Analysis and Recommendations of 7th Pay Commission on House Rent Allowance

Allowances related to Housing : House Rent Allowance (HRA) : Presently, HRA is payable at the following rates:

There are a large number of demands for paying HRA as a percentage of (Basic Pay + DA), instead of as a percentage of Basic Pay alone, as at present. Representations have also been received regarding enhancement of percentage rates and having only two classifications of Metros and Non-metros (instead of the present classification of X, Y and Z cities).

PBORs of uniformed forces have vehemently argued for doing away with the concept of Authorized Married Establishment and the requirement of a minimum age of 25 years for grant of Compensation in Lieu of Quarters (CILQ).

Analysis and Recommendations: Compensation towards the housing needs of Central Government employees is covered in three ways:

1. As a component of Basic Pay when it is initially fixed (based upon the Aykroyd formula)

2. As a constituent of Dearness Allowance [the AICPI(IW), on which the DA is currently based includes a weight of 15.27% towards housing], and

3. In the form of House Rent Allowance

In view of the fact that the DA calculation methodology that is being followed does include a certain weightage for housing, the demand to pay HRA as a percentage of Basic Pay + DA is not justified.

To arrive at the appropriate rates of HRA, the Commission used a two-fold approach:

(i) It compared the rise in housing compensation with the cost of housing in major X, Y and Z category cities over the period 2006 to 2013, and

(ii) It compared, de novo, the HRA after the rise in Basic Pay proposed with representative house rents in major X, Y and Z category cities.

For (i) above, the table of comparison (for a hypothetical employee whose Basic Pay was ₹1000 in 2006) is given below

As is clear from the above table, compensation for housing in 2013 was 1.79 times that in 2006 for Class X cities, 2.07 times for Class Y cities and 2.92 times for Class Z cities.

During the same period, the weighted (by population of cities) average rise31 in housing index for Class X cities was 1.69 times, for thirty most populated Class Y cities it was 2.10 times, and for twenty-five most populated Class Z cities it was also 2.10 times.

Thus, it can be safely concluded that the rise in housing compensation has largely kept pace with the rise in rental values in all categories of cities.

However, if a zero-based comparison of HRA with house rents is carried out the Commission observed that today there are websites that give a good idea of the prevalent house rents in various cities.

From the information available on the websites, it was observed that with the increase in Basic Pay proposed (and consequent rise in HRA with the rationalized percentages), most of the employees will be able to afford a rented house as per their entitlement.

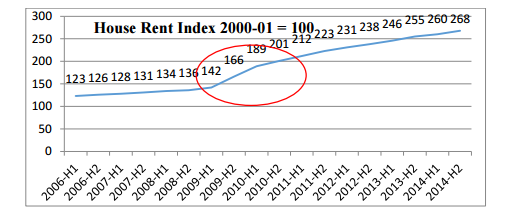

The Commission also took note of the link between increase in HRA and increase in house rent. There was a sharp rise in the index from the first half of 2009, immediately following VI CPC recommendations.

The All India House Rent Index32 chart given below demonstrates this

Considering all these factors, and in line with our general policy of rationalizing the percentage based allowances by a factor of 0.8, the Commission recommends that HRA should be rationalized to 24 percent, 16 percent and 8 percent of the Basic Pay for Class X, Y and Z cities respectively.

However, the Commission also recognizes that with the current formulation, once the new pay levels are implemented, the compensation towards HRA will remain unchanged until such time as the pay and allowances are next revised.

Going by the historical trend this event is likely to be a decade away. Some representations have been received stating that towards the later part of the ten year period the HRA compensation falls considerably short of the requirement.

Having regard to this, the Commission also recommends that the rate of HRA will be revised to 27 percent, 18 percent and 9 percent when DA crosses 50 percent, and further revised to 30 percent, 20 percent and 10 percent when DA crosses 100 percent.

Currently, in the case of those drawing either NPA or MSP or both, HRA is being paid as a percentage of Basic Pay+NPA or Basic Pay+MSP or Basic Pay+NPA+MSP respectively.

HRA is a compensation for expenses in connection with the rent of the residential accommodation to be hired/leased by the employee and is graded based on the level of the employee, and therefore should be calculated as a percentage of Basic Pay only. Add-ons like NPA, MSP, etc. should not be included while working out HRA.

Leave a Reply