7TH CPC INCREMENT ANOMALY – ANNUAL INCREMENT RATE LESS THAN 3% IN PAY MATRIX

What is Annual Increment?

A small pay hike for the employees who have worked a complete calendar year. The calculation of annual increment will be based on the grade or basic pay.

7th CPC Annual Increment is Less than 3 Percent in Pay Matrix – Confederation Anomaly Point

Item -1 ANOMALY IN INCREMENT RATE

As per clause(C) of the terms of reference of the National Anomaly Committee — where the official side and the staff side are of the opinion that any recommendations is in contravention of the principle or the policy enunciated by the Seventh Central Pay Commission itself without the commission assigning any reason — it constitutes an anomaly.

Regarding annual increment the recommendations of seventh CPC are as follows:

i. 7th CPC Report — Highlights of Recommendations –

SL – 7: Annual Increment – The rate of annual increment is being retained at 3 percent.

ii. 7th CPC Report — Forward

Para 1.19 — The prevailing rate of increment is considered quite satisfactory and has been retained.

iii. 7th CPC Report — Chapter 4.1 —Principles of Pay determination

Para- 4.1.17 — The various stages within a pay level moves upwards at the rate of 3 percent per annum.

iv. 7th CPC Report — Chapter 5.1 — Pay Structure (Civilian Employees)

Para 5.1.38 — Annual Increment

“The rate of annual increment is being retained at 3 percent”

Para 5.1.21 — The Vertical range of each level denotes pay progress within that level. That indicates steps of annual financial progression of 3 percentage within each level.

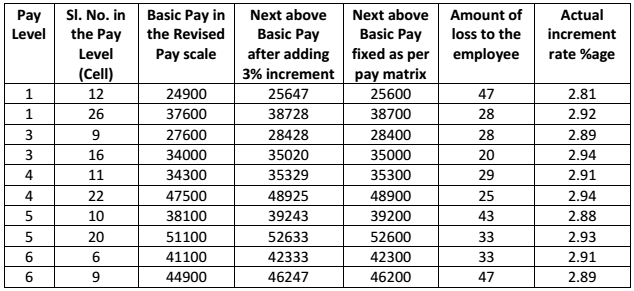

Contrary to the above principle laid down by the 7th CPC, the actual increment rate in the Pay levels of the Pay matrix are less than 3% as illustrated in the Table below:

ILLUSTRATION-I: LOSS IN INCREMENT

ILLUSTRATION – 2

In Level-2, Cell-2, the pay is shown as 20500. After giving one increment of 3% it should be 21115/- but the next cell is only 21000 (Level-2, Cell-3). Next stage should be 21115+633=21748 but the next cell is only 21700 (Level-2 Cell-4).

In Level — 6, Cell 14 should be 50500 + 1515 = 52015 whereas it is given only 52000.

From the above it can be safely concluded that

i. Recommendation of the Pay Commission regarding increment rate is in contravention of the principle or policy enunciated by the 7th Pay Commission, Hence it constitutes an anomaly.

ii. In many stages, eventhough the increment is shown as 3%, it is rounded off to the next below amount causing financial loss to the employees.

iii.In the sixth CPC, while calculating increment, if the last digit is (one) or above, it used to be rounded off to next 10 (Ten). So in this Pay Matrix also if the amount is 10 (Ten) and above, it should be rounded off to the next above 100 (hundred).

iv. Even if the difference may look small (in percentage) it will also have long term impact on the employees promotion inviting heavy financial loss. The following illustration will reveal.

Illustration

- Pay Level – 6

- Cell (Stage) in the Pay Level – 8

- Basic Pay in the Revised Scale – 44900

- Actual Pay after adding 3% annual increment – 46247

- Basic Pay fixed as per the Pay Matrix – 46200

- Loss of amount to the employee in the increment – 47

- Pay on promotion to next Level if fixed as per serial 4 above – 49000

- Pay on promotion to the next level, if fixed as per serial – 5 above – 47600

- Loss per month on promotion – 1400

Increment loss illustration

Thus, for a loss of Rs.47/- only in the Annual increment, the employee will suffer a recurring loss of Rs.1400/- per month during his/her promotion to the next level and this loss will have cumulative effect on rest of the period of the service career with financial loss on Dearness Allowance (DA) and further promotions and also Pensionery benefits.

The above anomalies are to be rectified.

Source: https://confederationhq.blogspot.in/

It may be upto 3%