Clarification regarding queries being received in Special Cash Package without Leave Encashment

- LTC Special Cash Package Scheme FAQ No 1 – Click to read

- LTC Special Cash Package Scheme FAQ No 2 – Click to read

- LTC Special Cash Package Scheme FAQ No 3 – Click to read

- LTC Special Cash Package Scheme FAQ No 3 – Click to read

No.12(2)/2020/E.II.A

Government of India

Ministry of Finance

Department of Expenditure

North Block, New Delhi

Dated 25th November, 2020

OFFICE MEMORANDUM

Subject:- Clarification regarding queries being received in respect of Special Cash Package equivalent in lieu of Leave Travel Concession Fare for Central Government Employees during the block 2018-21 (FAQ No.3)

The undersigned is directed to say that this Department has been receiving a number of queries relating to Special Package equivalent in lieu of Leave Travel Concession Fare for Central Government Employees during the block 2018-21 announced by the Government on 12th October, 2020. Two sets of frequently asked questions have already been clarified vide this Department’s OM of even no. dated 20th October, 2020 and 10th November, 2020 are available on this Department’s website viz. doe.gov.in.

2. A further set of frequently asked questions have been clarified and is attached herewith at Annexure below.

3. This issues with the approval of Secretary (Exp.)

sd/-

(S.Naganathan)

Deputy Secretary (E.II.A)

Frequently Asked Questions -FAQ No.3

Special Cash Package equivalent in lieu of Leave Travel Concession Fare

1. An employee wishes to avail the special cash package without opting for leave encashment. As per records he has sufficient EL for encashment purpose. Whether an employee can only avail LTC fare without claiming Leave encashment even though he has not exhausted the prescribed limit for leave encashment for LTC?

An employee can avail this scheme utilizing the applicable LTC fare without opting for leave encashment. Leave encashment is optional.

2. If an employee opts for only deemed LTC fare without the leave encashment and spends less than three times of the deemed fare as has been prescribed to claim reimbursement of the deemed LTC fare, how the reimbursement would be calculated?

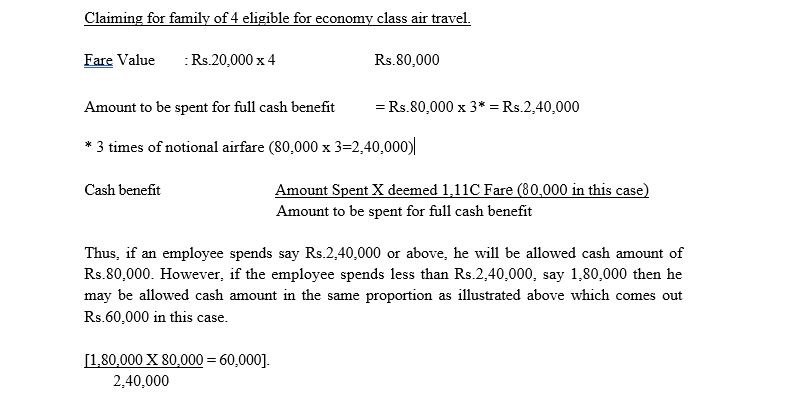

The reimbursement in this case would be on pro-rata basis. Since in order to claim the applicable deemed fare, an employee is required to spend three times of the deemed LTC fare, the reimbursement in the case of expenditure less than the prescribed three times would be 1/3rd of the actual expenditure. An illustration of calculation is given at annexure attached below.

3. Can an employee avail leave encashment for less than 10 days?

The number of days of Leave encashment for LTC (10 days or less than 10 days) is to be in accordance with the relevant provisions of LTC rules.

4. Will payment of premium of already existing insurance policies be covered under this scheme?

The special cash package envisages just of purchase of goods and services with GST of 12% and above made during the period between 12.10.2020 and 31.03.2021. Payment of premium of existing insurance policies does not fall under this category. However, payment of premium for insurance policies purchased during the period between 12.10.2020 and 31.03.2021 is eligible for reimbursement under the scheme.

5. If an employee buys a car or any other items or services, whether it is mandatory to submit original bills to DDO as the same may be required for claim the warranty and ownership of the item/service?

No, self attested photocopy would suffice. However, the original bills may be produces on demand for information.

6. The vouchers/bills to be submitted to avail this scheme on or before the 31st March 2021. Employees who are due to superannuate (say) on the 31st December 2020, be required to submit the vouchers/bills before his superannuation i.e. before the 31st December 2020?

Vouchers/bills should be submitted and settled before the date of superannuation in this case.

Example (1) (without Leave Encashment)

Example (2) (without Leave Encashment)

LTC Cash Voucher Scheme FAQ No 1

Whether the individual employee is required to take leave to avail this LTC- Cash Voucher Scheme?

An individual need not take leave for this purpose nor undertake any travel. This is a scheme in lieu of LTC travel. [Click to read in detail]

LTC Cash Voucher Scheme FAQ No 2

An employee whose workplace and hometown are same and is eligible for only one all India LTC in one Block Year. If that LTC is exhausted, will he be eligible for this scheme? [Click to read in detail]

Special Cash Package on LTC Calculator 2020

A simple online calculator for finding the maximum amount to avail complete cash benefit from this Special Cash Package Scheme on Leave Travel Concession. [Click to calculate]

Dear Sirs;

This is with reference to LTC CASH scheme announce by Govt of India In which I have Purchased a Scooty. When I submit the claim to my department they are insisting for GST invoice for the Insurance Policy which is not given by the dealer.

As all the details which is mandatory as per GST invoicing rule like GST Number; Applicable GST; Place Of Suply etc are available on Insurance Policy itself.

In view of the above kindly clarify that can Insurance Policy be consider as invoice ?