One-Time Option From NPS to OPS for Central Govt Employees

The Department of Pension and Pensioners’ Welfare issued an another order with detailed clarifications for the eligible employees to switch over from National Pension System to Old Pension Scheme under Central Civil Services (Pension) Rules, 1972.

“All cases where the results for recruitment were declared before 01.01.2004, against vacancies occurring on or before 31.12.2003, the candidates declared successful for recruitment shall be eligible for coverage under the Central Civil Services (Pension) Rules, 1972.

Accordingly, such Government servants who were declared successful for recruitment in the results declared on or before 31.12.2003, against vacancies occurring before 01.01.2004 and are covered under the National Pension System on joining service on or after 01.01.2004, may be given a one-time option to be covered under the CCS(Pension) Rules, 1972″.

Check also: NPS to OPS Latest News – Amendment in CCS (Pension) Rules 1972 – DoPPW Order Dated 17 February 2020

No.57/04/2019-P&PW(B)

Government of India

Ministry of Personnel, Public Grievances and Pensions

Department of Pension and Pensioners’ Welfare

Lok Nayak Bhawan, Khan Market,

New Delhi, the 25th June, 2020

OFFICE MEMORANDUM

Subject: Coverage under Central Civil Services (Pension) Rules, 1972, in place of National Pension System in terms of DoPPW OM dated 17.02.2020 – clarifications- regarding.

The undersigned is directed to say that instructions have been issued vide this Department’s O.M. of even number dated 17th February, 2020, that in all cases where the results for recruitment were declared before 01.01.2004, against vacancies occurring on or before 31.12.2003, the candidates declared successful for recruitment shall be eligible for coverage under the Central Civil Services (Pension) Rules, 1972. Accordingly, such Government servants who were declared successful for recruitment in the results declared on or before 31.12.2003, against vacancies occurring before 01.01.2004 and are covered under the National Pension System on joining service on or after 01.01.2004, may be given a one-time option to be covered under the CCS(Pension) Rules, 1972.

2. References have been received in this Department seeking clarifications in regard to the implementation of the aforesaid instructions in certain circumstances. The issues raised by the various Departments have been examined in this Department and the position is clarified as under:

Also read: Benefit of Gratuity to CG Employees Covered under National Pension System (NPS)

S. No. 1 – Issue raised: A Government servant joined in a Department /Office of the Central Government on or after 01.01.2004 on the basis of results declared before 01.01.2004 against vacancies occurred prior to 01.01.2004 and thereafter joined another Central Government Department / Office with proper permission after tendering technical resignation. Can the option exercised by such a Government servant be considered in accordance with the O.M. dated 17.2.2020 and, if so, which Department/office will take a decision on such option.

Clarification: Such a Government servant is also eligible to exercise option under O.M. dated 17.02.2020. A decision on the option shall be taken by the appointing authority of the post in the Department/Office for which such option is exercised by Government servant. In case the Government servant has submitted his option in his latest Department/office, that Department/Office shall forward the option to the concerned Department/office, for taking an appropriate decision. The decision taken by the concerned Department/Office shall be communicated to his latest Department. In such cases, the instructions relating to mobility as contained in this Department’s O.Ms. No. 28/30/2004-P&PW(B) dated 26.07.2005 and 28.10.2009 shall also be applicable and further action for counting of past service for pension/gratuity shall be taken in accordance with the CCS(Pension) Rules, 1972 by the latest Department/Office.

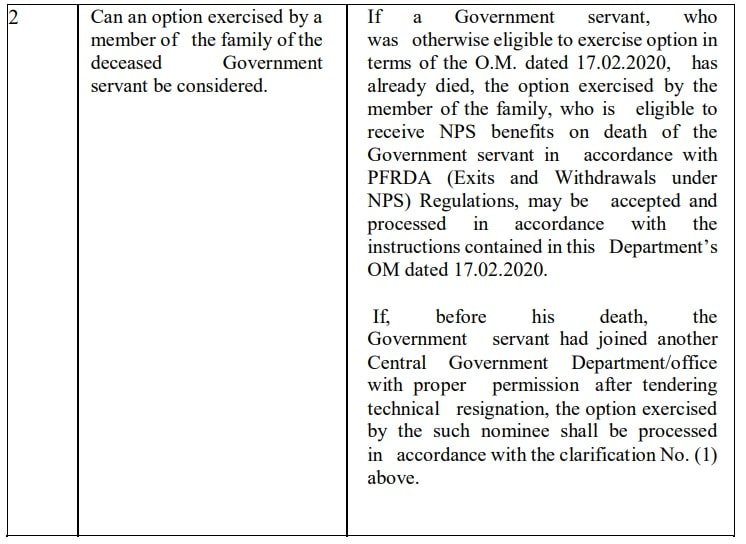

S. No. 2 – Issue raised: Can an option exercised by a member of the family of the deceased Government servant be considered.

Clarification: If a Government servant, who was otherwise eligible to exercise option in terms of the O.M. dated 17.02.2020, has already died, the option exercised by the member of the family, who is eligible to receive NPS benefits on death of the Government servant in accordance with PFRDA (Exits and Withdrawals under NPS) Regulations, may be accepted and processed in accordance with the instructions contained in this Department’s OM dated 17.02.2020. If, before his death, the Government servant had joined another Central Government Department/office with proper permission after tendering technical resignation, the option exercised by the such nominee shall be processed in accordance with the clarification No. (1) above.

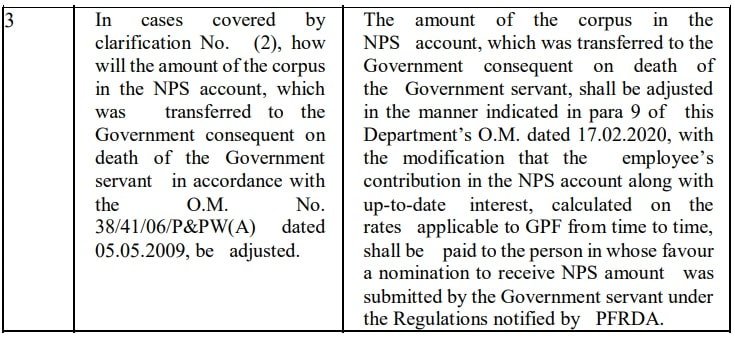

S. No. 3 – Issue raised: In cases covered by clarification No. (2), how will the amount of the corpus in the NPS account, which was transferred to the Government consequent on death of the Government servant in accordance with the O.M. No. 38/41/06/P&PW(A) dated 05.05.2009, be adjusted.

Clarification: The amount of the corpus in the NPS account, which was transferred to the Government consequent on death of the Government servant, shall be adjusted in the manner indicated in para 9 of this Department’s O.M. dated 17.02.2020, with the modification that the employee’s contribution in the NPS account along with up-to-date interest, calculated on the rates applicable to GPF from time to time, shall be paid to the person in whose favour a nomination to receive NPS amount was submitted by the Government servant under the Regulations notified by PFRDA.

S. No. 4 – Issue raised: Will the instructions contained in the OM dated 17.02.2020 be applicable in the case of Government servants who joined on or after 01.01.2004 on appointment on compassionate grounds. If so, how will the eligibility of such Government servants to exercise option under OM dated 17.02.2020 be determined.

Clarification: A Government servant, who joined on or after 01.01.2004 on appointment on compassionate grounds, shall be eligible to exercise option in terms of the OM dated 17.02.2020, if the competent authority had taken the decision on the recommendation of the Screening/Selection Committee to appoint the Government servant on compassionate grounds before 01.01.2004.

3. All Ministries / Departments are requested to bring the contents of these clarifications to the notice of Controller of Accounts/Pay and Accounts Officers, Attached office and Subordinate Offices under them.

4.Hindi version will follow.

sd/-

(S. Chakrabarti)

Under Secretary to the Government of India

Click to view the DoPPW Clarification Order dated 25.6.2020

It is a provision provided to certain category of Central Government Employees to switch from NPS to OPS.

This option is available to central government employees who were appointed on or before December 31, 2003, and are covered under NPS.

No, only certain category of Central Government Employees meeting the eligibility criteria mentioned above can avail this option.

Some employees prefer OPS as it offers a defined benefit pension, guaranteed income post-retirement, and may provide better financial security compared to NPS.

The process and guidelines for exercising this one time option will be communicated by the concerned authority in the central government.

Employees need to understand the potential impact on their retirement benefits, tax implications, and other financial aspects before making the decision to switch.

It is important to note that OPS may have certain disadvantages such as lack of portability, limited investment choices, and no flexibility for additional contributions.

No, once an employee exercises the option to switch to OPS, it is generally irreversible.

Employees can refer to the official circulars, notifications, or guidelines issued by the central government for detailed information on this one time option from NPS to OPS.

Leave a Reply