Rationalization of Income Tax system in India 2022

The Minister of State for Finance Shri Pankaj Chaudhary has replied in written form to the questions in the Parliament on 15th March 2022 regarding the rationalization of Income Tax Slabs.

“India has progressive direct taxation system wherein an individual or Hindu undivided family (HUF) or an association of person or body of individuals is required to pay tax at a higher rate with an increase in income levels.

The progressive tax policy does not intend to disincentivize people from seeking higher earnings but recognizes that taxpayers play a major role in nation building by paying their taxes as per their capacity. With rising income levels, those in the higher income brackets, need to contribute more to the Nation’s development. This ensures vertical equity and makes our taxation regime progressive.

It is the stated policy of the Government to phase out tax exemptions and deductions provided under the Income-tax Act, 1961 (the Act) while simultaneously reducing the tax rates”.

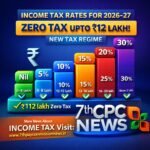

In line with this stated policy, Finance Act, 2020 amended the Act by way of insertion of section 115BAC in the Act to provide an option to individual and HUF taxpayers for paying income-tax at the following lower slab rates subject to certain conditions including that that they do not avail specified tax exemptions or deductions:

| Total Income (Rs) | Rate (%) (Optional Regime) |

| Up to 2,50,000 | Nil |

| From 2,50,001 to 5,00,000 | 5 |

| From 5,00,001 to 7,50,000 | 10 |

| From 7,50,001 to 10,00,000 | 15 |

| From 10,00,001 to 12,50,000 | 20 |

| From 12,50,001 to 15,00,000 | 25 |

| Above 15,00,000 | 30 |

“As is evident from the above, under the optional taxation regime for individuals and HUF taxpayers, there is no sharp jump in the tax rates with higher income levels.

IV. Maximum marginal tax rate of a taxpayer having total income exceeding Rs 5 crore will go over 40% after including surcharge and a health and education cess. As stated above the surcharge in such cases ensures that those in the higher income brackets contribute more to the Nation’s development”.

Leave a Reply