7th CPC Pay (Basic Salary) and Arrears Calculator for CG Employees

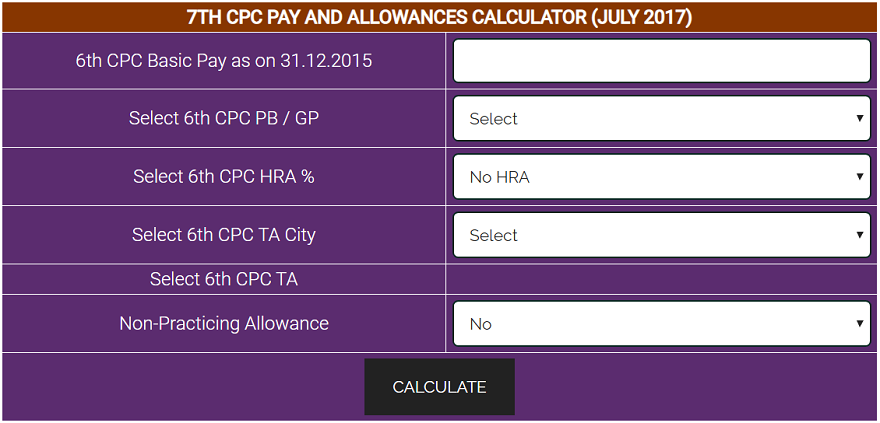

7th Pay Commission Pay Arrears Calculator for Central Govt Employees: Enter Your Basic Pay and Allowances details as on 1.1.2016. We just estimate your 7th Pay Commission arrears for the months between Jan and Jul 2016…

[Note: All the figures are indicative]

| PAY BAND 1 (5200- 20200) | |||

| Grade Pay | 1800 | 1900 | 2000 |

| Current Entry Pay | 7000 | 7730 | 8460 |

| Rationalised Entry Pay (2.57) | 7000 * (2.57) = 18000 | 7730 * (2.57) = 19900 | 8460 * (2.57) = 21700 |

| PAY BAND 1 (5200- 20200) | ||

| Grade Pay | 2400 | 2800 |

| Current Entry Pay | 9910 | 11360 |

| Rationalised Entry Pay (2.57) | 9910 * (2.57) = 25500 | 11360 * (2.57) = 29200 |

| PAY BAND 2 (9300- 34800) | ||||

| Grade Pay | 4200 | 4600 | 4800 | 5400 |

| Current Entry Pay | 13500 | 17140 | 18150 | 20280^ |

| Rationalized Entry Pay (2.62) | 13500 * (2.62) = 35400 | 17140 * (2.62) = 44900 | 18150 * (2.62) = 47600 | 20280 * (2.62) = 53100 |

| PAY BAND 3 (15600-39100) | |||

| Grade Pay | 5400 | 6600 | 7600 |

| Current Entry Pay | 21000 | 25350 | 29500 |

| Rationalised Entry Pay (2.67) | 21000 * (2.67) = 56100 | 25350 * (2.67) = 67700 | 29500 * (2.67) = 78800 |

| PAY BAND 4 (37400 – 67000) | |||

| Grade Pay | 8700 | 8900 | 10000 |

| Current Entry Pay | 46100 | 49100 | 53000 |

| Rationalized Entry Pay (2.57 / 2.67 / 2.72) | 46100 * (2.57) = 118500 | 49100 * (2.67) = 131100 | 53000 * (2.72) = 144200 |

| HAG | (67000-79000) |

| Current Entry Pay | 67000 |

| Rationalized Entry Pay (2.72) | 67000 * (2.72) = 182200 |

| HAG+ | (75500 – 80000) |

| Current Entry Pay | 75500 |

| Rationalized Entry Pay (2.72) | 75500 * (2.72) = 205400 |

| Apex | 80000 (fixed) |

| Rationalized Pay (2.81) | 80000 * 2.81 = 225000 |

| Cabinet Secretary | 90000 (fixed) |

| Rationalized Pay (2.78) | 90000 * 2.78 = 250000 |

How much grade pay is admissible to me for calculating my basic pension? Will it be 2800 or 4200. Thanks.

Jow much DA & Medocal allowance admissible in my case.?

Sir,

It is noted that people who vacate the railway quarters, and the same is going to occupy by others is been very difficult, i request you to pass a g.o. stating that the day when quarters is vacated should come under open pool. So that no quarters will be vacant.

Will D A be zero from jan 2016

As on 01.01.2016 My GP is Rs.2800/- and I got promotion on 28th April, 2016 and got GP Rs.4200/- please guide me which option I have benefited more …

Sir

My basic pay+ gradepay as on 01.01.2016 was Rs12430/( 5200-20200 + 2800gp)

And i was promoted to 9300-34800+4200 (gp) on 01.04.2016 then my basic pay became Rs 12430-2800 + 4200= 13830 because i opt for my pay would be fixed on next DNI i.e. 01/07/2016. After fixation of my pay on 01/07/2016 my new pay is fixed Rs 14720 in (9300-34800 +4200 gp). So please calculate my pay and arrear for the same above said subject.

What about NPS deduction during the period from Jan to July 2016? Will the difference b/w 6th cpc and 7th cpc also be deducted from the arears or not?

Arrear calculator has a mistake. It is just multiples only for 5 months.

Thank You

what for private employees after 7th pay. more than 75% is private employees in our country out of total population but govt not responsible for private employees salary matter why.

Private employers adopted monopoly against employees salary matter & benefits also. only Govt. employees purchasing capacity becomes so high but private employees purchasing capacity decreased rapidly & in the same time price of all the things like House Rent & another things will Increase rapidly. as a result of which money circulation will be constant between the so much few peoples. how could a private employees are survive within this limited salary along with private employers monopoly.

How the arrears value is calcualted.?

Is it the difference between new salary and old salary.?

Kindly explain arrear calculation.

Is there a calculator table available for Military service retirees for calculating 7 cPC arears and revised pension calculation.

It must consider basic after OROp?

Government should make payment and allowances laws for central gov contract young faculties and employees .. … And retired employees who are pensioners ,should have to give the chance to their youngsters so that every one will be employed in at least 2 yrs . AICTE should also follow the same.retirement age should be 60 yrs mandatory ..

What will be the DA % and allowances in 7 CPC

Governmenmt should make the retirement age of the employee 62 years

Thank you for matrix calculator. I have got information regarding pay package through calculator in view of 7th pay commission. Thanks once again.

Government should make payment / allowances laws for private sector employees as well. … Atleast retirement age should me made 60 yrs mandatory ..

PAUL PAPPAIAH says

May 31, 2016 at 8:25 am

Your comment is awaiting moderation.

SIR/Madam, My entry to kvs is on 10.02.1994, in 6400 basic pay. Due to Adverse remarks in 2004,2005 and 2006 by a principal due to personal revenge and caste and religious discrimination, I was denied the senior scale. Now in 2016, kvs chennai region has sanctioned my senior scale w.e.from 01.12.2012 only. Kindly suggest me the easy way to get the benefits from 01.01.2006 to 30.11.2012. It seems as if I have not served during the period from 01.01.2006 to 30.11.2012. Please help me in this regard and inform me at an early date.

Newer Comments »

SIR/Madam, My entry to kvs is on 10.02.1994, in 6400 basic pay. Due to Adverse remarks in 2004,2005 and 2006 by a principal due to personal revenge and caste and religious discrimination, I was denied the senior scale. Now in 2016, kvs chennai region has sanctioned my senior scale w.e.from 01.12.2012 only. Kindly suggest me the easy way to get the benefits from 01.01.2006 to 30.11.2012. It seems as if I have not served during the period from 01.01.2006 to 30.11.2012. Please help me in this regard and inform me at an early date.

To, T Ramesh Babu,

It was very heartening to see your comments on donating some part of the 7th cpc to Prime Minister’s Relief Fund.

In fact Modiji has appealed to the people to give up LPG subsidy. If possible you can also give up the 7th cpc and FEEL THE JOY OF GIVING UP.

when activated 7th pay commission in tamilnadu.

A was drawing 22130 on promotion in the gradepay 15600-39100,GP-5400 fixed from 9300-348– GP-4600. He retired on 31.03.2009 within one year without drawing any increments . How his pay be fixed and howmany increments be taken into accout. Please illustarate.

My father expired in 1998,he was an employee of Department of Telecom, he was not retired, his retirement date was 20feb,2005, Currently my mother is getting Pension of total 9500. Please let me know how will be the increment under 7th pay commission.

Mein C.R.P.F se 2004 ko voluntier retire hua tha abhi mujhe 7500 pension milta he so mein puchna cahta hu ki abhi mujhe kitna milega 7th CPC lgne ke baad…plz batao..

I have availed my Periodical Increment on 01.01.2016. As per seventh Pay Commission on which date my next Increment will due.Further at the time of Fixation of Pay whether my pay will be fixed after availing my old Increment on 01.01.2016.

I retired as Assistant on 30/11/2014 from E.S.I.Corporation on 30/11/2014. My basic pension is Rs.10635/-. My grade pay at the time of retirement is 4600/- . My pay band is 9300/- – 34800/-. I have drawn 9 increments from 1/1/2016 till retirement. I got MACP on 15/4/1981 on completion of 30 years of service on 15/4/81 thereby raising my grade pay to .Rs.4600/-.. Pl. calculate my revised pension from 1/1/2016 as

per 7th c.p.c.

Sir,

I would like to contribute some amount of my Pay Commission arrears to Prime Minister Relief Fund, especially during the regime of Honourable Narendra Modi for a his good governance. . Hence, you are requested to intimate the details or Bank account for depositing the amount.. Thanking you.

With regards,.

I retired on 30 11 2005 on pay 11725 in scale 7450-11500 as Sr Section Engineer in Railways. I reached Maximum of the scale 11500. on 1-1-2002 & got one stagnation increment on 1-1-2004. My question is – how many increments to be counted for revised pension in 7th pay commission ,whether 18 ,19 ,20 or 21