How to calculate 7th CPC Pension as per DoPPW order dated on 12.5.2017

“Implementation of Government’s decision on the recommendations of the Seventh Central Pay Commission – Calculation of Revised of pension of pre-2016 pensioners/family pensioners”

OM No.38/37/2016-P&PW(A) dated 12.5.2017

Implementation of Government’s decision on the recommendations of the Seventh Central Pay Commission – Revision of pension of pre-2016 pensioners/family pensioners, etc :

(i)REVISED PENSION OF PENSIONERS WHO RETIRED BETWEEN 1-1-1986 & 31-12-1995 (4TH CPC SCALES)

Step 1: work out Notional pay as on 1.1.1996 = LPD at the time of retirement + DA as on 1-1- 1996 was 148 % up to Rs.3500 BP and 111% for BP Rs.3501 to 6000 with minimum of Rs.5180 + IR 1 Rs 100/- + IR II =10% of BP (min Rs100) + 40% fitment benefit sum total be placed in appropriate stage in the 5th CPC scale corresponding to the scale from which retired

e.g 4th CPC scale =2000-60-2300-75-3200 LPD 2300 Notional pay = 2300 +3404 +100 +230 + 920 =6954 placing it at appropriate level of Corresponding 5th CPC scale = 6500-200-10500 Notional pay as on 1.1.96 comes to Rs 7100/

Step 2: Work out Notional pay in 6th CPC PB 2 Rs 9300-34800 GP 4200 =7100 X1.86 +4200 = 17406

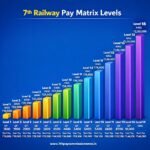

Step 3: work out Notational pay 7th CPC = 17406 x 2.57 = 44735plce it in pay matrix level 6 = 44900

Step 4: 7th CPC pension = Rs 22450 family pension

(ii) REVISED PENSION OF PENSIONERS WHO RETIRED BETWEEN 1-1-1996 & 31-12-20055 (4TH CPC SCALES)

e.g 5th CPC scale S 19 10000- 15200 LPD Rs 11300

Step 1: work out notional pay 6th CPC PB 3 GP 6600 =11300×1.86 +6600 = 27620

Step2: Work out Notional Pay 7th CPC in accordance with OM No.38/37/2016-P&PW(A) dated 12.5.2017 = 27620 x 2.57 = 70 984 place it at appropriate stage in Pay Matrix Level 11 = 71800/

Step 3 : Pension = 35900/ family Pension = Rs 21540/

Example: In case of a pensioner retired at last pay drawn of Rs.4000 on 31st January, 1989 under IV CPC regime, having drawn 9 increments in the pay scale of Rs.3000-100-3500-125-4500… Find the corresponding 6th CPC Grade Pay Rs.6600 and enter 9 earned increments in the calculator.

I retired from Ministry of Rural Development,New Delhi on 31.10.2004. I was drawing pay 8900/- as SO in the scale of 6500-10500 (5th cpc) My pension wa s fixed 6497/- including commutation value. In 6th cpc my pension was fixed 9790/-. After the SC judgement the DO PT issued orders in 2015 raising pension 50% of the new scale under 4.2 para. In my case no revision was done. In 7th cpc my pension was raised to 25125/- ( 9790x 2.57) After the orders of dopt in 2016 where the concordance table was show the basic pay in each CPC. My pay against 8900/- in 4th cpc was 20760/- in 5th CPC. The 50% of this is 10360/- After this OM the Ministry has revised my pension from 25125/- to 26800/- but not revised my pension in 6th cpc from 9790/- to 10360/- When I requested to the Ministry. They informed that under DOPT orders 12.5.17 no arrears is admissible as notional pension. I requested to the Ministry to revise my basic pension but they have treated as notional pension I request I may be informed whether I am en titled for revision of pension in 6th cpc

This is to informing that the rule 50% in basic pay of pension is from 1/1/2006. Further informing you that as per the latest orders of dated 4/1/2019 you are eligible Grade Pay increased as ₹ 4200 to 4600 i.e. you are eligible for 50% of 400/- of ₹ 200/- plus D.R. as applicable from time to time of 1/1/2006 to 31/12/15 & 1/1/2016 you are eligible in 7th ÇPC as Matrix Level 7 so you get arrears for it upto your settlement. So you contact your ex-employer or give a compliment to cpao website

The 6th cpc. fitment tables are applicable only in normal replacement cases even according to the OM dt 30-8-2008 forwarding the tables and in upgraded cases pay has to be arrived separately by reckoning upgraded grade pay.. But the revised pension is being fixed in upgraded cases also taking notional pay as per those tables.There wiil be increase in revised pension if notional pay is arrived by taking higher grade pay.. This has to be seen by the concerned pensioners.

Dear sir

i am tired by writing and contactcting all pension dealing offices like cpao grievence cell and ministry concerned staff but my doubt stands uncleared as yet as follows.

i am PSU ABSORBE IN 1984 while working for cea in 1984 . my 10 months average was 880 in 650-1200 pay band and i fully commuted my pension and got about 27000 rs plus mmy designation was extra asst. director.

now that post is no more there i am not in a position to know my pay band and grade pay

i like to know my pay in 5th ,6th , 7th cpc i was drawing 7 increments now service book not traceble

Answer to V.J.REDDY ; I have searched from net that as per your retirement last pay of Rs.880/- in scale of 650-1200 in the 3rd CPC it was at the 4th CPC as basic pay Rs.880+D.A.& A.D.A 1314.40+I.R.158+20% of basic pay of Rs.176 total 2528.40 fixed in 4th CPC at Rs.2,600/- in 5th CPC 7900, In 6th CPC 18,900 (including GP 4200) and 7th CPC as Rs.49000/- 50% of basic pay of Rs.24,500/- as revised notional matrix level 6 method of pension from 1/1/2016. If you are attained the age from 80 the percentage of basic pension will be added as additional pension with D.R. respectively.

Retired on 31.01.2012. Basic pay Rs.36480, GP. Rs.7600. Scale 15600-39100..Pension fixed Rs 22400/-.(basic on 01.01.2016 Rs 29300/-)

5th cpc- scale 12000-375-16500. Basic pay on 01.09.2007 was Rs. 16500/-.

I retired from Damodar Valley Corporation followed by 7th CPC. Our order just issued it is well known to you. Kindly intimate my new pension as per 7th CPC based on two formula.

Answer to UDAYASANKER ; From 1/1/2016 revised Pension as Rs.34,400/- plus D.R. as applicable rates.

In 6th cpc pay should be fixed as per formula 5th cpc as earlier narrated by the Govt secretaries-as under:

SirBasic pay + Grade pay X 1.86 + grade pay otherwise 40% differences of 5th cpc fixation always arise and becomes incorrect method will challenge in Law of court.

Those who promoted inbetween 1.1.2006 to 1.1.2009 their pay should also be fixed on promotional grade pay in 6th cpc by multiplying same mathod than b e fixed 7 th cpc pay matrix 2.57X by the latest outcome in the old pay and grade pay of promotion. One example as under:

Minimum BP14300 +GP4600 X1.86 +GP4600=35154+4600=39754 say minimum of scale 44900. and thereafter on promotion than X2.57 to arrive pay matrix to provide 50%pension

Jaihind jaibharat

The information contained in this respect for the pensioner is quite comprehensive. I would like to know how long it will take time in settling the matter.

my pay scale was 2000-3500 per 4th cpc. SUBSEQUENTLY MY PAY SCALE WAS 7500-12000 WITH GRADE PAY 4800 AS PER FIXATION BY cONTROLLER OF cOMMUNICATION ACCOUNTS TRIVANDRUM. I PRESUME I SHOULD SHOW my 4th cpc scale as 2500 -4000 corresponding to 5th cpc scale 7500-12000. Pl clarify

Step 1 seems alright. One can merely use the formula

Notional pay 0n 1/1/96 = LPD x( 1+ 1.48+ 0.1 +0.4) + 100 0r LPD x2.98 +Rs. 100 (for LPD 3500.

However, the 5CPC talked about things like “one increment in the new scale of pay for every 5 increments in the pre 5CPC scale of pay” or increment(s) depending upon ‘bunching’ in different stages of the revised scale of pay. Clclarification are neede on this score.

Step 2 under (i) talks of a multiplier 1.86 in calculating notional pay in 6th CPC. This is incorrect. The multiplier should be 2.26 that includes the fitment of 40%. However even this is not the fitment formula used to fix pay in the 6th CPC implementation. The pay was fixed as per the fitment tables for the purpose given by the M/Finance. Recall that the Govt. ordered that this fitment table should be used to arrive at the revised pension as per the 6th CPC. (DP&PW orders of 28/1/2013 and the table attached to it.) Using any other method for getting at the notional pay will be wrong.

to arrive at the figure which can be used to arrive at the appropriate stage of the 5th CPC scale of pay to get the notional pay on2.98 1/1/96.

1. Step 2 under (i) makes use of the multiplier 1.86. It misses the fitment benefit of 40%. The multiplier here should be 2.26 and not 1.86. Instead of doing this one should straight away make use of the fitment table to get at the the 6th CPC notional pay, as was done for the existing employees. This is supposed to be the method for getting notional pay as per the 12/5/17 orders.

2. Step 3 under (i): The use of 2.57 may not be desirable as the 7th CPC has used a factor like 2.72 for some Pay Band(s). It would therefore be correct to see the no. of increments implied by the 6th CPC notional pay in the 6th CPC scale of pay and use this number to arrive at the basic pay in the relevant column of the Pay matrix.

3. Section (ii) is for 5th CPC scales and not 4th CPC as mentioned.