7th CPC Pay Matrix Level-13 Modification – Multiplying Factor 2.67

Modification of Level-13 of Civilian Pay Matrix – Issues regarding

Govt of India has decided to change the fitment factor (Index of Rationalisation – IOR) from 2.57 to 2.67 for pay matrix level 13 in Civilian Pay Matrix Table. The Department of Expenditure issued orders on the enhancement of matrix pay due to incrase of fitment factor to 2.67.

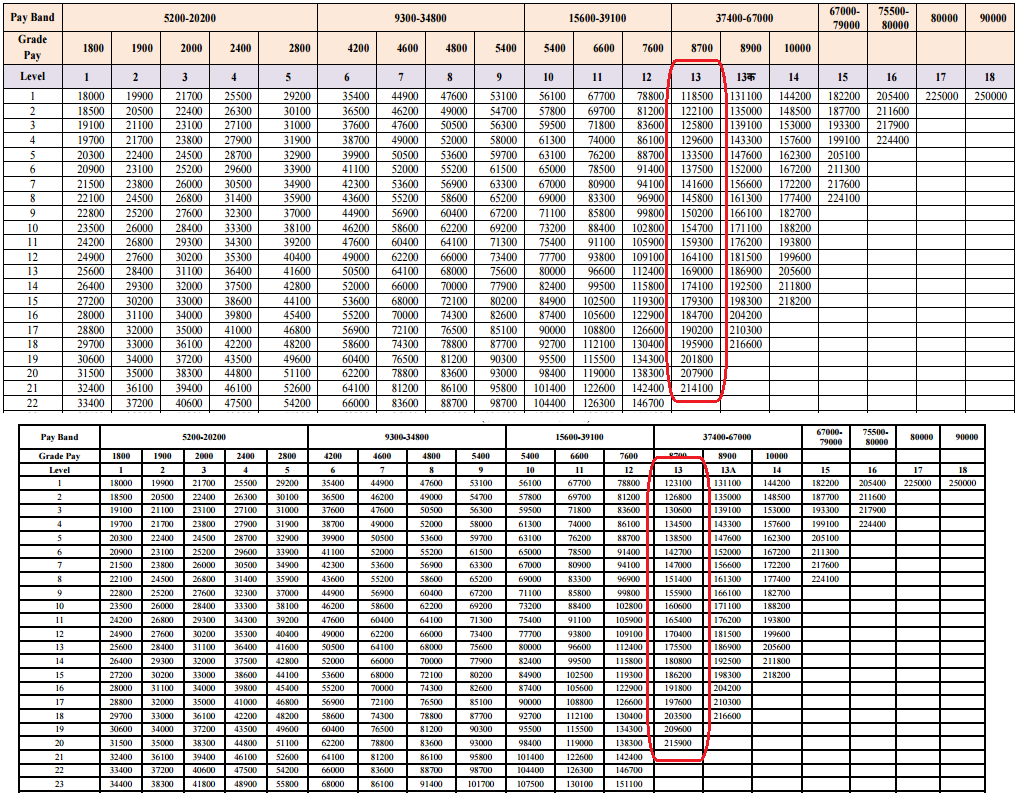

The present civilian pay matrix table of Level-13 starts at Rs.1,18,500 at Cell one and ends at Rs.2,14,100 at Cell twenty.

And now, the revised civilian pay matrix table of Level-13 Level-13 starts at Rs.1,18,500 at Cell one and ends at Rs.2,14,100 at Cell twenty

No.4-6/2017-IC/E-III(A)

Government of India

Ministry of Finance

Department of Expenditure

North Block, New Delhi

Dated, the 28th September, 2017

OFFICE MEMORANDUM

Subject: Modification of Level-13 of Pay Matrix – Issues regarding

The undersigned is directed to invite attention to the Pay Matrix contained in Part A of the Schedule of the CCS(RP) Rules, 2016 as promulgated vide notification No.GSR 721 (E) dated 25th July, 2016, where the Level-13 of the Pay Matrix starts at Rs.1,18,500 at Cell one and ends at Rs.2,14,100 at Cell twenty one and to state that in terms of CCS(Revised Pay) (Amendment) Rules, 2017 promulgated vide G5R 592(E) dated 15.6.2017, the said Level 13 of the Pay Matrix has been modified.

2.The modified Level-13 in terms of the CCS(Revised Pay) (Amendment) Rules, 2017 takes effect from 1st January, 2016. Accordingly, the earlier Level-13 of the Pay Matrix as contained in CCS(RP) Rules, 2016 notified on 25.7.2016 and effective from 1st January, 2016 has become non-existent ab-initio with the promulgation of the CCS(Revised Pay) (Amendment) Rules, 2017.

The modified Level 13 is an improvement on the earlier Level 13 in as much as the earlier Level 13 is based on the ‘Index of Rationalisation’ (IOR) of 2.57, whereas the modified Level 13 is based on the IOR of 2.67. It is for this reason of improvement that the modified Level 13 begins at Rs.1,23,100, as against the earlier one which began at Rs.1,18,500.

3. Consequent upon the aforesaid modification of Level 13 in terms of the CCS(Revised Pay) (Amendment) Rules, 2017 effective from 1.1.2016 and the resultant re-fixation of pay therein in supersession of the earlier pay fixation, references have been received from Ministries/Departments seeking clarifications on certain issues. These issues and the decisions thereon are brought in the succeeding paragraphs.

Issue No. 1 – Whether pay in the Level-13 is to be fixed by multiplying by a factor of 2.57 or 2.67

4. The 7th Central Pay Commission, while formulating the various Levels contained in the Pay Matrix, corresponding to the pre-Revised pay structure, used “Index Of Rationalization” (IOR) to arrive at the starting Cell of each Level (the 1st Cell) of the Pay Matrix. This IOR has been applied by the Commission on the minimum entry pay corresponding to the successive Grades Pay in the pre-Revised pay structure.

In Level-13 of the Pay Matrix, as formulated by the 7th CPC and as accepted by the Government in terms of the CCS(RP) Rules, 2016 promulgated vide notification dt. 25.7.2016, the IOR was 2.57. The IOR in respect of both Levels 12 and Level 13-A, i.e., Levels immediately lower and immediately higher than Level-13, is 2.67. Therefore, the modified Level-13 in terms of the Pay Matrix contained in the CCS(Revised Pay) (Amendment) Rules, 2017 has also been formulated based on the IOR of 2.67.

5. While the concept of the IOR, as applied by the 7th CPC, is exclusively in regard to formulation of the Levels in Pay Matrix, the formula for fixation of pay in the Pay Matrix based on the basic pay drawn in the pre-revised pay structure for the purpose of migration to the Pay Matrix, as recommended by the 7th CPC, is based on the fitment factor of 2.57.

The Commission recommends “this fitment factor of 2.57 is being proposed to be applied uniformly for all employees.” Accordingly, Rule 7 (1)(A)(i) of the CCS(RP) Rules, 2016, relating to fixation of pay in the revised pay structure, clearly provides that “in case of all employees the pay in the applicable level in the Pay Matrix shall be the pay obtained by multiplying the existing pay by a factor of 2.57………”

6. Thus, the fitment factor for the purpose of fixation of pay in all the Levels of Pay Matrix in the revised pay structure is altogether different from the IOR. The fitment factor of 2.57 is uniformly applicable for all employees for the purpose of fixation of pay in all the Levels of Pay Matrix.

This has no relation with the “IOR”. The formula for fixation of pay based on the fitment factor of 2.57, as contained in Rule 7(1)(A)(i) of the CCS(RP) Rules,2016, has not been modified by the CCS (Revised Pay) (Amendment) Rules,2017.

7. Accordingly, pay in the Level-13 of the Pay Matrix, as provided for in the CCS(Revised Pay) (Amendment) Rules, 2017, shall continue to be fixed based on the fitment factor of 2.57 as already provided for in Rule 7(1) (A) (1) of CCS(RP) Rules, 2016. In case pay has been fixed in the modified Level-13 by way of fitment factor of 2.67, the same is contrary to the Rules and is liable to be rectified and excess amount recovered forthwith.

Issue No. 2 : Pay re-fixed in the modified Level-13 working out lower than the pay fixed in the earlier Level-13

8. As mentioned above, earlier Level 13 in operation before the coming into force of CCS(Revised Pay) (Amendment) Rules, 2017 promulgated vide notification dt. 15.6.2017, has become non-existent ab-initio and the modified Level 13 as contained in CCS(Revised Pay) (Amendment) Rules, 2017 is the applicable Level 13 from 1.1.2016. Therefore, the earlier Level 13 is extinct and, hence, no employee can retain the some consequent upon promulgation of CCS(Revised Pay)(Amendment) Rules, 2017.

9. As such, pay in respect of those, who are entitled to Level 13 either from 1.1.2016 or from any date later than 1.1.2016, has to be re-fixed in the modified Level 13 and the pay as earlier fixed in the earlier Level 13 gets automatically rescinded.

Therefore, pay, as fixed in the modified Level 13 in terms of Rule 7 of the CCS(RP)Rules, 2016 in case of those who were drawing pay in the pre-revised pay structure in PB-4 plus Grade Pay of Rs.8700 as on 31.12.2015 or in terms of Rule 13 thereof in case of those promoted to Level 13 on or after 1.1.2016, shall now be the pay for all purposes.

10. However, a few instances have been brought to the notice of this Ministry, where pay fixed in the modified Level-13 contained in CCS (RP) (Amendment) Rules,2017 works out less than the pay fixed in the earlier Level-13 before promulgation of this amendment.

11.The pay fixed strictly in terms of the applicable provisions of CCS(RP) Rules, 2016 in the earlier Level-13 before promulgation of CCS(Revised Pay) (Amendment) Rules, 2017, was the pay before the date of promulgation of the said Amendment Rules on 15.6.2017.

As pay is now required to be re-fixed in the Level-13 contained in the CCS(Revised Pay) (Amendment) Rules, 2017, any overpayment, if taking place, consequent upon such re-fixation is not attributable to the concerned employee.

12.Accordingly, it has been decided that if the pay re-fixed strictly as per Rule 7 or Rules 13, as the case may be, of the CCS(RP) Rules, 2016 in the Level-13 based on the Pay Matrix contained in the CCS(Revised Pay) (Amendment) Rules, 2017 ( as per the fitment factor of 2.57) happens to be lower than the pay as earlier fixed as per the said Rules ( fitment factor of 2.57) in the earlier Level-13, then while the pay as re-fixed shall be the pay as applicable to the concerned employee for all purposes, any recovery of over payment on account of such re-fixation during the period up to 30.6.2017, the month in which the CCS(Revised Pay) (Amendment) Rules, 2017 has been issued, shall be waived.

13. The cases of employees who retired on or after 1.1.2016 and up to 30.6.2017 and if covered under pars 12 above, shall be processed as per Rule 70 of the CCS(Pension) Rules, 1972.

Issue No. 3 – Re-exercise of option for coming over to the Revised Pay structure in case of Level 13

14. A reference has been received whether in view of the modification in the Level 13 in terms of the CCS(Revised Pay) (Amendment) Rules, 2017 promulgated on 15.6.2017 with effect from 1.1.2016, the date of effect of the revised pay structure contained in CCS(RP) Rules, 2016, the employees who are entitled to the Level 13 on 1.1.2016 may be given fresh option to come over to the revised pay structure in case of modified Level 13.

15. The matter has been considered and it has been decided that since the modification of the Level 13 as per CCS(Revised Pay) (Amendment) Rules, 2017 is a material change, the employees, who were entitled to Level 13 as on 1.1.2016 and who had already opted for the earlier Level-13 as per Rules 5 and 6 of the CCS(RP) Rules, 2016, shall be given an opportunity for re-exercise of their option there under. Such an option may be exercised within three months from the date of issue of these orders.

16. In their application to employees belonging to the Indian Audit and Accounts Department, these orders issue after consultation with the Comptroller and Auditor General of India.

17. Hindi version of these orders is attached.

sd/-

(Amar Nath Singh)

Director

View Order (Hindi Version Attached)

The two images of Revised and Pre revised Civilian Pay Matrix Tables are given below for better understanding of modification…

DA Arrears Calculator 1.7.2024 for 3 Months

DA Arrears Calculator 1.7.2024 for 3 Months

Leave a Reply