केंद्र सरकार के कर्मचारियों के लिए 5वें और 6वें वेतन आयोग के समकक्ष वेतनमान

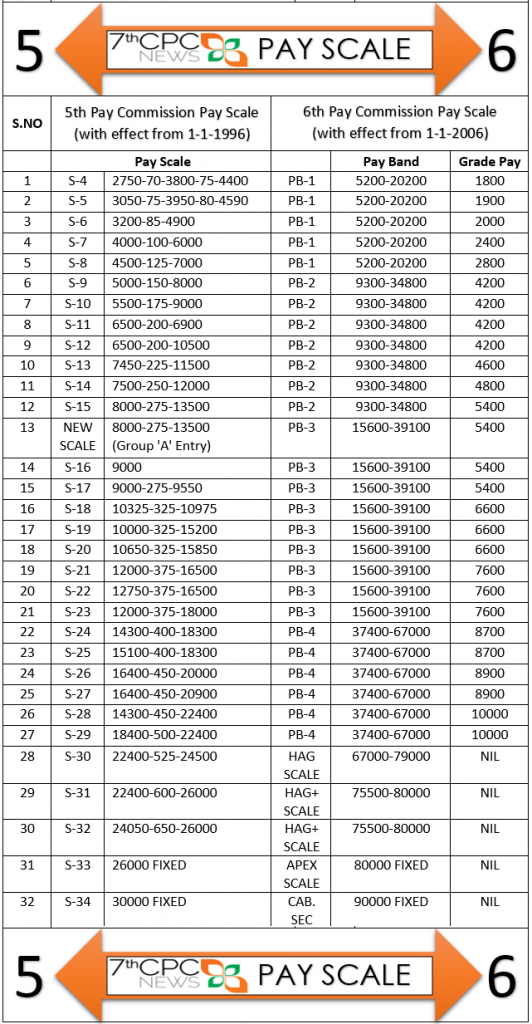

Equivalent Pay Scales of 5th and 6th Pay Commission for CG Employees: The 6th Pay Commission established a new pay band system, which replaced the conventional pay scales of the 5th Pay Commission. This system involved the consolidation of several 5th CPC pay scales into wider pay bands accompanied by grade pay. For instance, the 5th CPC scale of ₹5000–8000 was integrated into Pay Band-2, which has a Grade Pay of ₹4200. This modification streamlined the structure and sought to promote consistent career advancement and enhanced transparency in pay determination for Central Government employees.

Check here the detailed list of 4th, 5th and 6th Pay Matrix Tables for Central Government Employees in India.

6th and 5th CPC Pay Scales

5th Pay Commission Pay Scale Table and the corresponding pay scales of 6th CPC

| 5th Pay Commission Pay Scale with effect from 1.1.1996 | 6th Pay Commission Pay Scale with effect from 1.1.2006 |

|---|---|

| S-1 2550-55-2660-60-3200 is converted to | 4440-7440 GP 1300 |

| 2610-60-3150-65-3540 is converted to | 4440-7440 GP 1400 |

| 2610-60-2910-65-3300-70-4000 is converted to | 4440-7440 GP 1600 |

| 2650-65-3300-70-4000 is converted to | 4440-7440 GP 1650 |

| 2750-70-3800-75-4400 is converted to | 5200-20200 GP 1800 |

| 3050-75-3950-80-4590 is converted to | 5200-20200 GP 1900 |

| 3200-85-4900 is converted to | 5200-20200 GP 2000 |

| 4000-100-6000 is converted to | 5200-20200 GP 2400 |

| 4500-125-7000 is converted to | 5200-20200 GP 2800 |

| 5000-150-8000 is converted to | 9300-34800 GP 4200 |

| 5500-175-9000 is converted to | 9300-34800 GP 4200 |

| 6500-200-6900 is converted to | 9300-34800 GP 4200 |

| 6500-200-10500 is converted to | 9300-34800 GP 4200 |

| 7450-225-11500 is converted to | 9300-34800 GP 4600 |

| 7500-250-12000 is converted to | 9300-34800 GP 4800 |

| 8000-275-13500 is converted to | 9300-34800 GP 5400 |

| 8000-275-13500 (Group A Entry) is converted to | 15600-39100 GP 5400 |

| 9000 is converted to | 15600-39100 GP 5400 |

| 9000-275-9550 is converted to | 15600-39100 GP 5400 |

| 10325-325-10975 is converted to | 15600-39100 GP 6600 |

| 10000-325-15200 is converted to | 15600-39100 GP 6600 |

| 10650-325-15850 is converted to | 15600-39100 GP 6600 |

| 12000-375-16500 is converted to | 15600-39100 GP 7600 |

| 12750-375-16500 is converted to | 15600-39100 GP 7600 |

| 12000-375-18000 is converted to | 15600-39100 GP 7600 |

| 14300-400-18300 is converted to | 37400-67000 GP 8700 |

| 15100-400-18300 is converted to | 37400-67000 GP 8700 |

| 16400-450-20000 is converted to | 37400-67000 GP 8900 |

| 16400-450-20900 is converted to | 37400-67000 GP 8900 |

| 14300-450-22400 is converted to | 37400-67000 GP 10000 |

| 18400-500-22400 is converted to | 37400-67000 GP 10000 |

| 22400-525-24500 is converted to | 67000-79000 |

| 22400-600-26000 is converted to | 75500–80000 |

| 24050-650-26000 is converted to | 75500–80000 |

| 26000 (FIXED) is converted to | 80000 (FIXED |

| 30000 (FIXED) is converted to | 90000 (FIXED) |

5th and 6th CPC Pay Scales

6th Pay Commission Pay Scale Table and the corresponding pay scales of 5th CPC

6th and 5th CPC Pay Scales

sir,

my basic salary in year 2000-2001 was 810/- with 3% increment in every year month of july. as per 5 th commission in year 2003-2004 my salary was 3020/-, as per 6 th commission in year 2010-2011 my salary was 7020/-, and as per 7 th commission in year 2019-2020 my salary was 28,000/-,. there is no pramosion to my post. only 3% increment in every years july month. so pls can you tell me revised pay including of D.A 17% and H.R.16%, as per above mentioned 5th , 6th and 7th commission . pls send me details.

सर नमस्कार

Joining date 1-9-1998 in 4000-100-6000

Increment on 1-9-2005 4700

What will be the fixation scale in the 6th pay commission on 01-01-2006

What will the date of advantage of 8year Samayman vetanman

1st 10th year ACP date 1-9-2008 as 5200 grade pay 2800

On 3-2-2011 I have received 9300-34800 grade pay 4200

On 1-9-2014 I have got 2nd ACP 9300-34800 grade pay 4600

Give to me actual fixation of my salary

Thanking yoy

1-1-206 as 4700 plus 2400. Mention basic pay on 1-9-2014? Also inform as on 31-12-2015 & as on 1-7-2017 base pay I will say it is correct or not.

Respected sir, we both have joined 5000-150-8000 & 5500-175-9000 scale as per 5th cpc on 14/02/2006. Please tell me what is the basic pay as on 14/02/2006? Regards, Kanika gupta

Both of Basic Pay of Rs.9,300/- as new fixation on 14-2-2006 since the 6th CPC starts,

Rs.9,300 plus Grade Pay 4200.

sir,

I have joined the 13/02/2006 5500-175-9000 scale as per 5th CPC after implemented 6th CPC scale given me 9300-34800 with gp 4200 kindly tell me what entry pay will be after pay fixation on 13/02/2006.

and also give your valuable views on who has joined the 5000-150-8000 scale on same date what will be entry pay as per 6th cpc (9300-34800 with gp4200).

please tell me as early as possible.

regards,

Subrata majumder

Both are same basic pay from 13-2-2006 as 9300 plus Grade Pay 4200.

Sir,

I joined on 13/02/2006 on the pay scale 5500-175-9000. as per the 5th CPC central govt autonomous body.

as office superintendent cum accountant post. what will be entry pay as per 6th CPC as on 13/02/2006 & grade pay? What will be I am entitled MACP 1st & 2nd?. Kindly attach supporting documents if possible.

Please treat the matter as most urgent.

Regards,

Subrata Majumder

sir, i have joined in cent.govt. department in 2007 in 5000-8000 basic pay scale and after won a court case i got got basic pay of 5500-9000 . i want to know that what will be my pay scale under 6th pay commission. whether 1.86 multiplication factor will work for me . i.e. 5500×1.86= 10230

No

Sir,

My father joined as lecturer in 1996 with payscale 8000-125-13500 as well as my mother in 2001. Am I eligible for obc ncl certificate?

Sir, thank you for your service rendered to the public servants. (1) My pay scale was Rs.800-1150 which was downgraded to Rs.775-1150 (4th CPC) (2) Pay-scale Rs.825-1200 was denied as it being for Gp. C. (3) later on pay scale of Rs.825-1200 was REVISED to Rs.2750-4400. I was Matriculate at the time of joining the Govt. service as Gp. D employee (Peon). My post was converted to Technical post after full time modular training of two months and was placed in pay scale of Rs.800-1200 (but was downgraded as above).

In my view, the pay scale of Rs.2750-4400 was made for Group D employees (vide DO&PT: No.20020/4/2010-Estt.(D) , hence I was eligible/entitled to this pay scale while still being in Gp. D cadre/class. My specific question is whether the Ministry was right to deny me the pay scale of Rs.2750-4400 on the ground that it was meant for for Gp. C only? Otherwise, they did not have any problem, had it been Gp. D post (as I was Matriculate also from the date of joining the Govt. service). Sir, I shall be highly obliged. Thanks please

Since your appointment is for Peon Group D but you might have been Matriculation..As per the Group C post you have to pass in Typewriting then only you will be eligible for it. So you write dependents exam for L.D.C. then you are eligible group C scales. Though you LDC appointment they should have typwwritting certificate then they are getting first increment.

I retired on 30 June 2008 having completed 22 years of served in Army.I have not get 2 nd MACP

Will I get 2 nd MACP

MY GP is 2400 &Basic is 8760. NK Ghuge Deepak Dattu..kindly suggest me what I ?

I have write my rly pension Gravence with details but all of omii

To, whome I write my Less pension w.e.f. 01-08-2005 and also 6th 7th Revise , I want Justice My Mobile No. 09657792864. Address Firdose Appt. 103 . Beside Makka Masjid New Colony AMBERNATH (W) Mumbai. Maharshtra.

Answer to MOHD. SHAKIL – What’s your grievience, mention details of your last basic pay in which scale of pay, try to solve it if possible.

Dear Sir,

Your kind attention is also drawn to the Min. of Finance, Dept of Expenditure Order No.38/37/08-P&PW(A) dated 28th January 2013, para 4 which states that a Revised Concordance Table (Annexure) of the pre- 1996, Pre – 2006 and post – 2006 pay scales/pay bands indicating the pension/family pension (at ordinary rates) payable under the above provisions enclosed to facilitate payment of revised pension/family.

In this connection I wish to bring to your notice that CSIR being an autonomous institution, have adopted the pay band of 9300-34800 Grade Pay 4600 under 6th CPC Recommendations with effect from 01.01.2006 to the post of Security Officer in the scale of 6500-200-10500. As per this office order No.5-1(3)2008-PD dated 4th October, 2008 CSIR employees the post 2006 retirees will be assessed for their pension under their respective pay scales covered by the said order.

Accordingly,the incumbent of the post of Security Offcer 9300-34800

GP 4600 will be assessed for pension under post – 2006.

Therefore, I request that my revised pension should be covered as per post – 2006 retirees with GP 4600 tagged to the revised pay band.

yours sincerely

Inderjit Singh

Dear Sir

As Security Officer I worked in CSIR Hqrs. since my promotion in April 1996, in the pay scale 6500-200-10500 and sought voluntary retirement from August 1, 2005 and drew nine increments in the aforesaid scale of pay. As such CSIR is an Autonomous institution, I am to be governed by it’s pay structure and reference to existing corresponding pay band of 9300-38400 with grade pay of 4600 implemented with effect from 01.01.2006 in CSIR Hqrs and its labs and institutes all over India.

It will not be out of way to mention that the present incumbent Security Officer is working in grade pay of 4600, ever since his appointment.

But the fact remains that my notional pay as CSIR retiree, is to be fixed in the Security Officer’s pay band of 9300-38400 with Grade Pay of 4600 and not 4200 which has been allocated to the post of Security Assistant in the pay band of 9300-38400 with Grade Pay of 4200.

Further, in view of above facts, it is a serious discrepancy and anomaly in allocating 4600 GP to the post of existing Security Officers in CSIR with effect from 01.01.2006 and on the other hand allocating non existing GP of 4200 to the retired Security Officer from the same date ie.01.01.2006.

Therefore, your kind attention is drawn to the above facts of an anomaly which should be rectified in the Pre 2006 Pensioners Corresponding Fitment Table of Pay Band 9300-38400 with 4600 Grade Pay. instead of GP of 4200. More so it may be seen as a clear case of demotion in retirement.

I, sincerely, request you to kindly consider this case of public interest at large sympathetically and oblige.

Thanking you

Sir,

I am a retired Administrative off icer in the Income tax department I was promoted as Drade III in 1993 in the pay scale of 6500- 200- 10,500. I gave my retirement voluntirely on medical ground and relieved on 1st December 2004.Actually my grade pay is Rs.4600/- in the old scale.In the 6th pay commission my pay scale for the same grade is 9300-34,800- Gr.pay 4200/- thus which is decreased Rs.400/- + other allowances per month. I was drawing the Gradepay Rs. 4600/- + allowances till my retirement in 2004 December.Thus Iam loosing more than Rs.4800/- per year .When the 6th pay commission was came into force my Juniors are drawing more than me.So please clear my doubts at the earlist.

THANKING YOU AND AWAITING FOR YOUR EARLIST REPLY

Yours faithfull

N C Krishnan

Sir

from earstwhile O.C.S ( under telecom) I was absorbed to VSNL as per Govt wish in 1..1..1986 . and from 1.1.1990 my scale was 975-25-1150-30-1540, and my basic was 1210. After revision from 1.1.2006 basic was 2102 as 1/3 rd restored pension. Will u please tell me sir what will my basic and fixation as per 04.08.2106 order and new order of Supreme Court dt 1.9.2016 after dismissal of Civil Appeal 6048/2010.

Kindly help me to know the revised pension. and calculation of Arrear.

Another question is that I am being harrased by the bank when I am asking of PPO updation . Is there any way I can get the job done.

Thank you

S.Acharya

I have retired on 31-12-2005 and basic pension from 1-1-2006 is Rs, 7500. in 5th pay commission.6500-10500. Revise pay scale for that is 9300-34800 and Grade pay is 4200 which I not get because i retired.

What pension I will get in Seventh Pay from 1 January 16.

My basic pay 12275

Pay band 15600-39100

Date of retirement 31.07.2002

Present pension at present 13873

Less commutation 2455…11418

How to calculate no.of retirement increment earned for fixation of pension.

Kindly help me to know the revised pension.

Wow to arrive No. of increment earned ?

my basic was Rs. 24700/-

grade pay 6600/-

DA Rs. 18154

I was retired 31-01-2012

My pension basic is Rs. 15650/

I was in 15600- 39100 scale

my commutation of Rs. 6220/-

kindly tell me No. of increment earned

To

Mr Madhusudhana choudhury ji,

Sir Thank you for your reply.

I saw your reply to my query. I have already got my pay fixation as well as arrears on the basis of delinked pre 2016 pensioners of less than 33 years of service.. I am thankful to 90 paise blog staff for prompt publishing of notifications.bye ASR.

Sir, I am a pensioner from ICRA CIRCOT, I took VRS in the year 2003 after completing 29.5 yrs service. At the time of retirement my basic pension was fixed as Rs 1675 and after 6th pay commission my pension was revised to 3787 and now my doubt is as per govt orders for the persons who took VRS prior 2006 should get full pension and when I contacted my organization they are saying that my pension won’t get changed. At the time of retirement my last drawn basic salary was 3790 and according to my basic pension should be fixed as 1895( 3790/2) for full pension I.e 33 yrs as per new govt order. Hence I would like to know whether my calculation is correct or not, plz advice me

Mr. Krishnamurthy. The following points may please be noted.

1. As per present rules .upto 10 years continued service U will get full benefit of cent percent pension as regular superannuation.Accordingly you write an application to your employer i.e GM/H.V.Fy. Jabalpur and copy to PCDA(Pension) Allahabad. Certainly u will get the relief getting the Full Pension as like 33 Yrs. continuous service.

2. U have not mentioned The Pay Scale U were enjoying at the time of retirement and also the last basic pay u had drawn.

Without the above no body can say anything as regard your problm. With greetngs.

sir! I am an ex-serviceman , sgt from Air force discharged from service on 30th nov, 1974 and later on I joined in Heavy vehicle factory, on 20th June, 1984, and retired on 30th Sep,1997 and the factory comes under Ministry of Defence. My last drawn basic was Rs 6375.00. For 13 years, I got a minimum pension of 1250.oo and then as per 6th pay commission my pension is of minimum 3500/- basic. How much actually I should get. Pls reply me Sir.

Rs.4500-7000 and Rs.5000-8000 scales have been merged and placed iin PB 2 with BP of Rs.9300-34800 with GP of Rs.4200. How to calculate the revised pay as per 7th CPC?