As per the Gazette Notification issued on 29.09.2020, the new TDS rates for the period from 14.05.2020 to 31.03.2021.

Government of India

Directorate General of Works

Central Public Works Department

No. 158/SE(TAS)/2020/427

Dated: 05/11/2020

OFFICE MEMORANDUM

Sub: Reduction in rate of tax deduction at source (TDS)

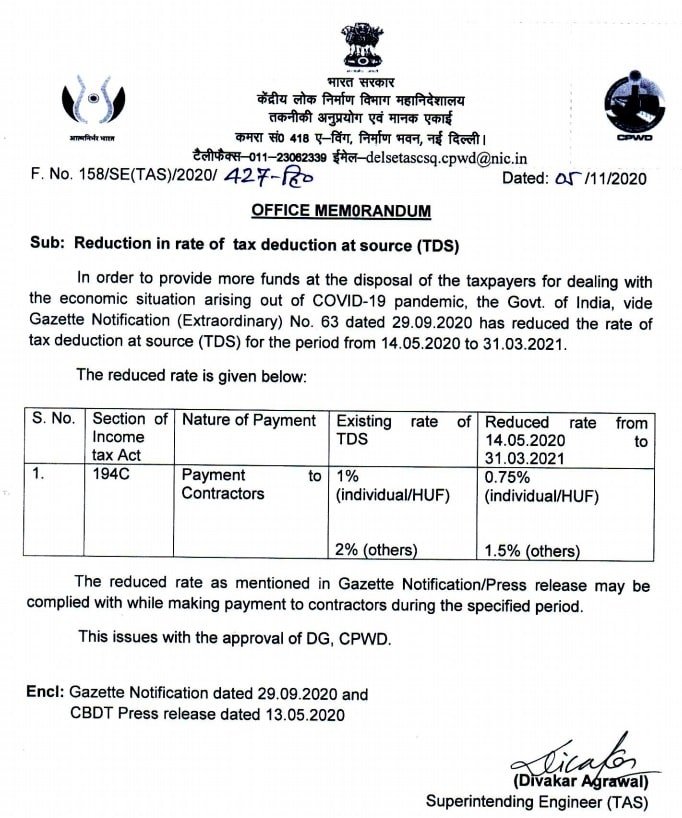

In order to provide more funds at the disposal of the taxpayers for dealing with the economic situation arising out of COVID-19 pandemic, the Govt. of India, vide Gazette Notification (Extraordinary) No. 63 dated 29.09.2020 has reduced the rate of tax deduction at source (TDS) for the period from 14.05.2020 to 31.03.2021.

The reduced rate is given below:

| S. No. | Section of Income tax Act | Nature of Payment | Existing rate of TDS |

Reduced rate from 14.05.2020 to 31.03.2021 |

| 1 | 194C | Payment to Contractors | 1% (individual/HUF) 2% (others) | 0.75% (individual/HUF) 1.5% (others) |

The reduced rate as mentioned in Gazette Notification/Press release may be complied with while making payment to contractors during the specified period.

This issues with the approval of DG, CPWD.

Encl: Gazette Notification dated 29.09.2020 and CBDT Press release dated 13.05.2020

sd/-

(Divakar Agrawal)

Superintending Engineer (TAS)

7th Pay Commission Salary Calculator January 2025 (55% DA Updated)

7th Pay Commission Salary Calculator January 2025 (55% DA Updated) January 2025 DA Calculator (55% Confirmed!)

January 2025 DA Calculator (55% Confirmed!)

Leave a Reply