7th Pay Commission Basic Pay Calculation Method in brief with illustration

Know Easy steps to Calculate your 7th Pay Commission New Pay Scale

7th Pay commission simplified the calculation for arriving revised Pay through new 7th CPC Pay Metrix

We here illustrate the method through easy 6 Steps to calculate our 7th CPC New Pay and Allowances to know your self

Lat us Assume you are drawing Grade Pay Rs.4200 and Pay in the Band Pay Rs.12110

To calculate your Basic Pay and Allowance follow the steps given below.

Step-I

Calculate your sixth CPC basic Pay

( Grade Pay + Band Pay) = 4200+12110= 16310

Step-II

Multiply the above figure with 7th CPC Fitment Formula 2.57

16310 x 2.57 = 41916.70 . ( Paisa to be rounded off to the nearest Rupee)

The Ans is = Rs.41917

Step-III

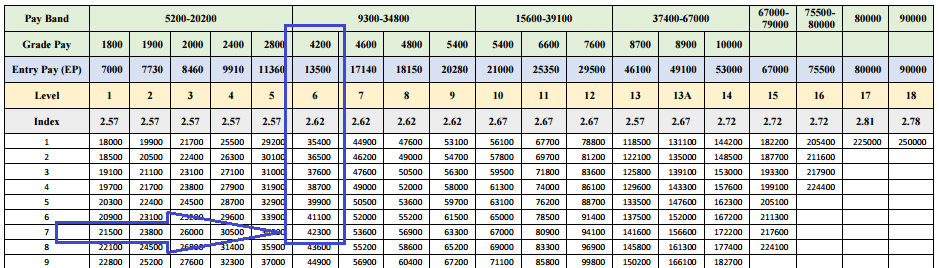

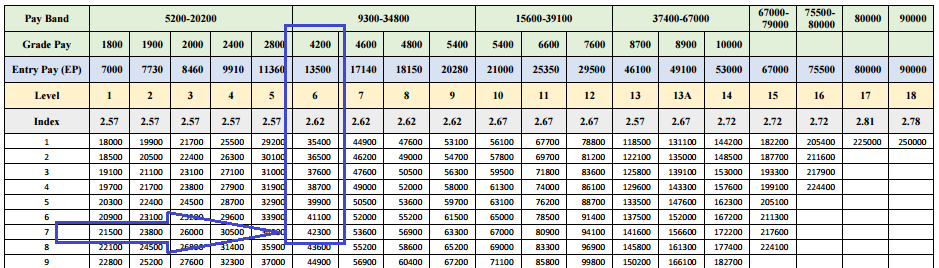

Match this Answer with Matrix Table ( Given Below) Figures assigned in Grade Pay column Rs.4200

There is no matching figure we arrived above in this matrix, so the closest higher figure assigned in the Grade Pay column can be chosen ie is Rs. 42300

So , Rs 42300 is your New 7th CPC Basic Pay

Step-IV

Identify your HRA [ See : 7th Pay commission recommendation on HRA]

HRA has been revised as 24%, 16% and 8% for 30% , 20% and 10% respectively

So if you are in 30% HRA Bracket, your HRA in 7th CPC is 24% vis versa.

Let us assume now you are in 30% HRA bracket, your revised HRA is 24%

Find the 24% of the Basic Pay = 42300 x 24/100 = 10152

Your HRA is Rs.10152

Step-V

Identify your TPTA (Transport Allowance)

7th CPC Recommends Transport Allowance for three Category of Employees for Two Types of Places

If you are living in A1 and A classified cities (See the List of 19 cities classified as A1 and A cities) you will be entitled to get higher TPTA rates

7th cpc TPTA Transport Allowance

And since your Grade Pay is 4200 you fall in Second category

ie Grade Pay 2000 to 4800 – Rs 3600+DA

Your TPTA is Rs. 3600/- (DA is Nil as on 1.1.2016)

Step-VI

(Sine DA will be Zero from 1.1.2016 So no need to calculate the DA to calculate 7th Pay and Allowances from 1.1.2016)

Add all the figures

New Basic Pay + HRA+TPTA = 42300+10152+3600 = 56052

Your revised 7th CPC Grass pay as on 1.1.2016 = Rs.56052

Source: www.gservants.com

when will be ssc cgl tier 1 result will be declared

MY registration no and password if i put its showing try again. please help me out of this.

respected sir

good afternoon i have given details my salary as per 6th pay Commission as below mentioned

1.1.2016. Pay band 9300-34800 GP,4200

basic pay.11270 + GP 4200

1.4.2016 (got Promotion )

basic pay.11720 + GP 4600 =16320 (Promotion Increment)

1.7.2016 basic pay 12210 + 4600 GP =16810(Notional Increment)

DA.125% and HRD 10%

hereby i kindly requesting plz tell what is may salary as per 7th pay commission on 1-04-2016 and on 01-07-2016

The pay of A as on 1.1.16 is Rs.27510/-+GP-5400/- (In PB-3) and as per 7th cpc table it is comes Rs. 84900/- as baisc pay where as pay of B as on 1.1.16 is Rs.27480/-+ GP-5400 in PB-2 is to be fixed Rs. 85100. In this aspect what action as per 7th cpc will be taken

As per the Pay Matrix, if the Commission has recommended that the post occupied by Mr.T in GP 4200 should be placed one level higher in GP 4600. Say the present basic pay of Mr. T is Rs. 14760 (10560 + 4200). If multiplying this by 2.57 would fetch Rs.37933 (rounding off Rs. 38700) which value is not there in the matrix in Level 7 (the upgraded level of Mr. T from level 6). How will the pay fix for Mr. T in Level 7?

As per the fitment the person who retires after 30 years in the same gp of 4600 will get more pension than the person who retires after putting in total service of 30 years in different gps i.e. 16 years in gp 4600, 13 years in gp 4800 and 1 year in gp 5400. Can anyone clarify on this please.

please dont accept this recommendation of 7th CPC submitted by Mathur sir. Since last 10 years we are not waiting for this.

Really, the recommendation made by 7th CPC is the most disappointing. Its recommendation regarding CSS, CSCS & CSSS Employees seems to be a major penalty for them. After seeing the Report I feel that 7th CPC has unsettled most of the settlement made in 6th CPC. In a nutshell 7th CPC can’t be termed as an ” Expert Body”.

CENTRAL GOVT HAS TO RE-VISIT 7TH CPC RECOMMENDATIONS BY CORRECTING THE MISTAKES. AFTER SEEING 7TH CPC REPORT IT IS THE DEMAND OF ALL OUR FELLOW STAFF IN CENTRAL GOVERNMENT THAT WE DON’T WANT ANYMORE PAY COMMISSIONS, WE WANT ONLY PAY REVISION ONCE IN 5 YEARS.

WE ARE VERY MUCH UPSET ON PERUSAL OF 7TH CPC REPORT.

IN THE 6th CPC THEY MERGED Rs.5000, 5500 & Rs.6500 PAY SCALES AND AFTER SOME TIME, THEY ALLOWED GP 4600 TO Rs.6500/-. IN SOME DEPARTMENT THEY ALLOWED GP 4800 FOLLOWED BY GP 5400 (PB-3). NOW THEY SAY GP 4800 & GP 5400 MERGED UNDER ‘LEVEL 9’.

WHY FOR NO REASON POOR EMPLOYEES AT THE LOWER LEVEL ARE ALWAYS TARGETTED?

PAY COMMISSION SHOULD NOT PLAY SUCH TRICKS – REDUCING THE PAY.

WHAT ABOUT WHO ARE ALREADY PROMOTED TO GP 4800 & COMPLETING 4 YEARS BY MARH 2016. ALL SENIORS WHO GOT GP 4800 AND PLACED UNDER NFSG GP 5400 (PB 3) RETIRED AND GETTING PENSION UNDER GP 5400 (PB3).

WILL THEY ALLOW FOR REDUCING THEIR PENSION?

SO GIVE AN OPTION LIKE EARLIER PAY COMMISSIONS TO SWITCH OVER TO 7TH CPC PAY FROM THE DATE AFTER 1.1.2016 (I.E. FROM THE DATE AFTER FIXING THEIR PAY IN GP 5400 (PB3).

PLEASE DON’T AIM FOR CREATING ANOMOLY MORE SO IN LOWER CATEGORIES. ADDRESS ALL LIKELY ANOMOLIES BEFORE IMPLEMENTATION OF 7TH CPC.

CENTRAL STAFF IN GP 2400, GP 4200, GP 4600 & GP 4800 WERE ALWAYS HIT BY ALL PAY COMMISSIONS. MAXIMUM NUMBER OF COURT CASES ARE ONLY SEEN IN ABOVE SAID CATEGORIES ONLY.

PLEASE, PLEASE,PLEASE AGAIN DON’T CREATE ANOMOLY .

NATIONAL JCM SHOULD PLAY THEIR KEY ROLE NOW. IT’S THE VOICE OF ALL CENTRAL STAFF. 7TH CPC REPORT IS NOT GOOD. THERE WAS NO NECESSITY TO WAIT FOR SUCH REPORT FOR 10 YEARS.

NATIONAL JCM COMRADES PLEASE DON’T ACCEPT 7TH CPC REPORT.

WHEREVER THEY HAVE TO GIVE – REPORT SAYS UNCHANGED/STATUSQUO.

WHEREVER THEY CAN REDUCE/MERGE – ACTION IS TAKEN.

WE WANT IT TO BE 7TH PAY COMMISSION NOT 7TH PLAY COMMISSION

“(Sine DA will be Zero from 1.1.2016 So no need to calculate the DA to calculate 7th Pay and Allowances from 1.1.2016)”

sir, why will DA be zero in jan, 2016? will it be merged with overall salary? does it mean even though the basic is multiplied by 2.57, which increases the HRA, we will not get basic+hra+tpta+da (119%)?

for eg. if my current basic is 25000, the increment is only going to be 2.57 times 25000, while 119% of 25000 as DA is scrapped. please clarify. thanks.