Union budget 2016-17 and 7th CPC demands

“Main consideration in the private and public sector being ‘profit’, and in Central Government it is “service” even through Railways, Income Tax & Central Excise are revenue earning departments, hence an equal comparison with the Government is not going to be ever possible. Performance for the Government is usually not measured in terms of profit, but in terms of achieving societal goals.”

Union budget 2016-17 and 7th CPC demands

The Union budget 2016-17 presented by Hon’able Finance Minister in the parliament on 29th Feb 2016 has the total expenditure in the Budget for 2016-17 has been projected at Rs 19.78 lakh crore, consisting of Rs 5.50 lakh crore under Plan and Rs 14.28 lakh crore under Non-Plan.

The increase in Plan expenditure is in the order of 15.3% over current year.

The fiscal deficit in RE 2015-16 and BE 2016-17 have been retained at 3.9% and 3.5% of GDP and the growth of GDP has now accelerated to 7.6%.

This clearly shows that the finance of the Central Government is in good shape.

The Hon’able Finance Minister in the parliament on 29th Feb 2016 has stated that the next financial year 2016-17 will cast an additional burden on account of the recommendations of the 7th Central Pay Commission and the implementation of Defence OROP.

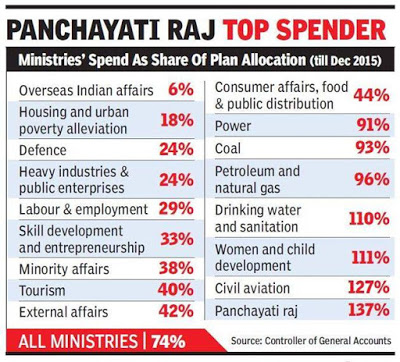

Let us examine the last year spending on various ministries.

This clearly shows many ministries have not spent the money allocated, this due to mainly the shortage of talented staff and various policies’ of the Government.

Today, the weakest link in respect of any government policy is at the delivery stage. This phenomenon is not endemic to India. Internationally also, there is an increasing emphasis on strengthening the delivery lines and decentralization with greater role being assigned at delivery points, which actually determines the benefit that the common citizen is going to derive out of any policy initiative of the government.

More the talented persons are there in Government services, more the delivery of the government schemes will be there, thus the Government machinery will be more effective and common man will benefit a lot.

The 7th CPC has not improved the service condition of the Central Government employees, it has provided just 14.3 % wage hike against the staff side demand of more than 70% wage hike.

The person joining a Government Service is not just for the employment is for a whole career, if a person joins a Government Service he will quit/ retire from the job only after putting 30 years service or more. In case of the person joining a private company he will jump from one company to another at least five times in thirty years.

The talented persons from all over the country are moving to IT, BT and private sectors, rather than Central Government sector. Because of the lower salary / pay structure in Central Government sector compared to IT and BT sectors and complex nature of rules and regulations in Central Government sector and also the skill and merit of the worker/ employee is not into account in Central Government sector.

Main consideration in the private and public sector being ‘profit’, and in Central Government it is “service” even through Railways, Income Tax & Central Excise are revenue earning departments, hence an equal comparison with the Government is not going to be ever possible.

Performance for the Government is usually not measured in terms of profit, but in terms of achieving societal goals.

The minimum wage should be calculated using Dr Aykroyd formula and following 15th ILC norms. The actual market rates should be adopted , not the imaginary rates as provided the 7th CPC should be adopted .

This will pay way of meaningful wage hike and fitment formula. House rent is from Rs 7000/- per month to Rs 35,000/- per month. The 7th CPC has provided just from Rs 3000/- to Rs 25,000/- per month. The old HRA rates should be adopted.

The strength of Central government employees should increase. In 1990 Population of the country is 85 crores – Central Government Employees strength is 40 lakhs . In 2014 Population of the country is 125 crores – Central Government Employees strength is 31 lakhs.

India has 1,622.8 government servants for every 1,00,000 residents. In sharp contrast, the U.S. has 7,681. The Central government, with 3.1 million employees, thus has 257 serving every 1,00,000 population, against the U.S. federal government’s 840.

Non-filling up of vacant posts has resulted in increased work load on the existing employees and delivery of the Government schemes.

Hence the Government should adopt a proper wage policy for the central Government employees and improve vastly the 7th CPC recommendations and fill up vacant post to deliver the Government schemes to the needy of the country. Now that the Central Government finances are good.

This way both Central Government employees will benefit and the common man will also benefit.

Source: http://karnatakacoc.blogspot.in/

Leave a Reply