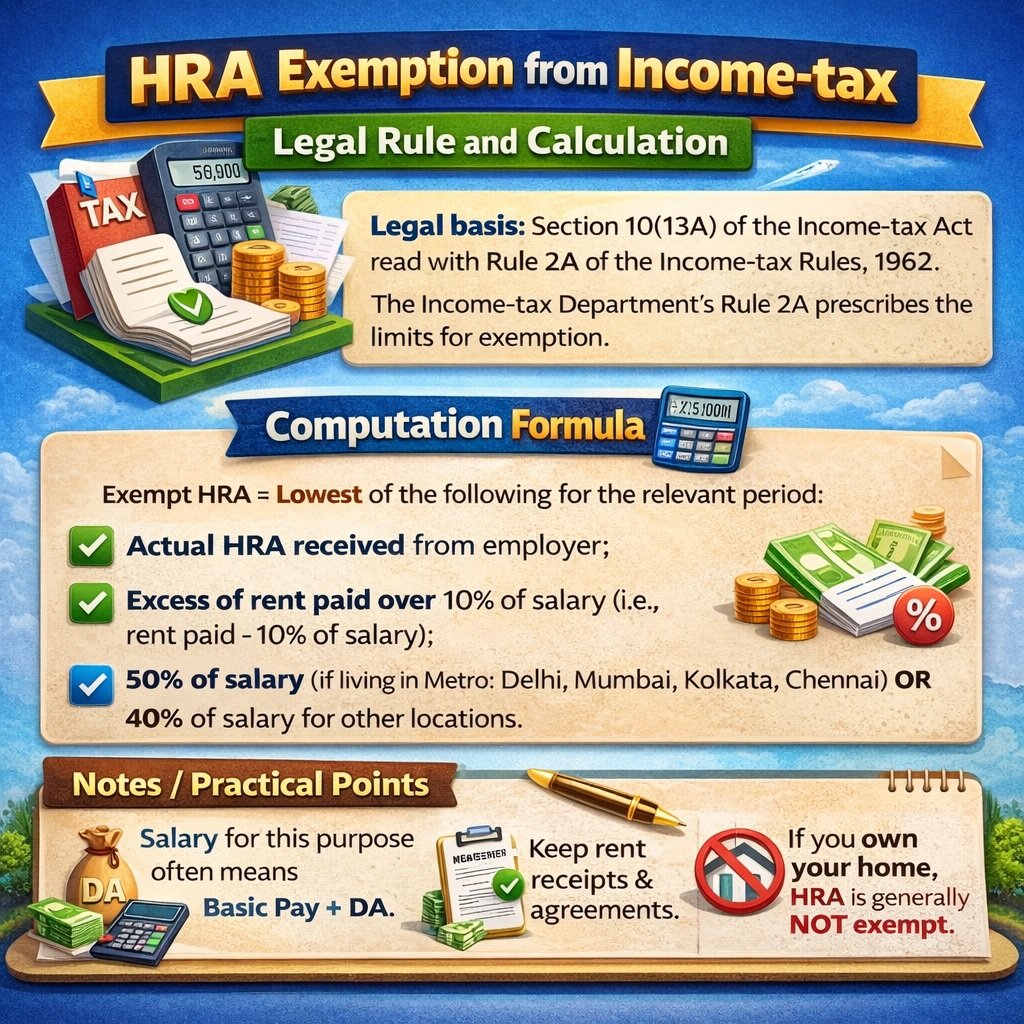

HRA Exemption From Income Tax – Legal Rule and Calculation

Legal basis: Section 10(13A) of the Income-tax Act read with Rule 2A of the Income-tax Rules, 1962. The Income-tax Department’s Rule 2A prescribes the limits for exemption.

Computation – general formula; Exempt HRA = lowest of the following three items for the relevant period:

- Actual HRA received from employer;

- Excess of rent paid over 10% of salary (i.e., rent paid − 10% of salary);

- 50% of salary (if living in specified metros: Delhi, Mumbai, Kolkata, Chennai) OR 40% of salary for other locations.

Notes / practical points: Salary for this purpose often means basic pay + dearness allowance (DA) where DA forms part of salary for HRA calculation (check employer’s salary definition). The Income-tax rule and employer practice determine whether DA is included.

Rent receipts and valid supporting documents should be kept; the employer may require rent receipts or a rent agreement for tax-exemption claims.

If you live in a house owned by yourself, HRA received is generally not exempt (unless special circumstances and legal interpretations apply) — the CBDT has emphasised verification of actual rent payment.

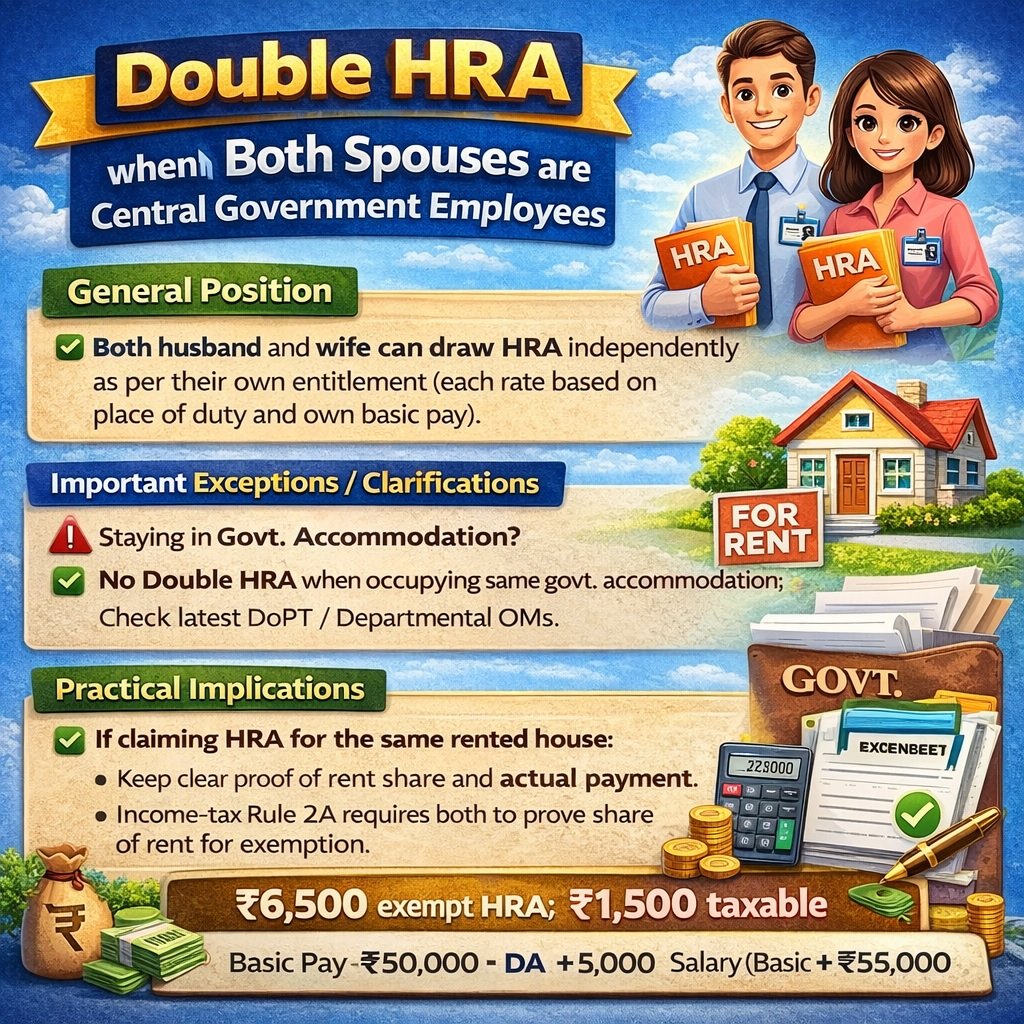

Double HRA / HRA When Both Spouses Are Central Government Employees

General position (central civilian employees): Both husband and wife can draw HRA independently as per their individual entitlement (i.e., each entitled rate based on place of duty and own basic pay) provided they fulfil the normal conditions for HRA (e.g., actually paying rent, not being in government-allotted accommodation which would disqualify HRA). This position is reflected in consolidated compendiums and clarifications issued on HRA.

Important exceptions / clarifications: If one spouse has been allotted government accommodation by Central / State / autonomous employer at the same station, that may affect the other spouse’s entitlement to draw HRA if they both continue to occupy the same government accommodation — departmental/DoE/DOPT instructions and OMs set out the conditions; check the particular OM that is applicable to the case. (Some specific DoE/DoPT clarifications say HRA is not admissible where government accommodation is actually allotted/availed of.)

Where both spouses are posted to the same station and both live in hired accommodation (i.e., each pays rent on separate accommodation or both jointly pay rent for rented accommodation they occupy), both may draw HRA in accordance with departmental instructions and their own entitlement. Departmental clarifications / circulars on husband-wife postings and HRA drawal exist (DoPT OMs on posting of husband & wife).

Practical implications: If both spouses claim HRA for the same rented flat and both are government employees, the tax position (Income-tax Rule 2A) requires that each claimant prove their share of rent/actual payment for claiming exemption. Income-tax practice examines the reality of rent payment, receipts, and division of rent liability.

Examples (calculation) — quick worked example

Assume: Employee A in a Y-class city (HRA rate 16%), basic pay ₹50,000; DA included = ₹5,000 → salary for HRA purpose we’ll treat as basic+DA = ₹55,000. HRA paid by employer (actual) = 16% of basic = ₹8,000. Rent paid = ₹12,000 per month.

Compute exempt HRA (monthly):

- Actual HRA received = ₹8,000.

- Rent paid − 10% salary = 12,000 − (10% of 55,000 = 5,500) = ₹6,500.

- 40% of salary (non-metro) = 40% of 55,000 = ₹22,000.

Lowest of (1),(2),(3) = ₹6,500 — this is exempt; remaining ₹1,500 of HRA (8,000 − 6,500) is taxable. (This illustrates the standard “least of three” test.)

State-wise Classification of Cities for HRA (X, Y, Z)

- Hyderabad (UA)

- Vijayawada (UA)

- Warangal (UA)

- Greater Visakhapatnam (M.Corpn.)

- Guntur (UA)

- Nellore (UA)

- Guwahati (UA)

- Patna (UA)

- Chandigarh (UA)

- S.A.S. Nagar, Mohali*

- Durg–Bhilai Nagar (UA)

- Raipur (UA)

- Delhi (UA)

- Ahmadabad (UA)

- Rajkot (UA)

- Jamnagar (UA)

- Bhavnagar (UA)

- Vadodara (UA)

- Surat (UA)

- Faridabad* (M.Corpn.)

- Gurgaon* (UA)

- Srinagar (UA)

- Jammu (UA)

- Jamshedpur (UA)

- Dhanbad (UA)

- Ranchi (UA)

- Bokaro Steel City (UA)

- Bangalore / Bengaluru (UA)

- Belgaum (UA)

- Hubli–Dharwad (M.Corpn.)

- Mangalore (UA)

- Mysore (UA)

- Gulbarga (UA)

- Kozhikode (UA)

- Kochi (UA)

- Thiruvananthapuram (UA)

- Thrissur (UA)

- Malappuram (UA)

- Kannur (UA)

- Kollam (UA)

- Gwalior (UA)

- Indore (UA)

- Bhopal (UA)

- Jabalpur (UA)

- Ujjain (M.Corpn.)

- Greater Mumbai (UA)

- Pune (UA)

- Amravati (M.Corpn.)

- Nagpur (UA)

- Aurangabad (UA)

- Nashik (UA)

- Bhiwandi (UA)

- Solapur (M.Corpn.)

- Kolhapur (UA)

- Vasai–Virar City (M.Corpn.)

- Malegaon (UA)

- Nanded–Vaghela (M.Corpn.)

- Sangli (UA)

- Cuttack (UA)

- Bhubaneswar (UA)

- Raurkela (UA)

- Puducherry / Pondicherry (UA)

- Amritsar (UA)

- Jalandhar (UA)

- Ludhiana (M.Corpn.)

- Bikaner (M.Corpn.)

- Jaipur (M.Corpn.)

- Jodhpur (UA)

- Kota (M.Corpn.)

- Ajmer (UA)

- Chennai (UA)

- Salem (UA)

- Tiruppur (UA)

- Coimbatore (UA)

- Tiruchirappalli (UA)

- Madurai (UA)

- Erode (UA)

- Moradabad (M.Corpn.)

- Meerut (UA)

- Ghaziabad* (UA)

- Aligarh (UA)

- Agra (UA)

- Bareilly (UA)

- Lucknow (UA)

- Kanpur (UA)

- Allahabad (UA)

- Gorakhpur (UA)

- Varanasi (UA)

- Saharanpur (M.Corpn.)

- Noida* (CT)

- Firozabad (NPP)

- Jhansi (UA)

- Dehradun (UA)

- Kolkata (UA)

- Asansol (UA)

- Siliguri (UA)

- Durgapur (UA)

• Mohali is treated at par with Chandigarh.

• Faridabad, Gurgaon, Ghaziabad, Noida: HRA based on dependency rule.

• Saharanpur: Upgraded to Y Class w.e.f. June 2011.

• Z-Class Cities: Any city NOT listed above as X or Y automatically falls under Z category (10% / 8% as per applicable HRA rate structure).

I am a deputationist at NEC Secretariat, Shillong and my parent office is Botanical Survey of India, Kolkata. Now my question is that, am I eligible for double HRA? If yes, kindly provide me the rules by which I can claim my double HRA because my office is not providing me the double HRA. please guide me.

My wife is UGC SRF and I am Post Doctoral Researcher. Are we both entitled for HRA or one of us? Please let us know if there is any guidelines for Phd and post-doctoral students

No.

Sir I Was transferred from Shimla to Pune. But retained quarter at old station for family & children for eight months by paying lisence fee as per rule. Am I eligible for HRA at new station for these eight month if any rule please.

No H.R.A. since your family members are availing Quarters at old station. Availing Quarters the question of H.R.A. may note be claimed.

I have been on regular posting from Delhi to Diu. On the basis of seniority list, i have been allotted government quarter but due to some domestic problems, I haven’t taken the government quarter and requested to the department to allow me out living permission with full HRA with my family in (Diu comes under z class city).

But the department canceled my HRA.

I have to apply again for HRA ? Or

Is there any other rule so as to avail full HRA.

Availing Government Quarter the payment of HRA question does not arise.

If officer is on three months course

HRA applicable or not

If both husband and wife are working in a single institute under central govt, whether both will get HRA or any one of them will get ?

(1) if they have not taken official accommodation

(2) if they have taken official accommodation

If a employee transfer in z class city but his family residence in home district or Y class city. What employee claim Y class city HRA….

H.R.A. is given for the employees duty place only. If the family is resisting in Government accommodation H.R.A. will not be given to the employees.

As a central Government employee Am I entitled to HRA for my family staying in my own house? Request corresponding CCS rules for the same.

Regards

Respected sir

I was appointed in 2021 so shall I get HRA

Why not are you got government accommodation? Sue but if you’re appointed in the month of July 2021 onwards you will get it..

if an employee posted in rural area and his services are placed in urban area , is he eligible for urban or rural HRA?

Is a person first posting in North east India eligible for Additional HRA Benefits?

can your provide the office memorandum or circular when both the husband and wife are working in Central government employee, MHA, India and when not provided with the government accommodation they will be eligible for HRA for a single one or they both will be getting full HRA while staying on rent.

O.M. dated 8-11-1988 below para 5(e) & under F.R. & S.R. Normal amount of HRA is admissible as per the entitlement subject to fulfillment of other conditions for drawal of HRA. It is in the Swamy ‘s HAND BOOK in para : Drawal of HRA when both husband and wife are Government servants and are living in hired/owned accommodation.

If an employee transferred to another city can he claim HRA of the previous place of posting for three months

HRA cannot be claimed. It will be given as per your residing in place of duty & the city range if eligible for that employee.

A employee get transferred from y category City to Z category City will get HRA at @y City for two months and for next four months place of his choice. Thereafter @ his place of duty.

can you share instructions in this regard

Is HRA payable to Govt. Employee during training in India if Govt. accommodation is provided to him during training?

No.

My employer has not revised HRA, saying that specific order has not been issued by Government. Whether any of you received enhanced HRA after enhanced DA of 28%?

Yes, the Department of Expenditure will issue specific orders on this subject. The revision of HRA rates will be effect from 1.7.2021. Wait Mr.Srinivas, you will get the higher rate of HRA with arrears.

If a class 1 employee is transferred from one place to another but his accommodation is in retention at old station so he is elligible for HRA at new station or not.

If the availing accommodation payment of HRA question does not arise.

I am transferred to Nepal Border in Uttar pradesh from Lucknow . My family is residing in Lucknow in GPRA . I have been allowed to retain the GPRA for eight months from the date of relieving .

Whether I am entitled to draw house rent at my present place of posting from the date of joining at new place of posting ? Please provide Govt. Order/rule copy in this regard.

Is it your transfer is temporary? If temporary transfer you’re eligible for Traveling Allowance. H.R.A. is given for employee including family.

Is there any Government Order/OM specifying the maximum distance from the office within which a Central Government Employee must live in. If, yes, then let me know the distance and (if possible) the No. of the Order/OM please.

Kindly, confirm whether the HRA is applicable within 8 Kms of Jammu municipal limit ends.

If any Railway employee availed full month of LWP after sanctioned by competent authority then he is eligible for HRA?

HRA is eligible but TRANSPORT ALLOWANCE will not be given.

Status of Lucknow and Noida should be upgraded to Cl X City with large population and present Police Commissioner system evoked.

If a female govt employee accompanied her husband on his posting with Indian mission at abroad , whether she will be entitled to hra or not

If she returns to continuous duty she is eligible HRA with the NOC permission from her office. But if the leave period more than 15 days transport allowance will not be given.

If govt employee refused the government accommodation he is applicable for HRA. Pl confirm

Normally allowed but it dependent upon service & duty.

Is there Leased Accommodation facility for Central Government Employees? Like Public Sector Banks & Insurance Companies and CPSEs?

I am a deputationist from State govt to Central govt posted in North East. My colleague’s from Delhi are getting double HRA but recently my single HRA is curtailed on the ground that I should shift to a government quarter which I am reluctant as because it will be hectic to shift my family. I am having another year to complete my tenure.

Greater Noida in UP which class in HRA for Central government Employee

If an employee is on temporary deputation and not having any residence at the place of his head quarter whether such employee is entitled for hra @ of his head quarter or place of deputation

Since he has got the addition deputation allowance & also temporary deputation he is entitled as per the Headquarters HRA.

I am ashok kumar garg posted in bsnl employees of dot now my basic 23800 i get hra 800 by officer i talk tomany time my officer but they not listen me

Please provide details of greater Mumbai area?

It is Thane city included in greater mumbai region please reply early

I m officer of CRPF my HQ is bilaspur madhya parades and I m performing duty in Assam my family reside at JODHPUR Rajasthan then can I entitle for HRA. If yes then which place

Will an employee get HRA while proceeding abroad with her husband on six months EL and one year EOL

I am central govt employee, working in Belgaum(Karnataka) but my family is staying in Bangalore, I want know that I can claim Bangalore HRA. Pl intimate.

Sir,

I belongs to Lucknow Central Govt employee. what is HRA applicable for Lucknow city in 7th pay commission.

Y city, 16%

I am refused government accomodation can I eligible for HRA ?

Yes, you are eligible for HRA at the percentage rate of your posting area.

Sir, I belong from gurdaspur Punjab, Nd posted as army person in Chennai Avadi, my family at my home station gurdaspur. What rate of HRA I have claimed.

U will get 24% HRA. (as per place of posting in this case)

Sir hra kya below 25 yrs ko milga ga kya sir

Couple case HRA rules

Dear Sir, I am selected for GP 2800 in Tis Hazari Court Delhi, I am a differently abled candidate. What would be the starting salary for me ?

Gm.sir…

Sir iam transferred ro delhi ro bhiwadi rajasthan

X category to z category in Esi hospital

Right now iam doing up and down 80 km

I heard that I wil get hra for 2 months like before …Please tel me

sir I am central govt. employee transferred from Ahmedabad to vadodara, I have not shifted my family from Ahmedabad to vadodara and not got govt accomendation, can i get HRA for 2 months like before ?

Answer to ROHIT : No change of HRA both are Y cities having 20%. same HRA.

Sir, I am central govt. Employee in capf posted in Allahabad. my own house in allahabad where i reisiding with my family therefore i have permit to out living permission but sir department is not given to HRA pse tell me i m deserve it for HRA or otherwise. if i m eligible HRA pse provide me OM NO. with full justification sir thanks

I am central government employee and staying in barracks but paying rent for family at Chennai. Am I eligible for HRA at Chennai rate?

No, only as per the place of work of the employee. You can avail the govt. quarters for your family at your duty place exception of HRA.

Sir, I am central govt. Employee serving at Dehradun. Here are no accommodation facilities for family and I residing in Line/barrack of Department with other members. My family residing at Patna. Please intimate whether I am entitled to draw full HRA (16%) for family at Patna?

I am a central govt employee. I am married but below 25 years of age. I m living in rented home. Am i authorise for full HRA????

We both Husband and wife posted in N.E. Region with my son. My parents who retired from Govt. Service is residing in my own house as they have no other house to live.

My HOO has denied to pay HRA both of us as they are not dependent on me, whereas in the rules clearly mentioned that part of the family should reside in the house. Kindly clarify.

Mobiles produce an avenue the location where the information can be transmitted seamlessly

either by means of short messaging services (SMS) or by signing in to the internet facility provided within the mobiles.

There are several advantages you can enjoy with online news, however, the ones mentioned listed below are the

most common ones. That amount also ensured The Avengers for the history books mainly because it surpassed Harry Potter as well as the Deathly

Hollows Part 2, which in fact had a gap weekend with $169.

i and my wife worked in different cities with a difference of 40 km . we both are living together at one place .are we both entitled for house rent allowance

If husband and wife are employees of central government and private sector, own their house, are they eligible for hra in full

सर,मैं केन्द्रीय कर्मचारी हूँ मैं स्थानांतरण होकर अपने घर के सामने आया हूँ ।अपने घर से कार्य करता हूँ मुझे HRA मिलेगी कि नही।कृपया बताए।

I am posted in Y city but our transfer to X city then what is HRA in new station in first month.

7thcpc as proposed 30% of hra for employees in matrix level 1.2&3 but we are not getting 30%hra

What is the rule of HRA if my family residing ‘ at Y’ class city and I am posted at ‘Z’ class city ….Can we get ‘Y’ class rate of HRA in place of ‘z’ class ….Pla tell me

If both husband and wife got. Employees then what rules hra

If HUSBAND AND WIFE BOTH ARE GOVT.EMPLOYEE THEN WHAT WILL RULE FOR HRA ACCORDING TO 7TH PAY

BOTH WILL GET HRA OR NOT

What is rule on HRA if family is staying in city other than posted city due to unavoidable situation.

Maximum HRA for husband and wife both Govt. Service holder?

The govt employees are worried about the HRA increase only instead of increment in salary. Its because they can grab more money from the tenents by renting the flat allotted to them.

In Antophill CGS Qtrs there are many brokers residing and renting flats, Because of 7th pay commission HRA increased. the tenants are forced to pay high rent

5000 for single room

12000 – 1 RK

15000 – 1 BHK

20000 – 2 BHK

HRA SHOULD be given for only pensioners and labour category. When good salary is paid, why HRA or CEF is given?

Most of the Govt Employee have 1 – 2 flats on their name. why no action is taken on them? where did they get the property from?

Strict action should be taken in this matter

HRA should be fixed between 3,000 to 12,000 respectively 12%-16% & 20%.

It will be correct decision.

When will be gratuity act amended

It is a simple calculation by 7 cpc but not justified as the rental condions of house in metro cities for 10 years ahead. It is just current rent in metro. So it is not justified. Just made people fool. Not geting the rite rates. L D sahoo. Faridabad

HRA should be fixed to catagory x.y and z except TA at 24 percent.

if HrA is 30% as on 6th pay is followedin 7th pay too wh ablut the peoples staying in govt quaters. thy mightbe loosing quite a huge amont as HRa this issuw should be sorted… many quatres are not tht much condition to pay As per 7th cpc

The reason of delay is our union leaders. They are shaking hands with got for their personal benefits

Orders of H R A as per the recommendation of the 7th Pay commission should issued at earlier . What r the reasons behind delay. . It is not so good to defer HRA . .

HRA should be admissible to spouse of Central Government employee as if not so then there will be double deduction of HRA of both alongwith licence fee of allottee of Govt. Qtrs.(for one house only) which seems not justtified. Suggestion is that if to do so then allotee should be provided with a class higher then the entitled type of Govt. quarter.

does NPA us included in basic pay for calculating HRA & DA in the 7 th pay?

State govt’s A1 sity HRA Allowance gives 30%, central govt. 7th cpc gives 24%, state govt employee and central govt employee living in same place, what is clarification

if hra rate is more it will help those government employees who have to live on rent because these days a single room house is more costlier than employee’s salary specially in group c..

NPA & MSP not merged with basic salary to calculate HRA by 7th pay commision.

What about calculation of DA , it will be calculated on sum of BASIC SALARY + NPA\MSP or only basic salary.

*NPA given to doctor’s

*MSP given to defense

Give your expert comments

If HRA is more many employees will be forced to leave govt built quarters as HRA rate is more in 7th pay commission. Most of the employees prefer govt quarters as safe and secured place as they would be coming from different parts of the country. Employees who have no own house will be forced to leave this comfortable living and stay in rented accommodation as gap between rents and HRA is huge.

Recommendation by7th cpc are really frustrating…in z class cities u cannot find home below Rs 5000. If someone is getting 5000 basic then also he has to pay 1000 from his pocket.So i feel government people can not maintain a good living standard…ITS FRUSTRATING …mainly for lower income group who are hoping fo better living standard.

HRA should not given to those who lives with their son, husband, wife etc. ‘s house. It should enquired by inquary comission. Because family members does n’t take rent from each other. It happened that father lives with son(owner of house). Take HRA from govnt. This is wrong.

kvs and 7th cpc including finmin and mhrd all are making fool to kvs primary teachers, they know very well all about the issue of kvs prt CAT case of grae pay 4600 i,e 17140 entry scale (in 6th cpc) and entry scale 44900 i,e level – 7 (in 7th cpc) But don’t want to provide directly. They are compelling us to become violent and do error……………………..primary teachers pay.

Given the increase in basic, the income tax implecations will be grave. For z class cities, HRA is 8%, whereas 10% will be deducted from rent receipt. Thus, no rent receipt exemption is allowed for z class cities. For other class of cities also, there is practically no exemption as it is very difficult to obtain PAN of house owner. As a result, the income tax exemption on the rent paid, although being an actual expense, will not be available for those living in rented accommodation. This is in stark contrast with those living in government accommodation, who, while enjoying privileged accommodation, will also enjoy full tax exemption.

Income tax exemption should be based on actual expense basis, as vouchers are produced as proof of expense.

In HRA Z classification need to be increased a little bit, as, the house rent has been increased to minimum of Rs. 5000 on rent in Z classification town.

So, it is suggested to increase HRA to 15% from 10% for Z classification.

MACP scheme may be extended to 4 times for those who have completed 35 years of service.

N

I just want to tell govt. that provide suitable accommodation to all employee we would not required HRA. But govt can’t so who the govt is here to cut HRA. Govt seen also how out side area is costly poor and low grade employee can’t serve. Actual factor is that there is no problems for babus because of there pocket is always full with mota rakam and so where bjp is working for higher salaried not poor and low salaried personnel and they are working for bjp.

Plz kay koi bata sakta hai ki ess pay commission main pension lago hoga kay jo 2004 main paramilitary main band ho rakha hai

Sir, i am widow of ex sub/nar tech cl i shiv kumar sharma of AMC corps. He Was medical

inveilidated out after serving 27 years ,Group ‘Y

but i am getting Normal family pension ,for 26 Years service and Group Z, Rs 6395/pm (BP)+ DA as admissiable time to time .

I request to your kind honor,my family pension may please be given as per correct length of service and Group of my husband.

thank you.

What is bonus of 2012-13 year in group c.

And any central employee elegiable for 4 month bonus if he left his job

seventh central pay commission recommendation is enough as 60% for X . 40% for Y and 20% for Z type of cities

Sir,

There used to 2 slabs of DA till 3rd pay commission in which the low paid employees used to get higher rate of DA and high paid officers used to get lower rate of DA.This used to keep the total amount to a reasonable level as cost of increase is same for all but it was made equal from 4 th pay commission.This has increased the gap between low and high paid employees.Hence the life for low income employees has worsen.Hence the DA should be reversed to 3rd pay commission pattern.

Reduction of Date of superannuation is not justified as a person who joins government jobs have some planning.most of the youth get married after getting jobs which is approx 30 years.Thereafter his kids are taking birth and take education upto the age of 55 and hardly manage for their marriage in their service life.Further there is no provision of pension in PSU.If person is got retired at early age he will not be survived.

Recommendation of HRA must be rationaled.Please refer example of Greater Noida.Hindon river is demarcation between greater noida and noida.Sectors located one side of Hindon falling in Noida is entitled for HRA @30% and sectors located in greater noida are entitled for 10% HRA. On the ground greater noida have better infrastructure of world class city.Population should not be the criteria for deciding of classification of city.satellite city of metro should be the same class to reduce the burden on the metro.

Does India not need to fix retirement age and qualification of Politicians?

In case both the spouses are employees of Government/autonomous/semi-autonomous organization and are living in Government accommodation,

House Rent Allowance should be admissible to the one in whose name Government accommodation has not been allotted.

At present HRA of both the spouse is cut which is wrong.

Even in our neighboring countries , House Rent Allowance is admissible to the one in whose name Government accommodation has not been allotted.

The copy of such orders is available on Internet. For Pakistan , we may refer order No. F.2(1) R.5/2007 dated April 18, 2013 issued by Finance Division, Government of Pakistan.

Sir,

The retirement age of 60/33 or 58/33 is not feasible for joining Government service at the age of 18 years as prescribed by Central Govt. for Group “‘C”” Posts i.e. 18 – 25 years of age. Who is joined at the age of 18 and so on is to be retired at the age of 51 to 58, which is so young with lot of experiences of assistances and more productive at this age.

For Group A post the age of joining Central Government services is 21 – 28 years, which will be retired at the age of 54 onwards is also not feasible to the structure of an Government Office to run efficiently and smoothly to any good governance.

There are already to much shortfall in manpower in the Central Government Offices because of huge retirement and fresh recruitment is already 10-15% against huge retirement due to lengthy procedural formalities and delay of recruitment and joining any Chief of the concerned department and organisation which lapse many posts some time by DoPT.

The age of 60 years for retirement of Central Government Employee is OK. The things is that the procedure new recruitment should be faster to recruit unemployed people and smooth run of all offices and Government. Work as Contractual basis is a exploitation of human being and still the offices is not running smoothly.

The present infrastructure and employee with employer need to be corrected and improved but not collapsed the structure which made by out going peoples of the country.

Creating new infrastructure and huge retirement in single movement and recruit further new employee immediately needs huge amount of funds which is not available at this juncture of time.

This is my personal view/ perceptions of new scenario and I want to be good governance for long lasting not short governance which may collapse with in few years.

Regards,

BM Dimri

Sir, I posted roadside station in jalpaiguri district as trackman since my appointment I havebeen not alloted any railway Qter i live in a private accommodation . I found HRA 945 Rupees and spent 2000 Rupees on rent and my salary about 20 thousand how can i manage expendeture on HRA or family member. So pls adjust HRA to Rly emploees.

1. HRA must be recommended as market rates, bcz govt rates are as “Unth ke munh me zeera”

2.govt. Quarters for middle class employees are not constructed at all .Please consider this group as employee like “ministerial Staff” bcz upper line is powerful / lower class is already considered. Middle class PISSSSS……… rahi h.

Sir,

HRA & Transport Allowance at Rajahmundry City, needs to increased after merger of near by villages in the city. the population will be increased to above 5 lakhs as per 2011 census.

N. NARASIMHA RAO,

RAJAHMUNDRY

Dear Comrades please think twice before writing a word about HRA……all are asking for 10, 20 & 30 % of (Basic+ Grade Pay) ….but in my view it is not justifiable…..because the both elements ( BP+GP) are constant. then once it fixed HRA it is constant for 1st year, and in 2 year it increased 0.30 % so on…….but in reality owners of the rent houses can hike rentals with minimum 5%……….per a year , so kindly explain to JCM leaders to add DA element in BP+GP+DA for new HRA…….. ex: in Dehi a PA rank employ will get 4800 Rupees as HRA…….. in 4800 Rupees he cant get even single room in delhi…………..in Delhi 1 BHK will cost about 10000 rupees in a ordinary locality near to suburbs

HRA facility must be extended to all Central Government Employee who are not in occupation of Govt. quarter. This facility muse be extended to all CAPFs.

SIR,

NEW HRA RECOMMENDERS BY 7TH CPC AS A T.P.T. OR THROUGH MARKET SURVEY.

new hra recommends by 7th cpc

Sir,100% of Govt Qtr/HRA required for all center government employees who are working in Static locations.

Respected sir

now a days we are facing more problems for paying more rents .State Government employees getting more HRA comparatively . Kindly recommend more HRA not less than State Government employees

thanking you sir

HRA SHOULD BE ATLEAST 1. 15% 2. 25% 3. 35% OF PAY BAND + GRADE PAY