Calculation of HRA – Only Pay in the Pay Matrix

Revision of House Rent Allowances admissible to Haryana Government Employees under 7th CPC

“Pay drawn in the prescribed Pay levels in the pay matrix and does not include Non-Practicing Allowance (NPA) or any other type of pay like Special Pay etc. for the purpose of calculating HRA payable to the Government employees”.

Non-Practicing Allowance (NPA) or any other type of pay like Special Pay etc. should not be included in the Basic Pay for the purpose of calculating HRA payable to the Government employees

From

Additional Chief Secretary to Government Haryana,

Finance Department.

To

1. All the Administrative Secretaries to Government, Haryana.

2. All the Head of Departments of Haryana.

3. All the Divisional Commissioners in Haryana.

4. All the Deputy Commissioners in Haryana.

5. All the Sub Divisional Officers (Civil) in Haryana.

6. The Registrar General, High Court of Punjab & Haryana.

Memo No. 4/2/2017-5FR

Dated, Chandigarh, the 22nd August, 2019

Subject:- Revision of House Rent Allowances admissible to Haryana Government Employees under 7th CPC.

I am directed to invite your kind attention towards Government of India office memorandum no. 02/05/2017-EII(B) dated 07.07.2017 wherein it was mentioned that the term “Basic Pay” in the revised pay structure means the pay drawn in the prescribed pay level in the Pay matrix and does not include Non-Practicing Allowance (NPA), Military Service Pay (MSP), etc. or any other type of pay such as Special Pay etc.

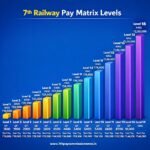

Check also: 7th CPC Pay Matrix Table for Haryana Govt Employees

Further reference is also invited to Haryana Government Finance Department order no. 01/19/2009-1PR(FD) dated 20.06.2018, wherein it was mentioned that the Non-Practicing Allowance shall be treated as part of the pay for the purpose of DA, entitlement of Loans and advances and TA/DA only.

Keeping in view the above, after careful consideration, condition No. 3(c) of order No. 4/2/2017-5FR(FD) dated 30,07.2019 and Sr. No.(04) in instruction No. 4/2/2017-5FR(FD) dated 14 08.2019 is clarified as under:-

“The term ‘Emoluments‘ in the revised pay structure means the pay drawn in the prescribed Pay levels in the pay matrix and does not include Non-Practicing Allowance (NPA) or any other type of pay like Special Pay etc. for the purpose of calculating HRA payable to the Government employees.”

Deputy Secretary Finance

for Additional Chief Secretary to Government Haryana,

Finance Department

Leave a Reply